Keeping Employee In Suspension Beyond Six Months After Superannuation & Not Paying Subsistence Allowance Is Incorrect: Madras HC

|

|The Madras High Court allowed an appeal against the order of the Single Judge which had upheld the disciplinary proceedings against the appellant considering the lapse of time of more than 10 years after retirement when the appellant was left without even payment of subsistence allowance lawfully due to him.

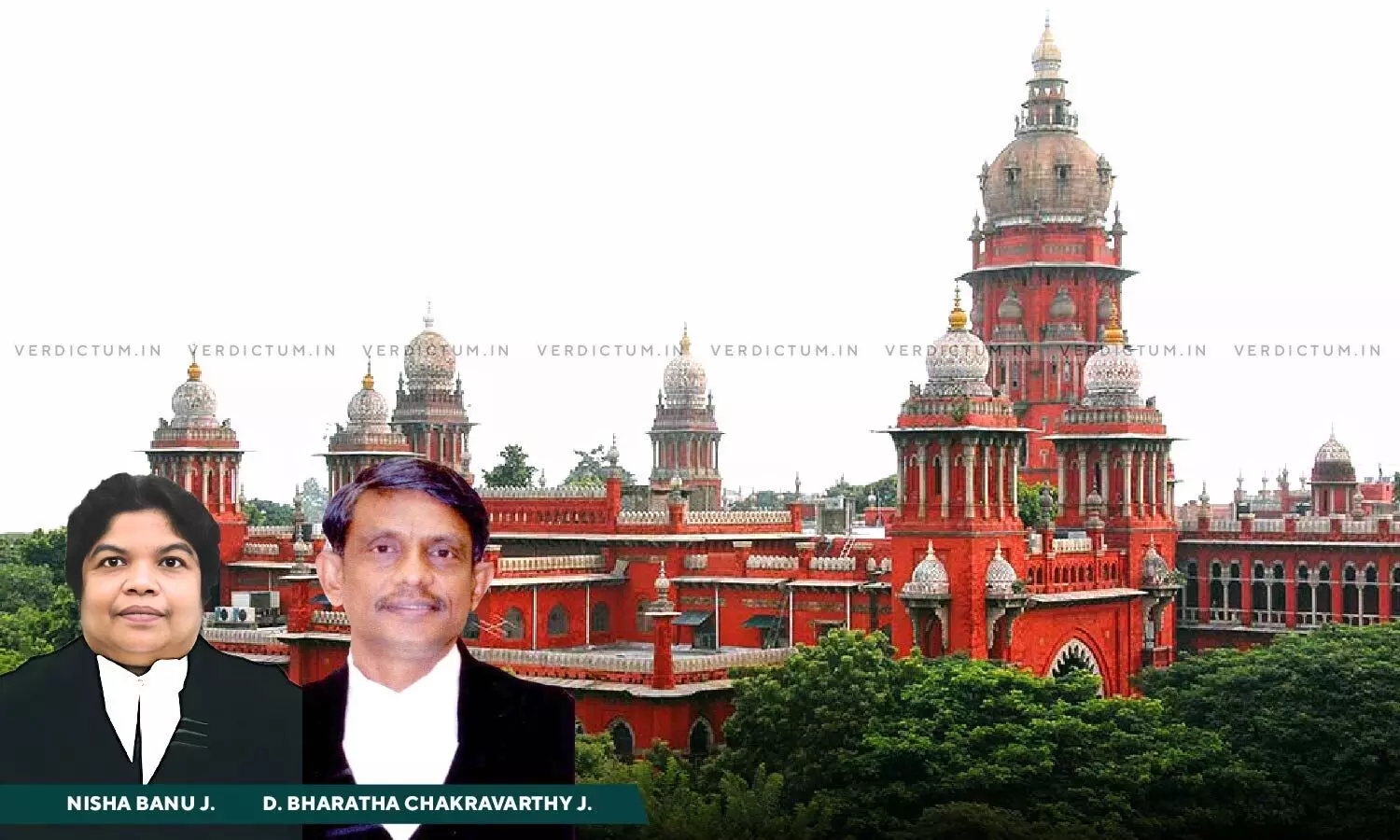

The Division Bench of Justice J. Nisha Banu and Justice D. Bharatha Chakravarthy observed that “if the employee can be continued beyond a period of six months under suspension, then he will be entitled to subsistence allowance, notwithstanding the same period of six months mentioned in the Rule for payment of subsistence allowance”.

The Bench added that the continuation of the disciplinary proceedings against the employee, especially when no charge was made out as per the Tamil Nadu Cements Corporation Limited Service Rules, is incorrect in law.

Advocate Balan Haridas appeared for the Appellant, whereas Advocate A. Sivaji appeared for the Respondent.

The brief facts of the case are that the appellant challenged the direction to appear for an inquiry on the ground of illegality and prayed for closing the disciplinary proceedings against him in respect of the charge memorandum dated July 14, 2004. It was submitted that all the articles of the charge, and the imputations related to his wife indulging in private construction business pertaining to the income amounting to bribe and disproportionate wealth of known sources of income. Thus, it was alleged that a criminal case was initiated in violation of 5.2(v) of the said Rules which came into existence by amendment dated July 15, 1994. Relying upon Rule 2.22(b), the appellant contended that the continuation of inquiry beyond the period of 6 months was illegal. However, the Single Judge Bench held that the said period of 6 months was only directory. Accordingly, the appellant approached the present High Court.

After considering the submission, the Bench agreed with the findings of the Single Judge that the period of 6 months was only directory in nature and not mandatory, since the purport of Rule 2.22(b) is to continue the disciplinary proceedings in extraordinary cases like that of the present case, where the delinquent employee attained the age of superannuation, pending the departmental proceedings.

The Bench noted that since the employee had to be retained in the service by placing him in suspension, the period of 6 months was being mentioned, and only because, the department should not be financially burdened with the payment of subsistence allowance for a long period, to complete the inquiry expeditiously, the period of 6 months was mentioned in the said Rule.

Therefore, the High Court clarified that when the appellant retired in the year 2011, keeping him in suspension eternally for all these years, and not paying subsistence allowance is incorrect in law.

The High Court found that the appellant’s wife undertook to construct a house, and in one case the construction was completed, whereas in the other case, the construction was not even completed.

A careful reading of Rule 5.2(v) of the said Rule made it clear that “it prohibited taking stockist-ships and forwarding agencies in the names of the family members or benami name was prohibited, and the employee could not carry out money lending or private business or trade or occupation. The private business or trade or occupation by the family member could not be said to be prohibited by the said Rule”, added the High Court.

Consequently, the Bench set aside the order of the Single Judge and declared the disciplinary proceedings illegal.

Further, the Bench also directed the respondents to permit the appellant to retire from service and pay all the retiral benefits, within two months from the date of receipt of the copy of the order.

Cause Title: T. Retnapandian v. Tamil Nadu Cements Corporation Limited and Ors.

Click here to read/download the Judgment