Every Port Under Port Act May Not Become Customs Port, Words ‘Within’ ‘In’ Cannot Include What Is Outside Port: SC

|

|The Supreme Court has recently observed that every port falling under the Indian Port Act and the Major Port Act may not on its own become a customs port.

The Court while dealing with the two connected appeals further reiterated that the words ‘within’ and ‘in’ cannot include what is outside the port.

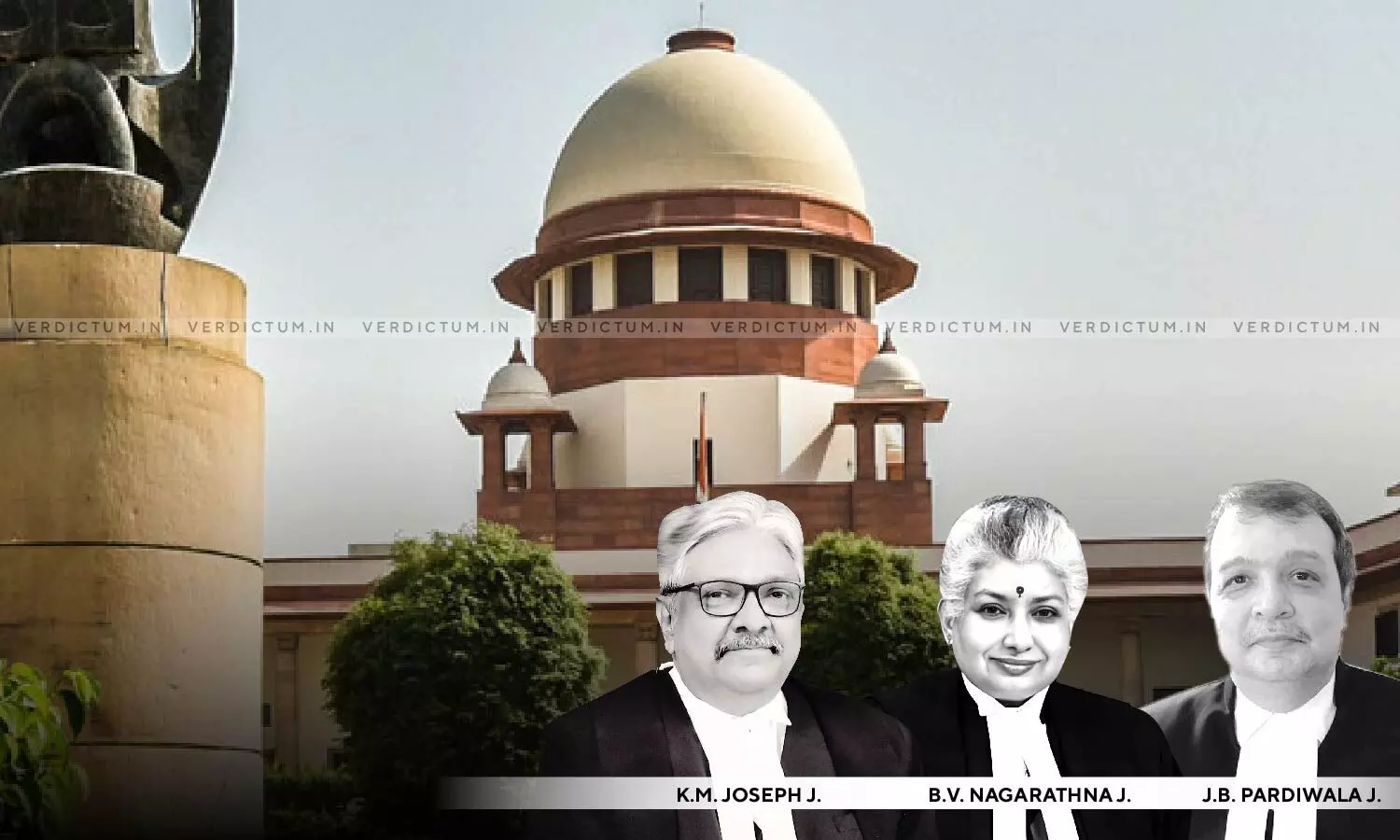

The Bench comprising Justice K.M. Joseph, Justice B.V. Nagarathna, and Justice P.B. Pardiwala held, “… every port falling under the Indian Port Act and the Major Port Act may not be on their own become a customs port. A customs port under Section 2(12) comes into being on a port being appointed as such under Section 7(a). A customs station no doubt, includes any customs port and a land customs station. The case of the appellant based on the license under Section 57 of the Customs Act may make it a customs area as it includes a warehouse but it is inconceivable as to how it would transform it into ‘in a notified port’. … We again reiterate that the words ‘within’ and ‘in’ cannot include what is outside the port.”

