"Department To Reconsider The Application Under Karasamadhana Scheme"- Karnataka HC While Quashing Recovery From Banker

|

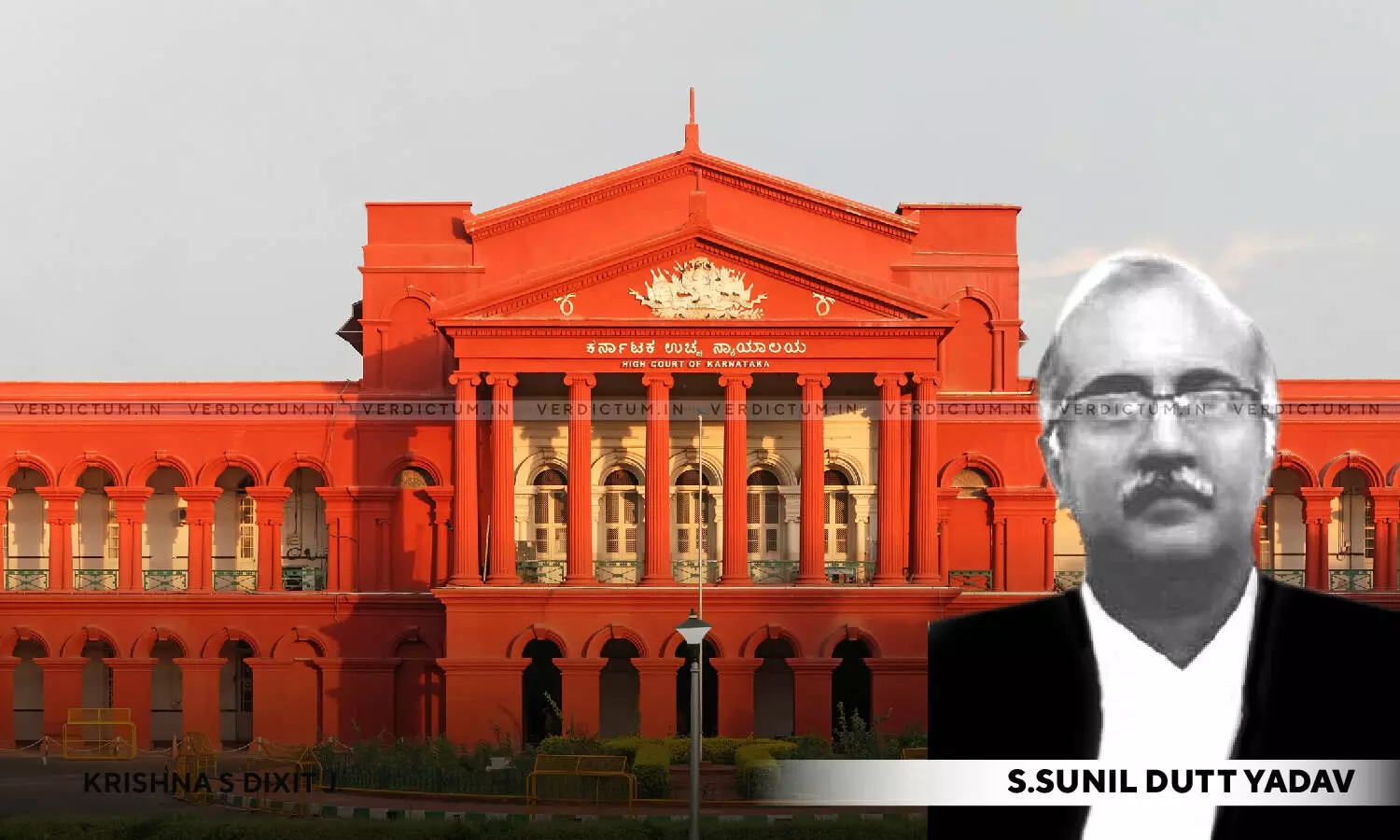

|A Karnataka High Court Bench of Justice S Sunil Dutt Yadav has held that in the event that an application is rejected, it is needless to state that the petitioner cannot be placed in a position worse off. It was further held that the petitioner is entitled to the restoration of his appeal, which would be the logical course of action.

In light of the same, the Court had quashed the recovery from the banker and has directed the department to reconsider the application under the Karasamadhana Scheme.

Counsel Joseph Prabhakar appeared for the petitioner, while Counsel K Hemakumar appeared for the respondent.

In this case, the petitioner had challenged the endorsement by which the respondent had rejected the complainant's application seeking benefits under the Karasamadhana Scheme.

The department had observed that the Circular of the Commissioner of Commercial Taxes provided that "the assessee shall not be eligible for refund of any amount that may become excess as a result of adjustment of penalty or interest paid by him at the time of filing an appeal".

The department issued an order for re-assessment, in accordance with Section 9(2) of the Central Sales Tax Act, 1956. This order imposed a tax and interest amounting to Rs. 57,16,022. Subsequently, a demand notice was issued. The petitioner then filed an appeal with the Joint Commissioner of Commercial Taxes (Appeals) under Section 62 of the Karnataka Value Added Tax Act, 2003 (KVAT Act). Along with the appeal, the petitioner also submitted a request for a stay and fulfilled the requirement stated in Section 62(4) of the KVAT Act by depositing 30% of the disputed amount.

During the pendency of that appeal, the CST Karasamadhana Scheme 2018 was introduced, which provided for the waiver of penalty and interest, subject to payment of tax. The petitioner opted for relief under the Scheme. However, in order to avail benefits under the scheme, it was required that the appeal be withdrawn. Accordingly, the appeal filed by the petitioner was withdrawn.

The Authority had rejected the claim on the ground that as of the date of the scheme coming into force, the entirety of the tax, penalty, and interest had been recovered, so the scheme was inapplicable.

The Court observed that "the question that requires adjudication by the Authority is whether a subsequent recovery from the banker of the petitioner after the appeal was taken on record and payment was made is an amount that could be taken note of".

Subsequently, the Court took the considered view that the matter required reconsideration at the hands of the Authority. The Court also directed that "the Authority is estopped from taking up a stand on a new contention or contrary to its stand while re-considering the issue".

Cause Title: M/s GE T & D India Limited v. State of Karnataka & Ors.

Click here to read/download the Judgment