SC Declares Sections 3(2) And 5 Of Benami Transactions Prohibition Act Unconstitutional, Holds 2016 Amendment Act To Have Prospective Effect

|

|The Supreme Court has declared Section 3(2) of the Benami Transactions Prohibition Act 1988 and Benami Transaction (Prohibition) Amendment Act 2016 to be unconstitutional. The Court has also held that Section 5 of the 1988 Act is unconstitutional.

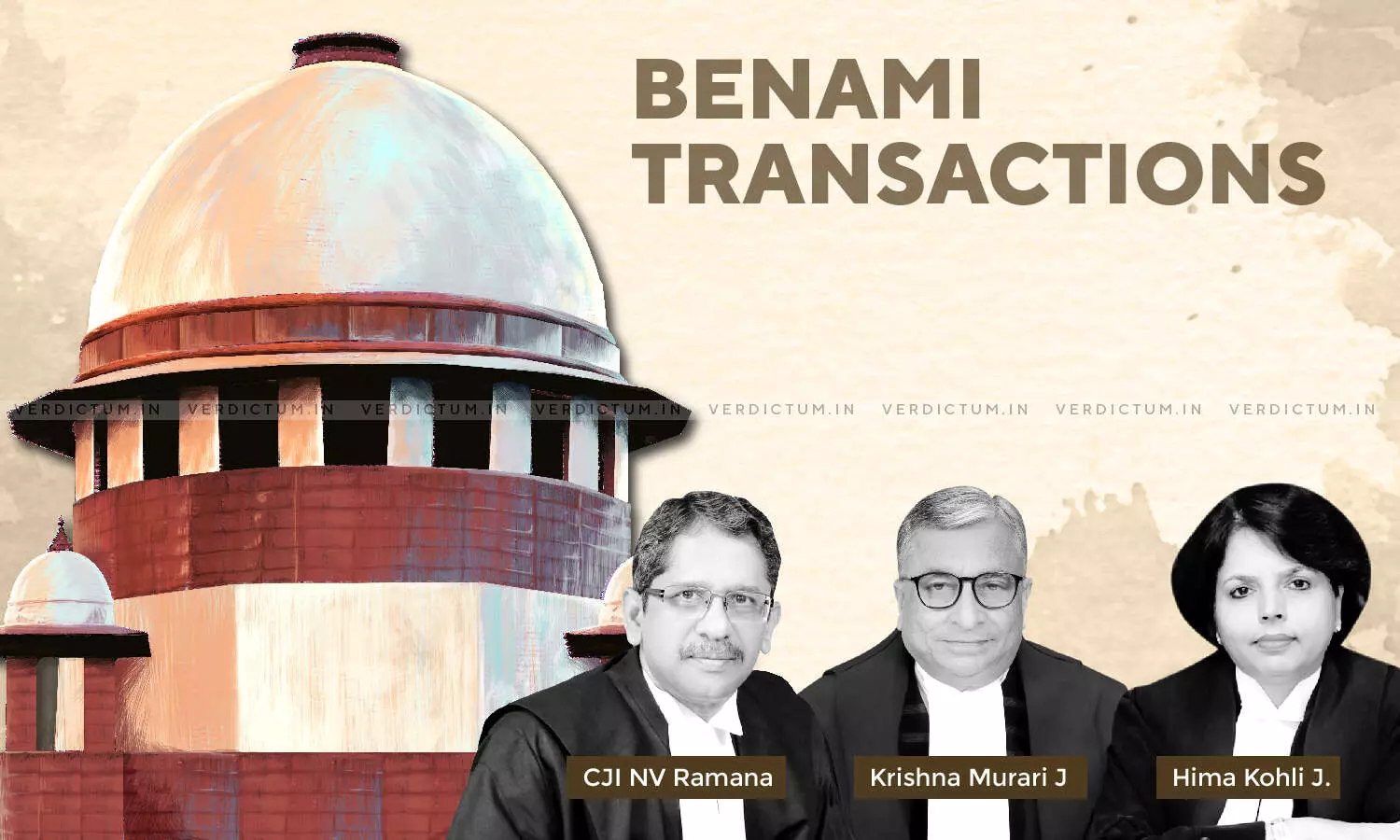

The Bench of CJI NV Ramana, Justice Krishna Murari, and Justice Hima Kohli has observed that unamended 3(2) of the 1988 Act was manifestly arbitrary hence it was unconstitutional. In relation to Section 3(2) of the 2016 Act, the Court held that it is violative of Article 20(1) of the Constitutional and Section 5 of the 1988 Act relating to the in rem forfeiture provision was also manifestly arbitrary.

The Court also held that the concerned authorities cannot initiate or continue criminal prosecution or confiscation proceedings for transactions entered into prior to the coming into force of the 2016 Act.

In this case, the issue which was dealt with by the Court was –

Whether the Prohibition of Benami Property Transactions Act, 1988 as amended by the Benami Transactions (Prohibition) Amendment Act, 2016 has a prospective effect.

The Respondent-Company's 99.9% shareholdings were acquired by M/s PLD Properties Pvt. Ltd. and M/s Ginger Marketing Pvt. Ltd. at a discounted price of Rs.5/ per share for a total amount of Rs.19,10,000/.

