Mumbai Municipal Corporation Can Levy Water Tax & Water Benefit Tax Irrespective Of Whether Water Is Consumed By Owner Or Occupier Of Property Or Not: Bombay HC

|

|The Bombay High Court has held that water tax and water benefit tax under the Mumbai Municipal Corporation Act can be levied irrespective of whether water is consumed by the owner/occupier of the premise or not.

MARS Enterprises and Oil had challenged the Municipal Corporation of Greater Mumbai’s (MCGM) demand for water tax and water benefit tax under the Mumbai Municipal Corporation Act, 1888 (MMC Act), despite the disconnection of the water supply.

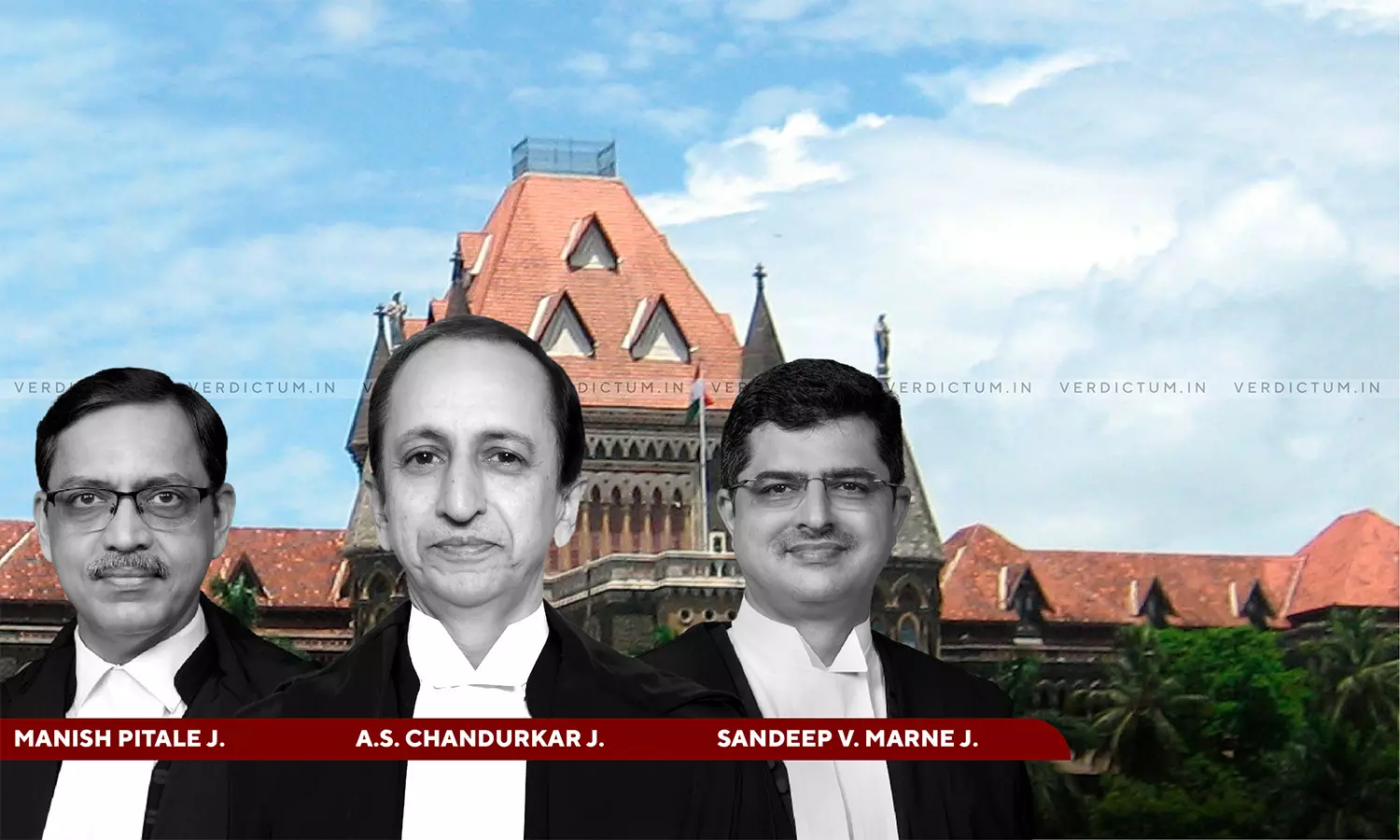

A Bench of Justice A.S. Chandurkar, Justice Manish Pitale and Justice Sandeep V. Marne observed, “Municipal Corporation can levy ‘water tax’ under Section 140(1)(a)(i) of the MMC Act once the facility of water supply is made available to the owner/occupier of a property and whether he actually consumes water or not becomes immaterial…water benefit tax as envisaged under Section 140(1)(a)(ii) of the MMC Act is leviable for meeting of expenditure for providing, operating and maintaining the water supply facilities, the same can be levied irrespective of the fact whether there is actual consumption of water or not.”

Advocate Arup Dasgupta appeared for the petitioner, while Sr. Advocate A.Y. Sakhare represented the respondents.

MARS Enterprises had requested the disconnection of the water supply in 1995. Despite the disconnection being confirmed by the MCGM in 1997, MARS Enterprises received a property tax bill in 2004, which included a levy for water tax and water benefit tax, respectively. The company contested this demand on the grounds that no water was consumed during the period of redevelopment, and therefore, it should not be liable for these taxes.

The Full Bench had to decide the liability of the owner/occupier not consuming water supplied by the Municipal Corporation to pay water tax and water benefit tax.

These questions emerged due to conflicting judgments by different division benches of the High Court. A conflict was highlighted between the judgments in the cases of Harish Lamba v. MCGM (2006) and The Wallace Flour Mills Co. Ltd. v. MCGM (2002). In the former, it was held that no water tax could be levied if water was not consumed, while the latter supported MCGM’s authority to levy such taxes even when no water was used.

The Full Bench answered the following issues:

Does the Corporation have the power to levy tax under Section 140(a)(i) of the said Act on the actual water supply?

- The expression ‘for providing water supply’ appearing in Section 140(1)(a)(i) of the M.M.C. Act for levy of ‘water tax’ does not mean the actual supply of water to owner/occupant and ‘water tax’ under Section 141(1)(a) (i) can be levied irrespective of the fact whether the owner/occupier actually consumes water or not.

Could the water benefit tax, as envisaged under Section 140(a)(ii) of the said Act, be levied irrespective of the actual water consumption since it pertains to the maintenance of the system?

- The ‘water benefit tax’ leviable under Section 140(1)(a) (ii) of the M.M.C. Act is also leviable irrespective of the fact whether the owner/occupier actually consumes the water or not even though the ‘water benefit tax’ is for meeting the expenditure for providing, operating and maintaining the water supply facility and water works.

Consequently, the Bench observed, “The Municipal Corporation can levy ‘water tax’ under Section 140(1)(a)(i) of the MMC Act once the facility of water supply is made available to the owner/occupier of a property and whether he actually consumes water or not becomes immaterial.”

Accordingly, the High Court placed the petition before the Division Bench for passing appropriate orders.

Cause Title: MARS Enterprises v. Mumbai Municipal Corporation of Greater Mumbai (Neutral Citation: 2024:BHC-OS:13004-DB)

Appearance:

Petitioner: Advocates Arup Dasgupta, Sonam Ghiya and Drshika Hemnani

Respondents: Sr. Advocate A.Y. Sakhare; Advocates Rohan Mirpurey and Sunil Sonawane