Airports Economic Regulatory Authority's Appeal Against TDSAT Judgment On Tariff Determination Maintainable: SC

|

|The Supreme Court held that the Airports Economic Regulatory Authority of India (AERA) can file an appeal against TDSAT's judgment under Section 31 of the AERA Act regarding tariff determination.

The Court upheld the maintainability of appeals filed by the Airports Economic Regulatory Authority (AERA) under Section 31 of the Airport Economic Regulatory Authority of India Act, 2008 (AERA Act) challenging the judgments of the Telecom Disputes Settlement and Appellate Tribunal (TDSAT)

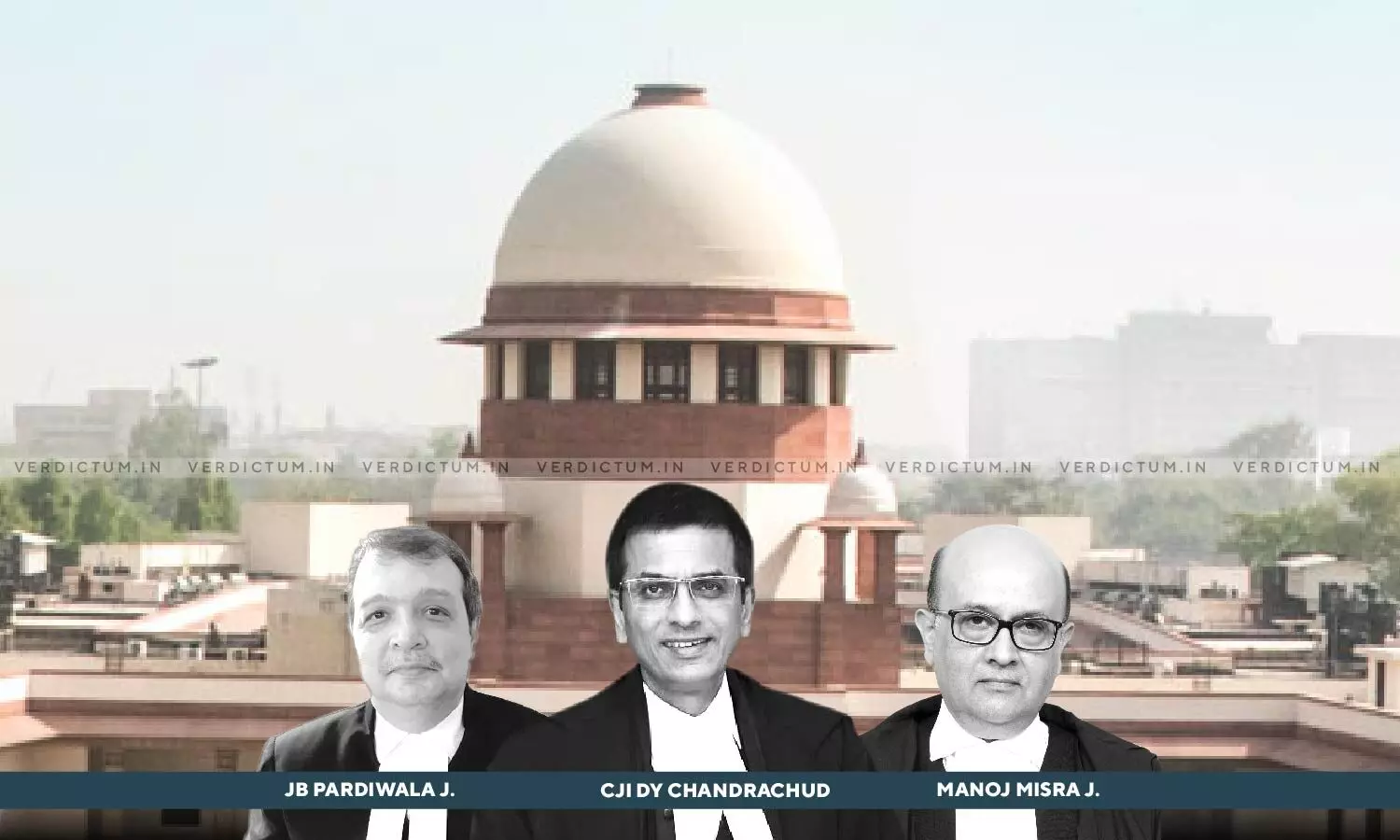

A Bench of Chief Justice Dhananjaya Y Chandrachud, Justice J B Pardiwala and Justice Manoj Misra held, “It is clear from the above judgments that the principle that a judicial or quasijudicial authority cannot be a respondent in the appeal is circumscribed by certain other factors…However, a statutory authority may be entrusted with the performance of both adjudicatory and regulatory functions. This Court has held that while it need not be impleaded as a respondent in an appeal against an adjudicatory order, it may be made a contesting party in an appeal against an order issued in exercise of its regulatory functions because then it may have a vital interest in the ‘lis’ bearing on matters of public interest.”

