Can Referral Court Consider Issue Of "Accord & Satisfaction" U/S 11 Of Arbitration & Conciliation Act?: Supreme Court Explains

|

|The Supreme Court has reiterated that the scope of enquiry at the stage of appointment of arbitrator is limited to the scrutiny of prima facie existence of the arbitration agreement.

The Court observed that the question of “accord and satisfaction,” being a mixed question of law and fact, falls within the exclusive jurisdiction of the arbitral tribunal unless otherwise agreed upon by the parties. It said that the dispute pertaining to the “accord and satisfaction” of claims is not one which attacks or questions the existence of the arbitration agreement in any way.

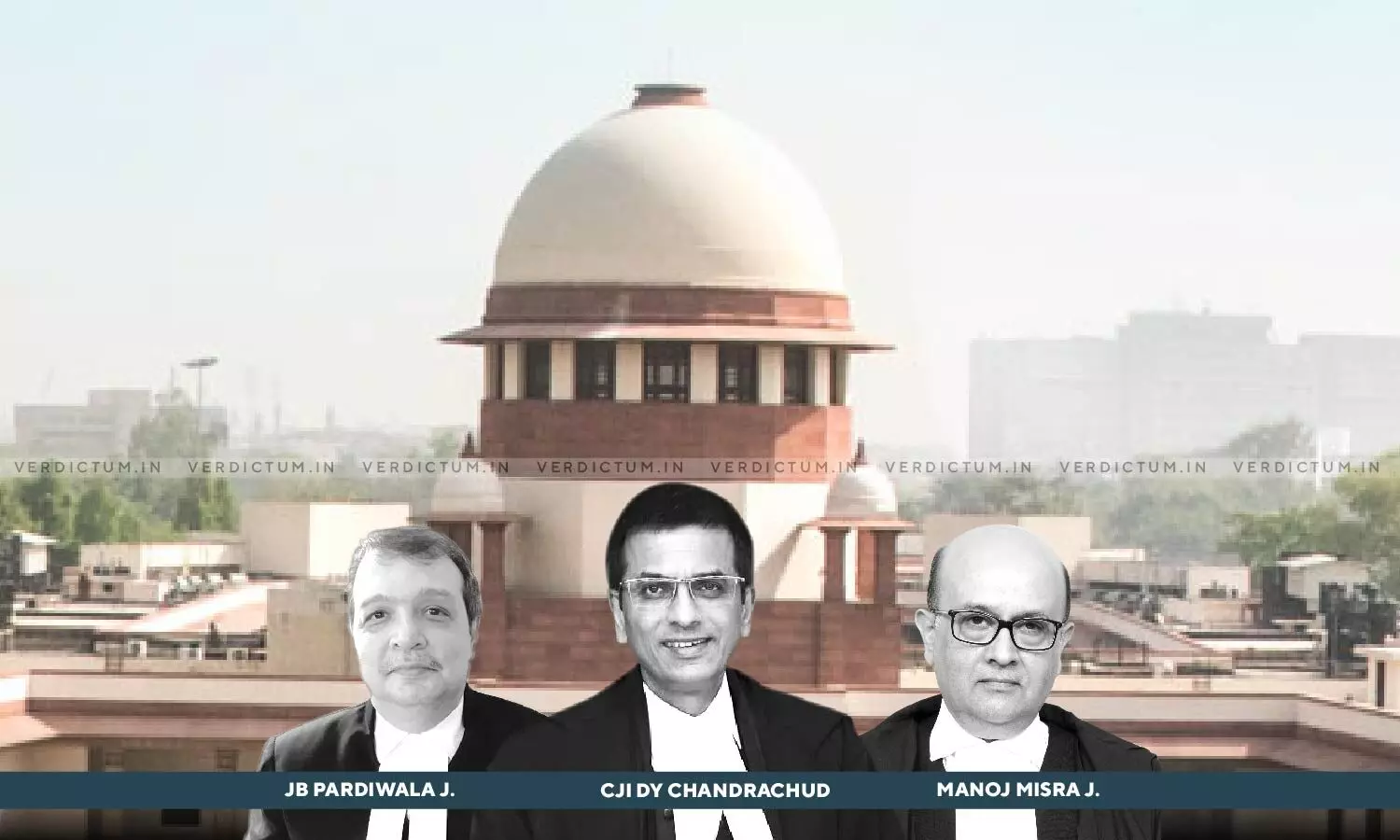

In that context, the Bench of Chief Justice DY Chandrachud, Justice JB Pardiwala and Justice Manoj Misra observed that, "the scope of enquiry at the stage of appointment of arbitrator is limited to the scrutiny of prima facie existence of the arbitration agreement, and nothing else... The dispute pertaining to the “accord and satisfaction” of claims is not one which attacks or questions the existence of the arbitration agreement in any way. As held by us in the preceding parts of this judgment, the arbitration agreement, being separate and independent from the underlying substantive contract in which it is contained, continues to remain in existence even after the original contract stands discharged by “accord and satisfaction”."

In this case, the Court was determining whether the arbitration agreement contained in a substantive contract survives even after the underlying contract is discharged by “accord and satisfaction”.

The appellant, SBI General Insurance Co. Ltd., a private sector general insurance company, provided general insurance to its customers, with one of its offices located at Shukan Business Centre, Ahmedabad. The respondent, M/s Krish Spinning, a partnership firm engaged in manufacturing and spinning cotton filaments, obtained a standard fire and special perils insurance policy from the appellant on 31.03.2018, with coverage until 30.03.2019 for a sum of Rs 7,20,00,000.

During the coverage period, two fire incidents occurred at the respondent's factory premises, causing significant asset losses. The first fire on 28.05.2018 resulted in a claimed loss of Rs 1,76,19,967, while the second fire on 17.11.2018 led to a claimed loss of Rs 6,32,25,967. The dispute in this case pertains only to the first incident.

