An Attempt To Turn Purely Contractual Dispute Between Parties Into Criminal Case Amounts To Abuse Of Process Of Law: SC

|

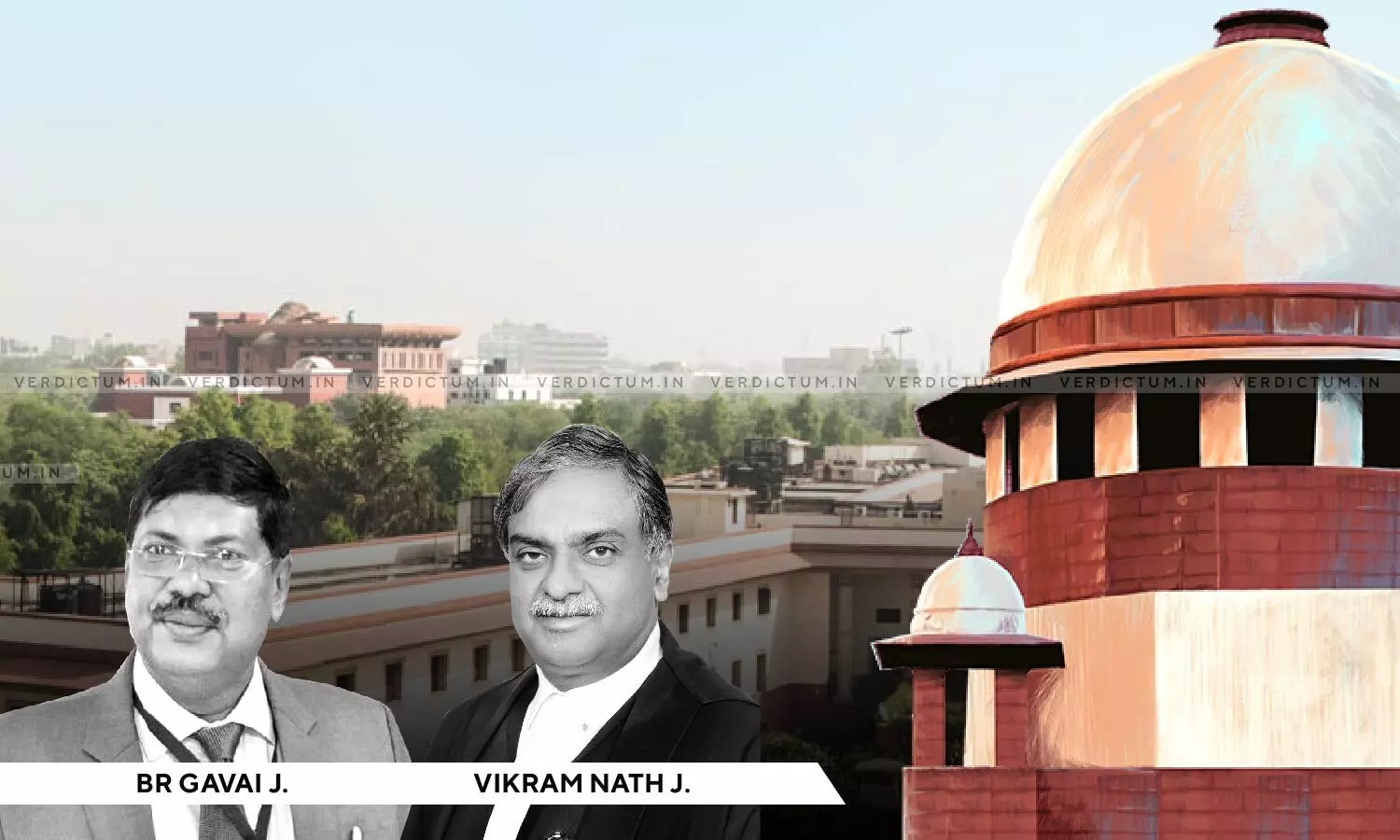

|Finding that the complainant has made an attempt to turn a purely contractual dispute between the parties into a criminal case, a two-judge Bench of Justice B.R Gavai and Justice Vikram Nath observed that "the present complaint is nothing else but an abuse of process of law, since the complaint taken at its face value, does not disclose that any of the ingredients of the offence complained of have been made out under Sections 406, 420 read with Section 34 of the IPC read with Section 15-HA of the Security Exchange Board of India Act, 1992".