Later, the Deputy Commissioner of Income Tax (Adjudicating Authority) issued a notice to the Respondent-Company under Section 24 (1) of the 2016 Act to show cause as to why the aforesaid property should not be considered as a Benami property and the Respondent-Company as Benamidar within the meaning of Section 2(8) of the 2016 Act.

The Respondent-Company claimed that the scheduled property was not a Benami property.

The Adjudicating authority passed an order under Section 24(4)(b)(i) of the 2016 Act, provisionally attaching the property.

Aggrieved, the Respondent-Company filed a Writ Petition before the Calcutta High Court which directed the Adjudicating Authority to conclude the proceedings withing 12 weeks.

The Respondent-Company preferred an appeal against the order before the High Court.

The High Court while quashing the show cause notice held that the 2016 Act does not have retrospective application.

Aggrieved, the Union of India approached the Apex Court.

ASG S.V. Raju appeared for the Union of India along with ASG Vikramjit Banerjee, while Senior Counsel Abhishek Manu Singhvi appeared for the Respondents before the Supreme Court.

The Apex Court while referring to the 57th Law Commission Report noted that it did not find suitable to accept the stringent provision of making benami transactions liable to criminal action. Rather it recommended adoption of certain less stringent, civil alternatives.

The Bench noted that unamended 1988 Act had only nine Sections and the law chose to include only tripartite benami transactions and excluded the bipartite/loosely described benami transactions.

The Court also noted that the definition of Benami transactions under Section 2(a) did not capture the essence of Benami transactions as the broad formulation includes certain types of legitimate transactions as well.

"The transferee/property holder's lack of beneficial interest in the property was a vital ingredient, as settled by years of judicial pronouncements and common parlance, and found to be completely absent in the definition given in the Act," the Court observed.

The Court further referred to various provisions of the 1988 Act, including –

Section 3 – Prohibition of benami transactions

The Court noted that Section 3 puts forth a prohibitive provision. Also, it intended to criminalize an act of entering into a benami transaction.

Section 4 – Prohibition of the right to recover property held benami

Section 5 – Property of benami liable to acquisition

The Court with respect to Section 5 observed that this provision was never utilized as it was felt that there was a requirement of additional statutory backing to make the law effective.

Further the Bench also noted that the main contention of the Union of India that the amended 2016 Act only clarified the 2016 Act and the 1988 Act had already created substantial law for criminalizing the offence and the 2016 amendments were merely clarificatory and procedural, to give effect to the 1988 Act.

The Court also noted that the mens rea aspect was specially considered by the 57th Law Commission Report and the same was not integrated into the 1988 Act.

The Bench thus observed that the 1988 Act was envisaged on the touchstone of strict liability.

The Court further held that under the amended 2016 Act, the aspect of mens rea, is brought back through Section 53. Such resurrection clearly indicates that doing away of the mens rea aspect, was without any rhyme or reason, and ended up creating an unusually harsh enactment.

"The criminal provision under Section 3(1) of the 1988 Act has serious lacunae which could not have been cured by judicial forums, even through some form of harmonious interpretation. A conclusion contrary to the above would make the aforesaid law suspect to being overly oppressive, fanciful and manifestly arbitrary, thereby violating the 'substantive due process' requirement of the Constitution," the Bench held.

"From the above, Section 3 (criminal provision) read with Section 2(a) and Section 5 (confiscation proceedings) of the 1988 Act are overly broad, disproportionately harsh, and operate without adequate safeguards in place. Such provisions were stillborn law and never utilized in the first place. In this light, this Court finds that Sections 3 and 5 of the 1988 Act were unconstitutional from their inception," the Court noted.

The Court while adjudicating upon the issue of whether section 3(1) and chapter IV read with section 5 of the 2016 act have retroactive effect, countered the following arguments of the Union of India –

i. That the 1988 Act was a valid enactment with procedural gaps that were filled retrospectively by the 2016 amendment.

(ii.) That the provision of confiscation (civil forfeiture) under the 1988 Act, being in the domain of civil law, is not punitive and therefore, the prohibition under Article 20(1) of the Constitution is not attracted in this case.

Concerning the first line of argument, the Court held –

"With respect to the first line of argument, our discussion above can be summarized as under:

(a.) Section 3(1) of 1988 Act is vague and arbitrary. (b.) Section 3(1) created an unduly harsh law against settled principles and Law Commission recommendations. (c.) Section 5 of 1988 Act, the provision relating to civil forfeiture, was manifestly arbitrary. (d.) Both provisions were unworkable and as a matter of fact, were never implemented."

"In the case at hand, the 2016 Act containing the criminal provisions is applicable only prospectively, as the relevant Sections of the preamendment 1988 Act containing the penal provision, have been declared as unconstitutional. Therefore, the question of construction of the 2016 Act as retroactive qua the penal provisions under Sections 3 or 53, does not arise," the Court held.

In the light of these observations, the Court disposed of the appeal.

Cause Title – Union of India & Anr. v. M/s. Ganpati Dealcom Pvt. Ltd.

Click here to read/download the Judgment