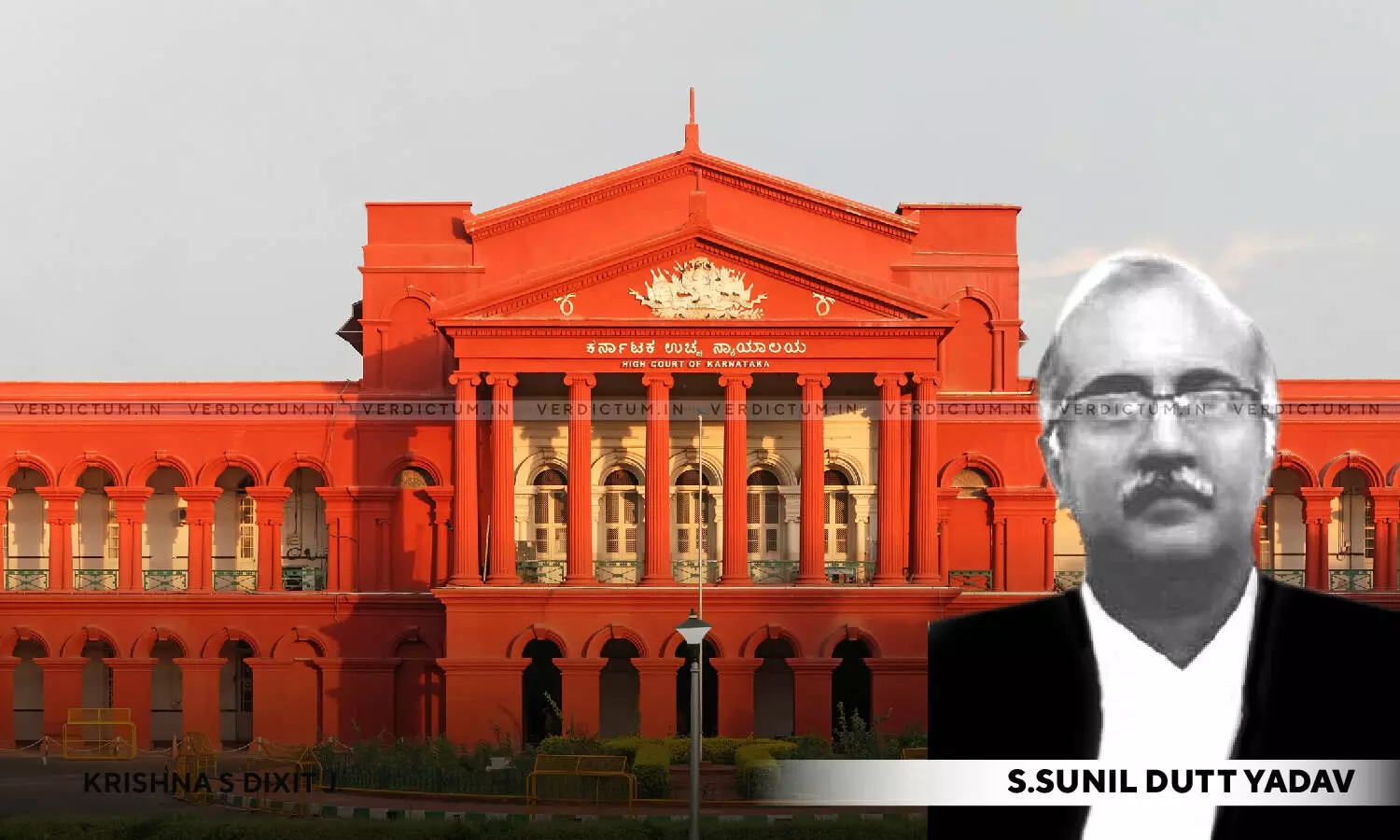

Sec 144C IT Act: AO Should Not Pass Final Assessment Order Till DRP Decides On Objections Raised By Taxpayer: Karnataka HC

|

|While setting aside the assessment order, the Karnataka High Court held that AO ought to have waited for Dispute Resolution Panel (DRP) to pass its directions in the case of Open Silicon Research Private Limited [an eligible assessee as per Sec.144C(15)(b)(i) of the Income Tax Act, 1961].

The Bench of Justice S. Sunil Dutt Yadav observed that “Non- intimation to the assessing officer under section 144C (2)(b)(ii) though is a lapse on the part of the petitioner, the only way of meaningfully and harmoniously interpreting the obligation of filing objections under section 144C(2)(b)(ii) is to construe the procedure that once such objections are filed before the DRP and till the decision is taken by the DRP regarding directions to be passed, the assessing officer ought not to proceed further”.

The Bench found that the draft order was issued and communicated to the assessee and the assessee had filed its objections before the DRP as is evident from the Acknowledgment at Annexure-H which is within the time stipulated.

Considering the lapse in not filing objections u/s.144C(2)(b)(ii) before AO, the Bench stated that though DRP’s direction was dated May 15, 2023, after the assessment order was passed on Oct 26, 2022, the question as to whether non-filing of objections before AO will have the effect of AO being empowered to go ahead and conclude the proceedings when in fact assessee had filed objections before the DRP and had not intimated the same to the AO, requires consideration.

Advocate Bharadwaj Sheshadri argued on behalf of the assessee while Revenue was represented by Advocate M. Dilip.

The High Court explained that once such objections have been filed, DRP as per Sec.144C(5) may issue directions for the guidance of AO to enable him to complete the assessment.

While clarifying that “the power of the DRP is provided for under Sections 144C(6) to 144C(10)”, the High Court explained that once DRP exercises its power vested u/s.144C and directions are issued, the AO has no discretion except to act in conformity with the directions.

Accordingly, the High Court concluded that where objections no doubt have been filed before the DRP and directions passed though at a later point of time, considering the manner of construing the procedure, the assessing officer ought not to have proceeded and ought to have waited till directions were passed by the DRP.

Accordingly, the High Court set aside the assessment order.

Cause Title: Open Silicon Research Private Limited v. DCIT and Ors.

Click here to read/download the Order