Sec 54 U.P GST Act – Any Delay Beyond Statutory Period Of 60 Days In Dealing With Refund Claim Entails Interest Liability: Allahabad HC

|

|While hearing a petition seeking directions to the UP Goods and Services Tax Department to disburse refund of tax collected from the Petitioner, the Allahabad High Court observed that since an Appellate order in favor of the Petitioner was passed and directed refund of amount pre-deposited before disposal of appeal, then such amount ought to have been refunded to the Petitioner.

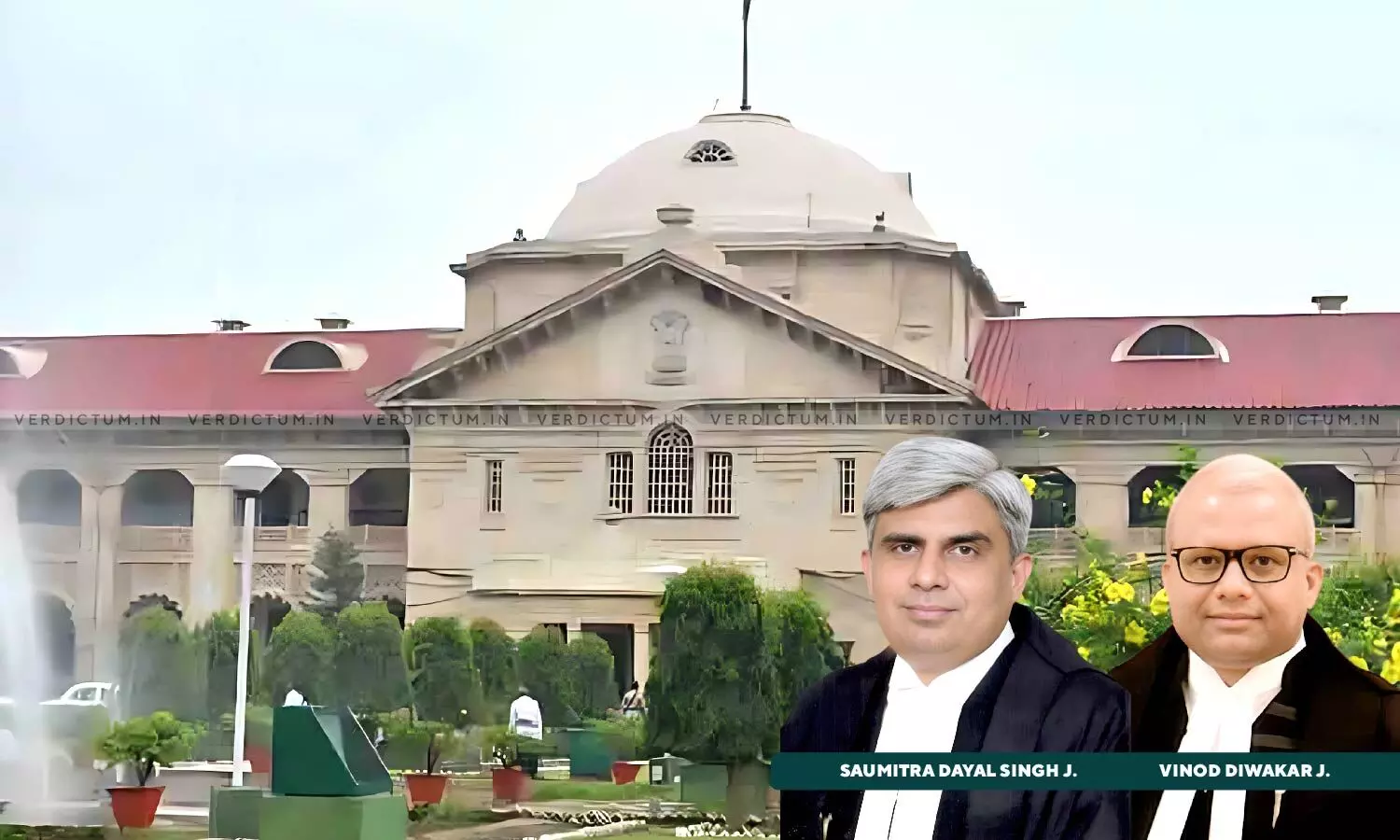

A Division Bench of Justice Saumitra Dayal Singh and Justice Vinod Diwakar also referred to a judgment of the Coordinate Bench of this Court, in the case of Savista Global Solutions Pvt. Ltd. Vs. Union of India & 5 Ors. (Writ Tax No. 113 of 2021) before directing the Respondent to dispose of the Petitioner’s refund application, and observed that “By virtue of Section 54(7) of the Act, that claim ought to have been dealt with and disposed of within 60 days of its receipt. It is also not in dispute, by virtue of Section 56, any delay beyond statutory period of 60 days in dealing with the claim for refund, the revenue entailed the interest liability @ 6% from the end of period of 60 days”.

The Petitioner was represented by Advocate Shubham Agarwal, whereas the Respondent-Revenue was represented by Advocate Devendra Gupta.

The brief facts of the case were that the Petitioner operated as a dealer of Beedis. In the relevant period, a consignment from West Bengal to Haryana was intercepted in Uttar Pradesh. The truck was detained on allegation of improper documentation. Further allegation of smuggling Beedis into Uttar Pradesh was made. The goods were subsequently seized and with order being passed under Section 20 of the Integrated Goods and Services Tax Act (IGST) read with Section 129(3) of the UP GST Act. A combined tax and equivalent penalty demand, totaling about Rs 47.32 Lakhs, was raised. On first appeal, the tax demand was quashed and the tax amount which had been deposited by the Petitioner, pending disposal of appeal before the Appellate Authority, was directed to be refunded. However, the Respondent-Revenue did not either appeal against such order or proceed to refund the tax deposited.

On hearing the contentions of both sides, the Bench observed that Section 54 of the UP GST Act required the Petitioner to file an application in the prescribed form and manner, within two years from the refund becoming due.

The Bench found there to be no doubt that the Petitioner had filed an offline application seeking refund. In this regard, reference was made to Rule 97-A of the UP GST Rules, which permitted both manual and electronic filing of refund claim.

The Bench then referred to Section 54(7) of the UP GST Act, which obligated the Respondent-Revenue to hear and dispose of a refund claim within 60 days of it being received.

The Bench then drew attention to Section 56, holding that any delay beyond statutory period of 60 days in dealing with the claim for refund, the Revenue was liable to pay interest @ 6% from the end of period of 60 days.

Therefore, the Bench directed the Respondent-Revenue to dispose of the Petitioner’s refund claim within three months’ time and to pay up the amount of refund claim together with statutory interest, within a period of three months from date of the order.

Cause Title: M/S Desai Brothers Limited Ratanpur v. State of UP and Ors. [Neutral Citation No. 2023: AHC:162034-DB]

Click here to read/download the order