Solicitor General Tushar Mehta and Attorney General Venkataramani represented the appellant, while Senior Advocates K.K. Venugopal and A.M. Singhvi appeared for the respondents.

The Supreme Court had to determine whether AERA, as a statutory regulatory authority, can challenge the judgments of the TDSAT particularly in matters of tariff determination.

The Bench observed, “It may be recalled that determination of tariff for aeronautical services is merely one of the functions discharged by AERA. Section 17(1)(b) grants TDSAT the jurisdiction to “hear and dispose of appeal against any direction, decision or order of the Authority under this Act.” Section 18(5) by using the expression “as the case may be” accounts for such a situation and requires that a copy of the order to be provided to AERA even if it is not a party to the appeal.”

Thus, the Court explained that the expression “as the case may be” in Section 18(5) must be read to mean that a copy of the order of TDSAT must be given to AERA even if it is not a party to the appeal or the dispute. “The expression cannot be interpreted to impliedly exclude AERA as a respondent in the appeals against its orders before TDSAT,” it clarified

“Section 18(5) refers to parties in a dispute or appeal. AERA is not a party to the lis when TDSAT adjudicates a dispute between two or more service providers, or a service provider and a consumer in terms of Section 17(1)(a). For disputes adjudicated by TDSAT under Section 17(a), AERA may be included as a party in terms of the proviso to the provision. If the expression “as the case may be” is interpreted to refer to “dispute or appeal”, thereby excluding AERA as a party to either the dispute or the appeal, it would amount to reading down the proviso to Section 17(1)(a),” the Bench clarified.

The Bench explained that when it came to an appeal against the tariff order issued by AERA, it was not just acting as an ‘expert body’ but as a regulator interested in the outcome of the proceedings. “AERA has a statutory duty to regulate tariff upon a consideration of multiple factors to ensure that airports are run in an economically viable manner without compromising on the interests of the public,” it remarked.

“Section 31 does not expressly confer AERA with the right to file an appeal against the order of TDSAT before this Court. In fact, it does not confer that power to any party expressly,” the Court remarked.

The Court clarified that a judicial or quasi-judicial authority cannot be impleaded in an appeal against its order if the order was issued solely in exercise of its “adjudicatory function,” while the same authority can be impleaded as a respondent in the appeal against its order if it was issued in exercise of its regulatory role since the authority would have a vital interest in ensuring the protection of public interest.

Consequently, the Court held, “In view of the discussion above, the appeals filed by AERA against orders of TDSAT under Section 31 of the AERA Act are maintainable. The Registry shall list the matters before the Regular Bench for adjudication of the appeals on merits.”

Cause Title: Airports Economic Regulatory Authority of India v. Delhi International Airport Ltd. & Ors. (Neutral Citation: 2024 INSC 791)

Appearance:

Appellant: Solicitor General Tushar Mehta; Attorney General Venkataramani; ASG N. Venkataraman; Senior Advocates Prashanto Chandra and Sajan Poovayya; Advocates Buddy Ranganadhan, Kartikay Agarwal, Darshita Sethia, Kunal Tandon, Shweta Bharti, Mahesh Agarwal, Ankur Saigal, et al; AOR Ritesh Kumar, Amit Pawan, E.C. Agrawala, et al

Respondents: Senior Advocates K.K. Venugopal, A.M. Singhvi, Arvind Datar, Sajan Poovayya, Maninder Singh; Advocates Hemant Sahai, Sanjanthi Sajan Poovayya, Rishi Agrawala, Amrita Narayan, Milanka Chaudhary, Srishti Widge, Ankur Talwar, Manu Krishnan, Aanchal Mullick, et al; AOR Sahil Tagotra, Mohit D. Ram, Amit Pawan, et al