The Bench said that under CRZ III, the facility of storage of non-hazardous materials including edible oil is permitted only at a distance between 200-500 meters and that the storage tanks in question are not works executed by the port.

“We would think that in the facts of this case and on a construction of the statute or the law in question, viz., the 2011 notification, the understanding of the authorities if that be the basis of the contention, cannot overwhelm our understanding of the notification. … The maker of the notification has not even contemplated the activities in question in a ‘port area’. We must here elucidate and observe that if the contention is to be upheld that a storage tank can be permitted outside the port limits, it will introduce chaos”, the Court observed.

The Court further observed that the 2011 Notification cannot receive an interpretation that would leave matters of moment to be afflicted with the vice of uncertainty.

Senior Advocate Ranjit Kumar and Senior Advocate Dhruv Mehta appeared on behalf of the appellants while Senior Advocate Anitha Shenoy and Advocate Archana Pathak Dave represented the respondents.

Facts of the Case –

The appellant was engaged in the business of processing and refining edible oil and imported edible oil. The edible oil was imported through the Chennai Port and in the public auction, it purchased an existing storage facility. On payment of Rs. 50,97,921/-, the Chennai Fishing Harbour Management Committee granted permission to lay the underground pipeline.

The appellant challenged the Order passed by the National Green Tribunal (NGT), Southern Zone. By the impugned Order, the NGT allowed the appeal filed by the respondent and set aside proceedings. By the said proceedings, ex post facto clearance was granted purporting to invoke paragraph-4.3 of the Notification issued in the year 2011 (the 2011 Notification) under the Environment Protection Act, 1986.

The appellant was given clearance for the laying of the pipeline for the transfer of edible oil from the Chennai Port to the storage terminal tank and for the establishment of the storage transit terminal. The NGT found that while the ex post facto clearance could be granted under paragraph-4.3, however, the activity of putting up a storage tank transit terminal, being contrary to the 2011 Notification was illegal. It was found to be illegal in turn, on the ground that the storage terminal was not located ‘in’ the Chennai Port and would have been permissible under the permitted activities of Coastal Regulation Zone II (CRZ II).

The Supreme Court in view of the above facts and circumstances of the case noted, “As far as the pipeline is concerned, no doubt, it is permitted in CRZ I and arguments were addressed before us that even if the storage facility is to be demolished, making use of the edible oil brought through the pipelines, which are, no doubt, located underground, the oil could be collected at the spot from where it is currently located viz., where the pipeline ends and transported therefrom to the factory.”

It was further noted by the Court that in regard to the pipelines, it would be the District Coastal Zonal Management Authority, which could take a decision.

“As regards the pipelines which have been drawn, the appellants may approach the relevant District Coastal Zonal Management Authority within a period of one month from today. The District Coastal Zonal Management Authority will consider any application made in regard to the continued use of the pipeline and take a decision in accordance with law within a further period of six weeks from the date of the receipt of the application”, the Court directed.

The Court also directed that appellants be given a period of six months from to comply with the impugned order of the NGT.

“In view of the request made by the appellants that they may be permitted to continue to use the pipeline along with the storage facility for a period of one year, we would think that the interest of justice do require grant of some time”, the Court said.

The Court granted the appellant in the first appeal a month’s time to pay the compensation ordered, if not already paid.

“As far as the direction to demolish the pipeline, the matter will await the decision to be taken by the District Coastal Zonal Management Authority”, the Court further said.

Accordingly, the Apex Court partly allowed the appeals.

Cause Title- K.T.V. Health Food Pvt. Ltd. v. Union of India and Ors.

Click here to read/download the Judgment