The Court dismissed the complaint filed before the Trial court under Sections 403, 406, 420 and 120B of the IPC, after noticing that though an attempt was made at the time of the hearing to contend that it has only filed the complaint after it came to know about the fraud in the year 2009, there is no averment to that effect in the complaint.

Advocate Aruna Gupta appeared for the Appellant and Advocate Ashwani Kumar appeared for the Respondent.

Going by the background of the case, the first Respondent (Ganesh Benzoplast - Original complainant) availed two Inter Corporate Deposit (ICD) facilities from first accused (Morgan Securities and Credits Pvt. Ltd). The first Respondent executed a Letter of Pledge (LoP) in favour of accused company, pledging 15,00,000 of its equity shares as security, at an amount of Rs. 2.40 Crores. The Appellants (Prakash Aggarwal, Meera Goyal and Suresh Chand Goyal) who were Directors of first accused, issued a notice to the first Respondent asking it to pledge additional shares as the value of the pledged shares had decreased on account of depression in the financial market. Due to financial hardship, the first Respondent proposed to sell the pledged shares to realize the due amount, and remit the excess amount. Later, the first Respondent repaid the first ICD and the loan account was closed.

Thereafter, the first accused company issued another notice to the first Respondent demanding the repayment of the ICD as the value of the pledged shares had again fallen, failing which the pledged shares would be sold. However, even before date when the first instalment was to be paid by the first Respondent, the accused company invoked the arbitration clause in the ICD agreement, claiming the outstanding dues. Also, during the pendency of the arbitration proceedings, the accused sold some pledged shares. This was challenged by the first Respondent by filing a criminal complaint against accused alleging fraud, cheating and criminal breach of trust. In the meantime, an arbitral award was passed in favour of accused company.

The Trial Court, however, issued process under Sections 406, 420 read with Section 34 of the IPC read with Section 15-HA of the Security Exchange Board of India Act, 1992. When the matter reached High Court, the issuance of process under Sections 406 and 420 read with Section 34 of IPC was confirmed. However, charges under Section 15-HA of the SEBI Act were dropped at the instance of the first Respondent. Hence, present appeals.

After considering the submissions, the Apex Court found from a perusal of the terms of the ICDA as well as the LoP, that in the event of any of the events occurring as provided in Clause 9 of the ICDA, the accused company was entitled to sell the shares either to itself, its group companies or to any outsider.

The accused company had also agreed not to dispute or claim any loss on account of the price at which such securities were sold, added the Court.

The Bench further found from a perusal of the entire complaint that the only allegation is that the accused company had sold the shares to itself when the market price of the shares had fallen.

“Though the complainant was aware about the sale of shares as early in the year 2001, he did nothing till the year 2006 when, according to it, it had applied to BSE and NSE for details. Even after the year 2006, the complainant waited till the year 2011 to lodge the complaint. Though, it is sought to be urged by the complainant that it came to know about the fraudulent act of the accused persons/appellants in the year 2009, which gave a cause of action to it to file the complaint, there is no averment to that effect in the complaint”, added the Bench.

Insofar as the other contention that the shares were sold at a lesser price than the market price is concerned, the Bench noted that there was no averment in the complaint in that regard and since the transactions were made through the BSE and NSE, the contention in that regard is without substance.

Accordingly, the Apex Court allowed the appeal.

Cause Title: Prakash Aggarwal v. Ganesh Benzoplast Limited and Anr.