After the first fire, SBI appointed M/s Paresh Shah & Associates as the surveyor, who assessed the loss at Rs 84,19,579. Despite initially claiming Rs 1,76,19,967, Krish Spinning agreed to the surveyor's assessment and signed a consent letter on 24.12.2018, followed by an advance discharge voucher on 04.01.2019, confirming receipt of the assessed amount as full settlement. The appellant paid this amount on 31.01.2019.

For the second fire incident, SBI paid a total of Rs 4,86,67,050 in three installments, with the final installment released on 14.10.2019. Shortly after, on 25.10.2019, Krish Spinning sent a letter to SBI alleging they were compelled to sign the discharge voucher due to financial need and requested a copy of the survey report. SBI refused to accept this letter initially but later provided the survey report in response to an email.

On 02.03.2020, Krish Spinning issued a legal notice demanding the balance payment for the first fire claim, alleging coercion and undue influence in signing the discharge voucher. They invoked Section 11(6) of the Arbitration and Conciliation Act, 1996, for appointment of an arbitrator, as SBI did not nominate one.

The High Court ruled that the dispute, including the plea of "accord and satisfaction" raised by SBI, should be decided by an arbitrator, referencing the Supreme Court decision in Oriental Insurance Company Ltd. v. Dicitex Furnishing Ltd. The High Court's order was challenged by SBI, leading to the appeals.

It was emphasized that if the referral court exceeds its scope of inquiry as provided under the relevant section and examines the issue of “accord and satisfaction,” it would amount to usurping the power intended to be exercised by the arbitral tribunal alone, not the national courts. Such actions would undermine arbitral autonomy and conflict with the scheme of the Arbitration and Conciliation Act, 1996.

The Court further noted that if referral courts delve into issues pertaining to “accord and satisfaction” and similar matters, achieving the objective of expediency and simplification of pleadings would become difficult. Moreover, tests like the “eye of the needle” and “ex-facie meritless,” though designed to minimize judicial interference, still require referral courts to examine contested facts and appreciate prima facie evidence, which is not in line with modern arbitration principles that prioritize arbitral autonomy and judicial non-interference.

Subsequently, the Apex Court held that all legal contentions including objections available to the appellant were to kept open to be taken up before the Arbitrator.

Cause Title: SBI General Insurance Co. Ltd. vs Krish Spinning (Neutral Citation: 2024 INSC 532)