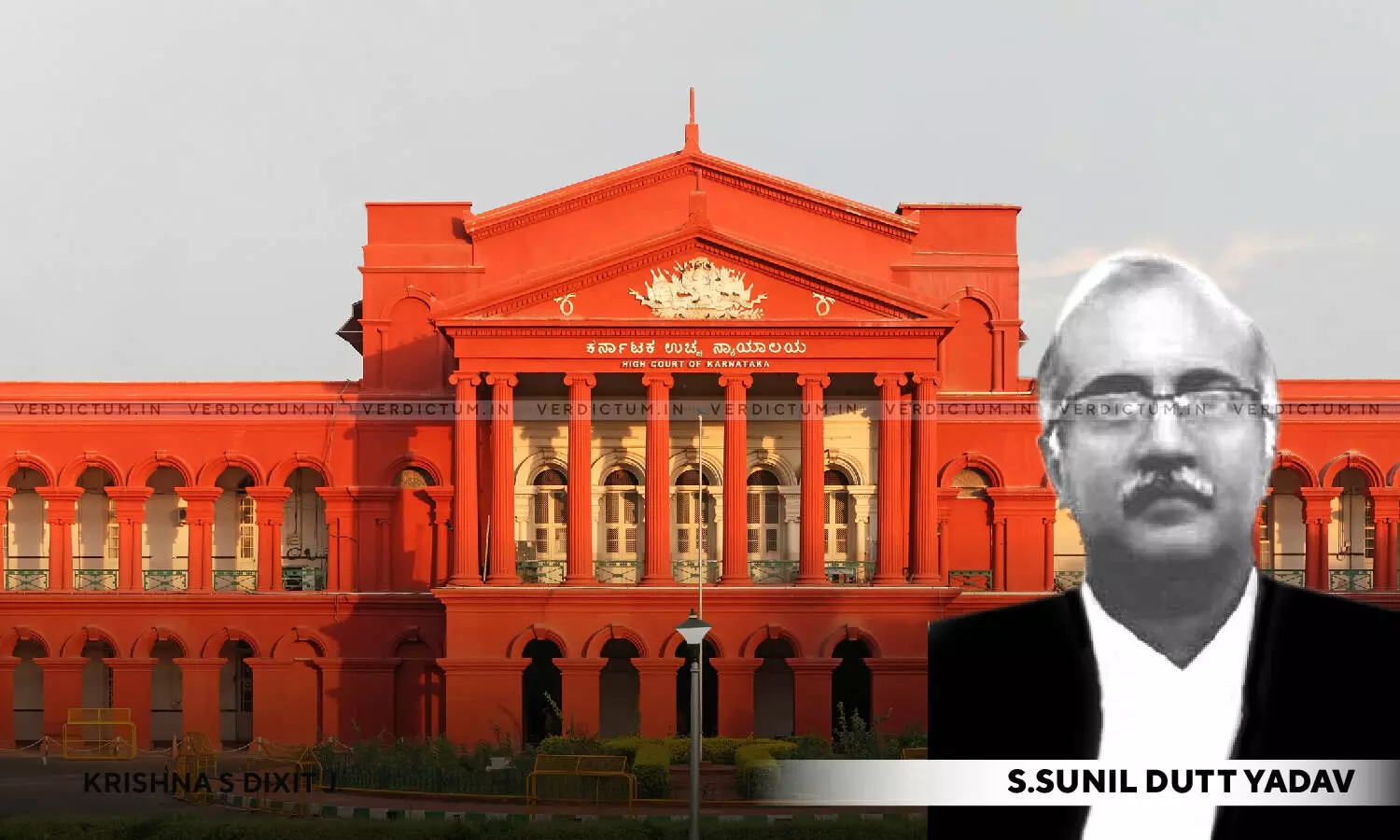

Karnataka HC Condones Delay In Physical Filing Of GST Appeal; Cites Retrospective Application Of Amended CGST Rules

|

|The Karnataka High Court condoned the delay in physical filing of the GST appeal while citing retrospective applicability of amended CGST Rules, 2017.

The Court noted that Rule 108(3) now sets the date of appeal as the issuance of acknowledgement, marking a departure from the previous rule where it depended on furnishing a certified copy of the order if done under 7 days.

The Court was hearing a Writ Petition seeking issuance of Writ of Certiorari to set aside the impugned order whereby the appeal filed under Section 107(11) of the KGST/CGST Act, 2017 was dismissed on the ground that the appeal was filed beyond time and the delay was such that it would be beyond the time that was condonable under Section 107(4) of the Act.

The bench of Justice S. Sunil Dutt Yadav observed, “The change effected by virtue of Rule 108(3) is that the date of appeal would be the date of issuance of acknowledgment and such change is in contradistinction to the earlier requirement which provided that the date of appeal would be the date of furnishing of certified copy of the order, if submitted after seven days. If that were to be so, the date of physical filing of the certified copy ought not to have been taken note of.”

Advocate Syed M. Peeran appeared for the Appellant and HCGP Shamanth Naik appeared for the Respondent.

Brief Facts-

The petitioner's refund order was rejected and the order was served on the same day. The appeal was filed online via the GST common portal within three months of rejection. According to Section 107 read with Rule 108 of the CGST Rules, 2017, the appeal must be filed within three months from the date the order was communicated. The grounds for rejecting the appeal was that the physical re-filing of the appeal was done more than 10 months after the order of rejection was served.

The Court said that although the appeal was filed before the substitution of Rule 108(3), the matter should be decided based on the amended Rule, as the decision was made after the amendment.

The Court noted that the substitution aimed to clarify the requirement for submitting a certified copy of the order. Therefore, as per the Court, if the intent was to provide clarity retrospectively, the substituted Rule should apply to the petitioner's case as well.

Accordingly, the Court set aside the order and condoned the delay.

Finally, the Court disposed of the petition.

Cause Title: M/s Hitachi Energy India Limited v. State of Karnataka (Neutral Citation: 2024:KHC:21940)

Appearance:

Appellant: Adv. Syed M. Peeran, Adv. Ronan Karia and Adv. Nischal K.M.

Respondent: HCGP Shamanth Naik