Income Tax Act| Assessment Order Amounts To Nullity If Assessee Was Dead On Date Of Passing It: Karnataka HC

|

|The Karnataka High Court has observed that if the assessee is dead on the date of passing the assessment order under Section 147 read with Section 144 of the Income Tax Act, the order against the dead person amounts to nullity and must be set aside.

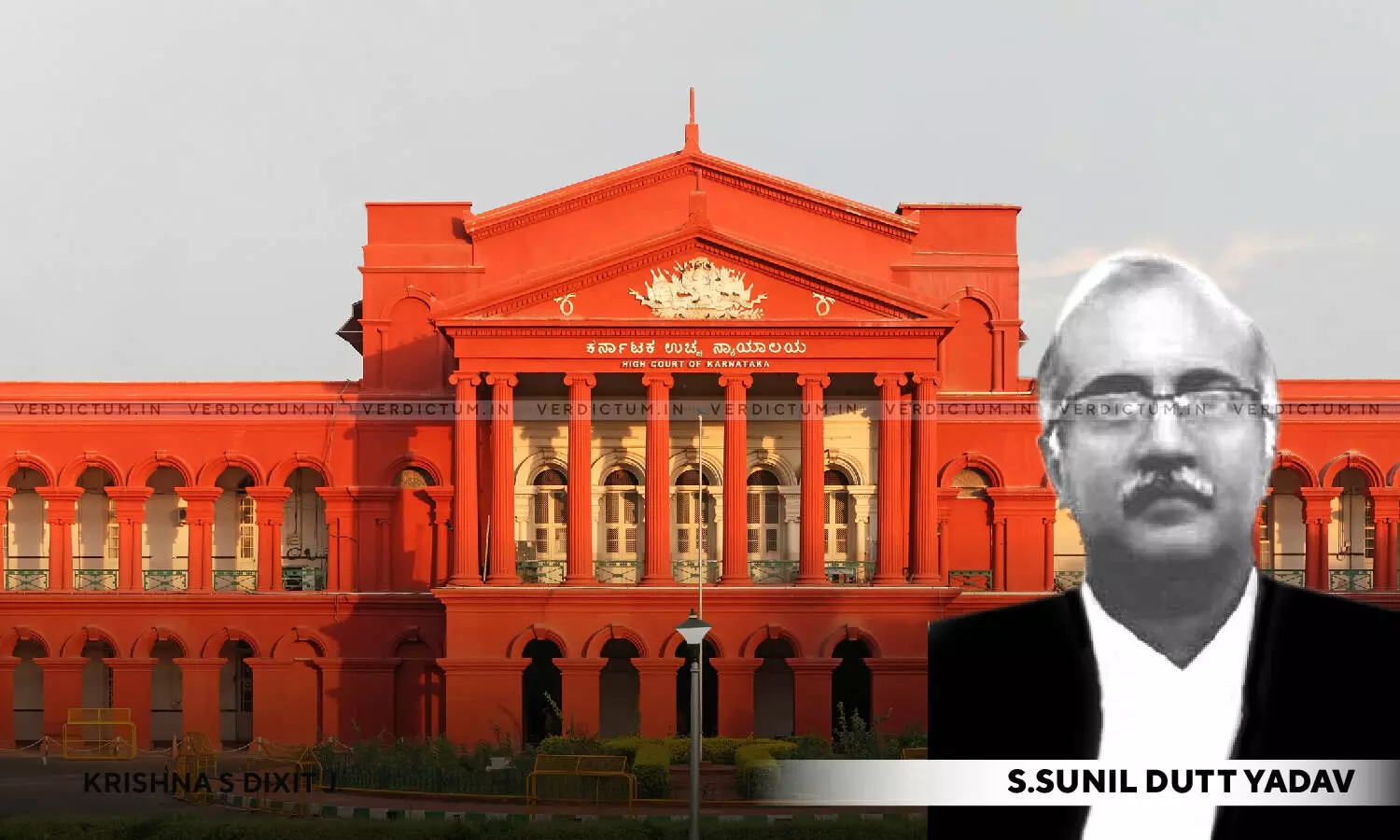

In that context, the Bench of Justice S Sunil Dutt Yadav observed that, "In light of the assessee being dead as on the date of passing the assessment order under Section 147 read with Section 144 of the Act, the order against the dead person amounts to nullity and accordingly, requires to be set aside."

The petitioner (legal representative of deceased assessee ) had challenged several tax-related orders and notices, including the assessment order under Section 147 read with Section 144 of the Income Tax Act, 1961, the computation sheets, demand notices, and penalty order, as well as orders and notices under Sections 148A(d) and 148 of the Act. The petitioner also sought to have their accounts unfrozen as a consequential relief.

In this case, the assessee passed away on May 21, 2022. He was alive when the notice under Section 148A(b) and the order under Section 148A(d) of the Act, as well as the notice under Section 148 of the Act dated March 31, 2022, were issued. However, the assessee died during the assessment proceedings initiated after the notice under Section 148. Consequently, the assessment order was issued against a deceased person. The proceedings had progressed ex-parte.

The Court held that when an assessee dies during the pendency of proceedings, the process must continue through the legal representatives, as stipulated by Section 159(2)(a) of the Act.

Accordingly, the Court set aside the assessment order, computation sheet, demand notice, demand proceedings, and penalty proceedings. Consequently, the order freezing the bank account was also set aside.

The matter was remitted to the stage following the notice issued under Section 148 of the Act. The Revenue was instructed to proceed in accordance with Section 159(2)(a) of the Act. The Court further noted that "upon such steps being taken, the petitioner is at liberty to file their reply to the notice issued under Section 148 of the Act."

Cause Title: Sowmya S vs Income Tax Officer & Ors.

Click here to read/download the Judgment