Acquisition Of Reliance Home Finance Ltd.: Dissenting Debenture Holders Be Provided Option To Accept Terms Of Resolution Professional- SC

|

|The Supreme Court yesterday while hearing a batch of appeals with respect to the acquisition of Reliance Home Finance Limited (RHFL) by Authum Investment and Infrastructure Limited (AIIL) held that the dissenting debenture holders should be provided an option to accept the terms of the Resolution Plan (RP) who proposed such acquisition.

The appeals were preferred against the order passed by the Bombay High Court by which it dismissed the interim application filed by RHFL under Section 151 of the Civil Procedure Code seeking approval of the RP pertaining to its dissolution.

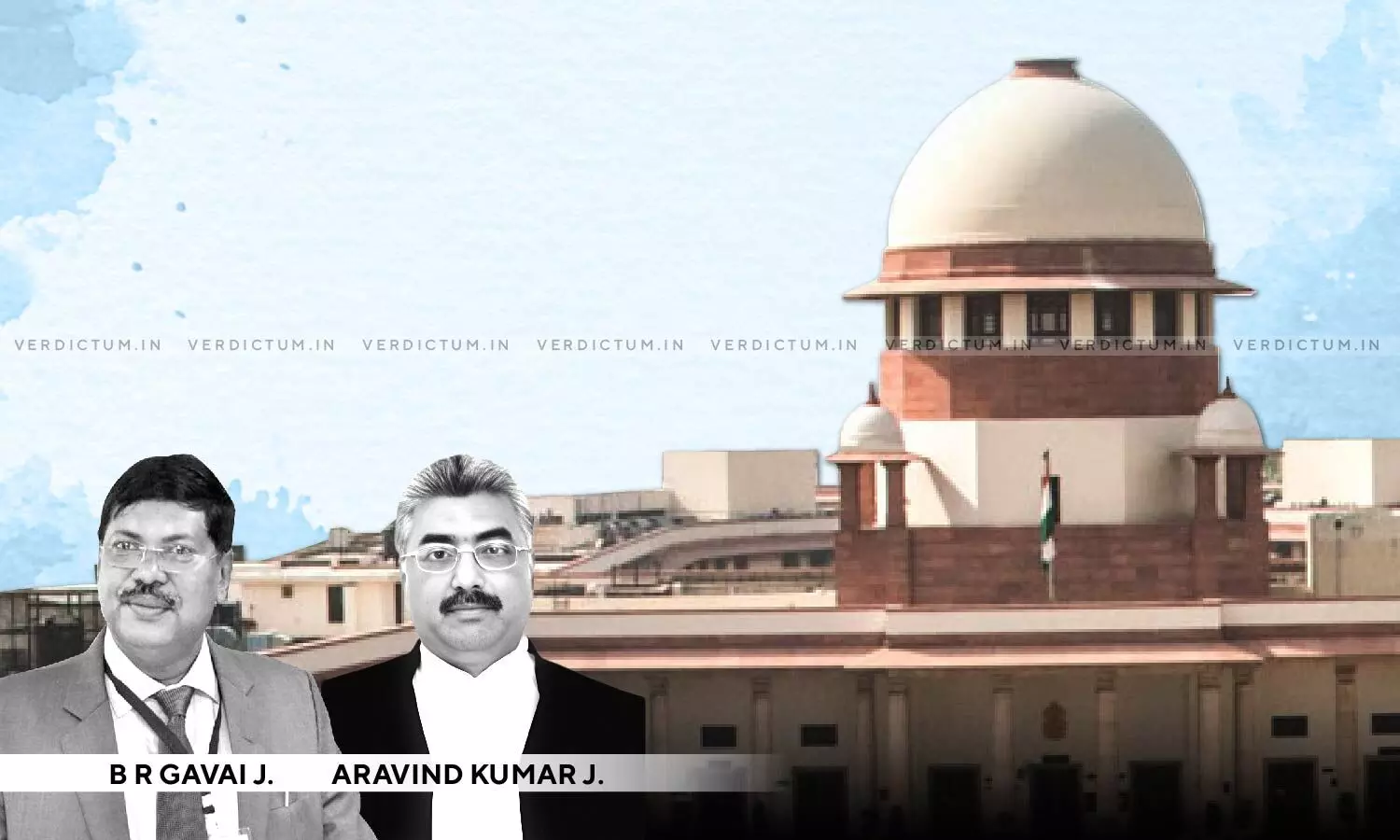

The two-Judge Bench of Justice B.R. Gavai and Justice Aravind Kumar observed, “… we direct that the dissenting debenture holders should be provided an option to accept the terms of the RP. Alternatively, the dissenting debenture holders will have a right to stand outside the proposed RP framed under the lender’s ICA and pursue other legal remedies to recover their entitled dues.”

The Bench directed the AIIL to make the required payments prior to March 31, 2023.

Senior Advocates K.K. Venugopal and Dhruv Mehta appeared on behalf of the appellants while Senior Advocate K.V. Viswanathan appeared for the Banks and ASG Venkatraman appeared for the SEBI.

Brief Facts –

AIIL being a non-banking financial corporation originally proposed the RP for RHFL and executed a number of Debenture Trust Deeds for the issuance of debentures on a private placement basis. In 2019, RHFL defaulted on its loan obligations to various lenders and in relation to the Debenture Trust Deeds issued as well.

National Company Law Tribunal (NCLT) directed the RHFL and Reliance Capital Ltd. to make payment with interest due to the debenture holders of RHFL including the appellant (AIIL). The High Court vide its order directed for a meeting of the debenture holders to be convened to allow debenture holders to vote on the RP as a result of which the majority of the holders voted in favour of the same.

The Supreme after hearing the contentions of all the counsel said, “… small investors, whose exposure is up to Rs. 5 lakhs, are benefiting to the extent of 100% of their principal amount. Even debenture holders whose exposure is more than Rs. 5 lakhs are receiving 23.24% of their principal amount, similar to the case of Rajkumar Nagpal (supra).”

The Court noted that a different voting mechanism proposed under the SEBI Circular will further delay the resolution process and potentially disrupt the efforts undertaken by the stakeholders, including the retail debenture holders.

“… such unscrambling of the resolution process will not only prove time consuming but may also adversely affect the agreed realized gains to the retail debenture holders, who have already consented to the negotiated settlement before the High Court”, the Court further noted.

The Court stressed on the protection of the rights of the dissenting debenture holders who stand outside the proposed RP framed under the lender’s Inter-Creditor Agreement and seek to pursue other legal remedies.

“We, therefore, in exercise of the powers under Article 142 of the Constitution of India, allow the RP preferred by AIIL qua the debenture holders, except the dissenting debenture holders”, directed the Court.

Accordingly, the Apex Court disposed of the appeals.

Cause Title- Authum Investment and Infrastructure Limited v. R.K. Mohatta Family Trust and Others

Click here to read/download the Judgment