Any Promise To Pay Debt Cannot Cure Fault Of Limitation In PreExisting Action After Insolvency Proceedings Are Initiated: Supreme Court

|

|The Supreme Court held that after the initiation of insolvency proceedings and in the absence of any averments or pleadings, any promise made to pay the debt cannot cure the fault of limitation in a preexisting action.

The Court while dismissing a Civil Appeal filed by the Managing Director (MD) of the Second Respondent (Totem Infrastructures Limited) against the proceedings on account of default in repaying the financial facilities extended to the company. The Court emphasized that such a promise made to repay the debt would constitute an independent cause of action.

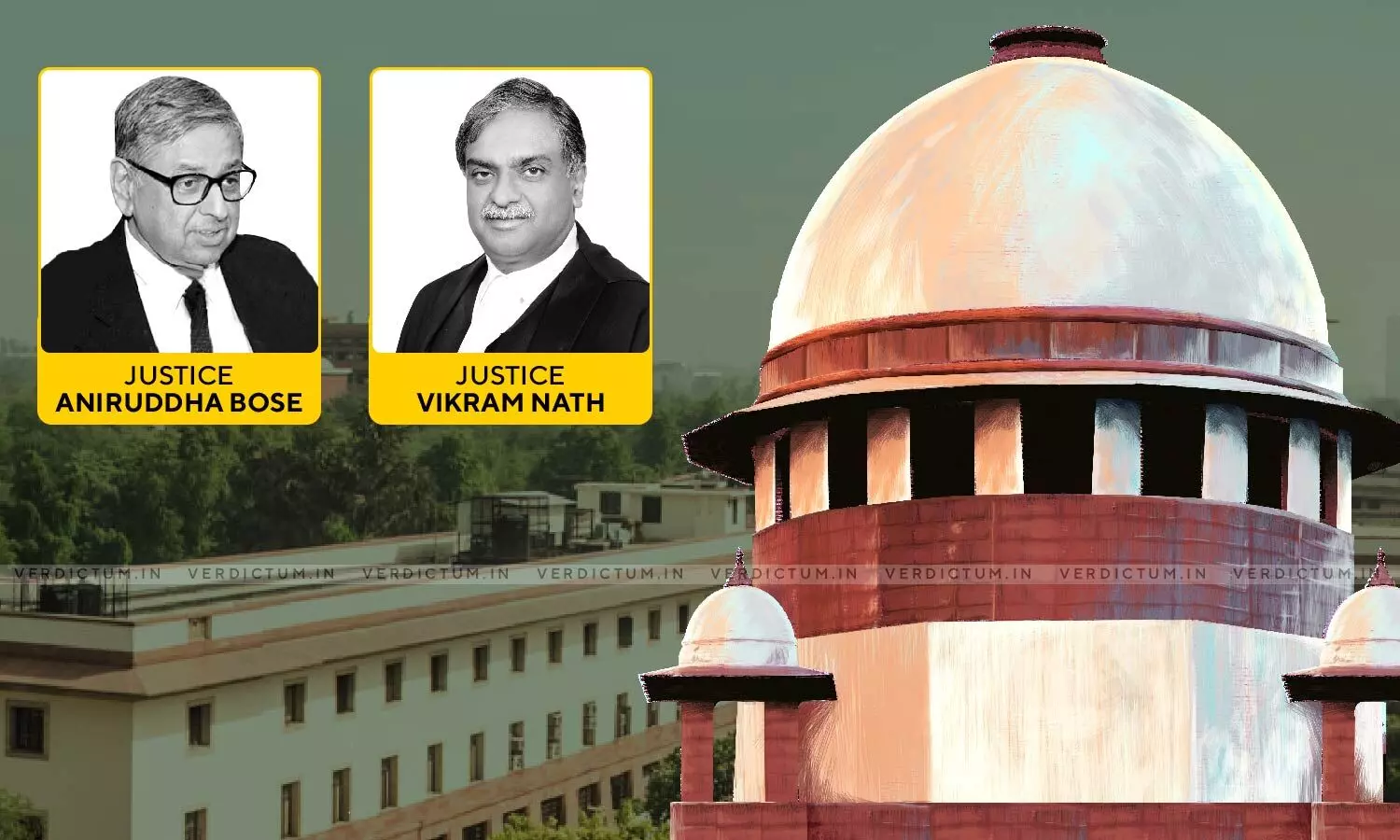

The Bench comprising Justice Aniruddha Bose and Justice Vikram Nath observed, “We accept the submission of the appellant that this letter was a request to consider a onetime settlement. But again, in absence of averments or pleading, after initiation of insolvency proceeding, any promise made to pay the debt cannot be treated to have cured the fault of limitation in a preexisting action. A promise of this nature would constitute an independent cause of action”.

