Prior Anchorage Charges Levied Upon Vessel Under Sale Is Not In Nature Of Encumbrances For Purpose Of Anchorage Fee- SC

|

|While adjudicating upon a case falling under the Port Trusts Act 1963, the Supreme Court has observed that levying prior anchorage charges upon vessel under sale are not in the nature of encumbrances for the purpose of anchorage fee.

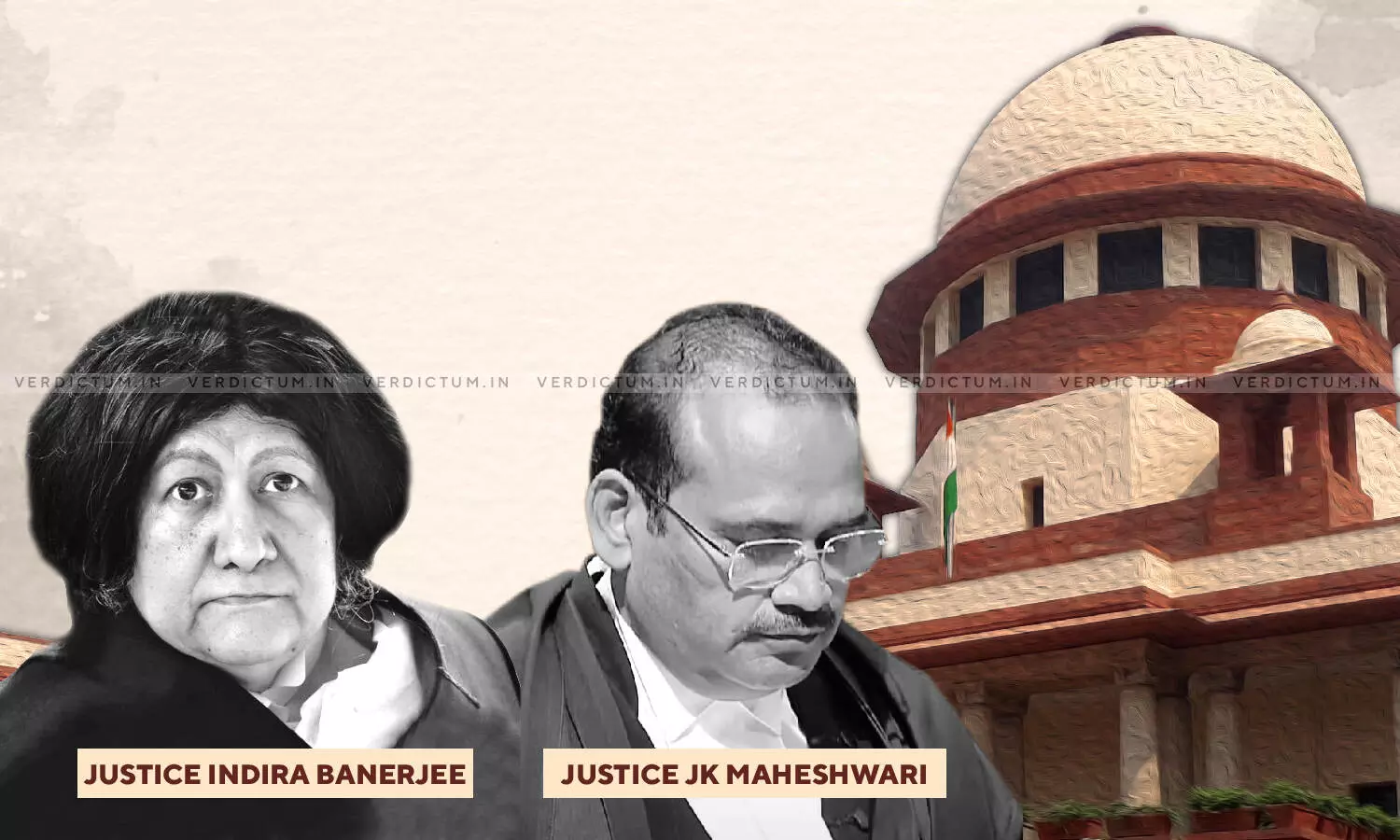

The Bench of Justice Indira Banerjee and Justice JK Maheshwari dismissed the appeal of the Appellant and upheld the impugned judgment of the Division Bench of the Bombay High Court which had held that it is far fetched to suggest that prior anchorage was of the Vessel under sale and the rate that it attracts as a result of such prior anchorage are in the nature of encumbrances for the purposes of anchorage fees to be applied after the date of Bill of Sale and till the Vessel sells at the instance of the purchaser.

Further, the Court also held –

"NKD, in its cross objection, contended that anchorage charges fall within the expression 'port dues' under Section 50-B of the Port Trusts Act. Under Section 50-B, when a Vessel enters a port but does not discharge or take in any cargo or passengers, she is charged with port dues at a rate to be determined by the Authority, which, in any event, should not exceed half the rate with which she otherwise would be chargeable."

In this case, NKD -Appellant had purchased a vessel after which a Bill of Sale was drawn in favor of the Appellant. The Bill of sale clearly stated that the vessel was sold free from all encumbrances after which the delivery of the vessel was given to the Appellant.

The Vessel had initially arrived at the Port of Bombay. When NKD was going to remove the Vessel, Respondent No. 1 raised bills in respect of anchorage charges and Respondent No. 4 raised bills in respect of Light due charges.

The Bill of State had also clearly stated that the successful bidder would be liable to pay the costs, charges, fees and expenses of any kind involved in removing the Vessel.

Disputes arose between NKD and the Port Trust with regard to the anchorage charges claimed by the Port Trust.

The Port Trust charged approximately Rs.15,00,000/- per day on the basis that the Vessel had been docked at the anchorage for more than 30 days. If the vessel were to be docked for less than 30 days, the anchorage charges would be approximately Rs.5,00,000/- per day.

NKD filed an application in Commercial Admiralty Suit in the Commercial Division of the High Court seeking directions on the Customs Authorities and the Mumbai Port Trust to raise revised bills, levying Light Dues Charges and/or Anchorage Charges from the date on which physical possession of the vessel was made over to NKD.

The Commercial Division of the High Court (Single Bench) allowed the application filed by NKD.

While the Port Trust filed Commercial Appeal against the order of the Single Judge, NKD filed a cross objection to the Commercial Appeal of the Port Trust.

Senior Counsel Siddharth Bhatnagar appeared for the Appellant while Senior Counsel Jayant Bhushan appeared for the Respondents before the Apex Court.

The Court noted, "In our view, the Division Bench rightly held that the argument was without merit. As held by the Division Bench, it is far-fetched to suggest that prior anchorage was of the Vessel under sale and the rate that it attracts as a result of such prior anchorage are in the nature of encumbrances for the purposes of anchorage fees to be applied after the date of Bill of Sale and till the Vessel sells at the instance of the purchaser."

Further, the Court also noted, "As held by the Division Bench, NKD purchased the Vessel on 'as is, where is' basis free from encumbrances in the instant case, anchorage charges have been levied from the date of the sale. The rates were payable on the basis of the number of days for which the Vessel was docked."

The Court thus held that Division Bench rightly allowed the appeal and set aside the order of the Single Judge, and thus dismissed the appeal.

Cause Title – M/s. NKD Maritime Limited v. The Board of Trustees of the Port of Mumbai & Ors.