Advocate K. Parameshwar appeared for the Appellant and Advocate Avrojyoti Chatterjee appeared for the Respondent.

Brief Background:

The Appellant was the Managing Director (MD) of the Second Respondent (Totem Infrastructures Limited) against whom proceedings were initiated on account of default in repaying financial facilities extended to them by several banks in the form of loans and bank guarantees. A notice under Section 13(2) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI) was issued by the Debt Recovery Tribunal (DRT). The National Company Law Tribunal (NCLT) was approached by the State Bank of India (First Respondent) under Section 7 of the Insolvency and Bankruptcy Code, 2016 (IBC) based on three recovery certificates. The NCLT appointed an Interim Resolution Professional (IRP) while admitting the application and the declaration of memorandum. The Appellant approached the National Company Law Appellate Tribunal (Appellate Tribunal) challenging the order of the NCLT, which was dismissed.

Aggrieved the Appellant approached the Court by way of a Civil Appeal challenging the order of the Appellate Tribunal on grounds that his acknowledgment was beyond the limitation period and would not revive the right to sue, citing Section 18 of the Limitation Act (LA).

The Bench noted that if the date of initial default is considered then the Bank’s right to sue would have extinguished as three years had lapsed. The Court observed that if the letter of acknowledgment is considered then the same was made after the institution of proceedings under Section 7 of IBC and therefore there could be no reference to such acknowledgement.

The Bench held that the Appellate Tribunal could not have purported acknowledgment of debt to extend the limitation period without an amendment of the pleadings. The Court further held that in the absence of averments or pleading, after initiation of an insolvency proceeding, any promise made to pay the debt cannot be treated to have cured the fault of limitation in a preexisting action. A promise of this nature would constitute an independent cause of action.

The Court ascertained the issue: “whether the debts in connection with the recovery certificate issued in the year 2015 could form subject matter of an application under Section 7 of the IBC filed on 06.09.2019”.

The Court reiterated that the Corporate Insolvency Resolution Process (CIRP) could be brought within three years from the date of the issue of the recovery certificate. The Bench held that the suit filed before the NCLT was a composite application based on three recovery certificates. The Bench observed that the two recovery certificates were instituted within 3 years as postulated under Article 137 of the LA.

Furthermore, the Court noted that Section 19(22A) of the Recovery of Debts and Bankruptcy Act, 1993 (RDB Act) allows recovery certificate holders to be deemed decree holders for winding-up actions, this right is limited to companies registered under the Companies Act, 2013 and certain other entities. However, the Bench noted that such restriction does not apply when initiating proceedings under the IBC or making claims under the IBC.

The Bench observed that the corporate debtor in question was incorporated under the Companies Act, 1956, and credit facilities date back to 1993-94, during a time when the Companies Act of 1956 was in effect. Consequently, the Court observed that the legal position of the case must align with the interpretation in Kotak Mahindra Bank Limited v A. Balakrishnan and Another [(2022) 9 SCC 186], which recognized that a recovery certificate maintains the character of a decree and can be used to lodge a claim in an IBC proceeding.

“In the event a financial creditor wants to pursue a recovery certificate as a deemed decree, he would get twelve years’ time. We are of this view as the extent of operation of a recovery certificate has been construed by this Court in Kotak Mahindra I (supra) to go beyond filing of windingup petition alone. It would retain the character of a decree to lodge a claim in an IBC proceeding”, the Bench observed.

Additionally, the Bench held that the Appellate Tribunal did not thoroughly examine the legality of the 2015 certificate as a deemed decree. The Court therefore directed the Appellate Tribunal to adjudicate upon the legality of the 2015 certificate. If the Appellate Tribunal finds that the Corporate Insolvency Resolution Process (CIRP) does not apply to the 2015 recovery certificate, the claim based on it can be separated from the composite claim, the Bench asserted.

Therefore, the Bench directed the Committee of Creditors to treat the amount indicated in the 2015 recovery certificate as part of the claims during the public announcement.

Accordingly, the Court dismissed the Appeal.

Cause Title: Tottempudi Salalith v. State Bank Of India & Ors. (2023 INSC 923)