Civil Courts Are Not Barred From Entertaining Counterclaims Of Borrowers Against Banks & Financial Institutions- SC

|

|The Supreme Court on Thursday observed that Civil Courts are not barred from entertaining counterclaims of borrowers against banks and financial institutions which are pursuing separate recovery proceedings against them before a Debt Recovery Tribunal (DRT) under a special law.

The Apex Court was dealing with the vexed legal question of whether a borrower, facing the recovery proceedings by a lending bank under the Recovery of Debts Due to Banks and Financial Institutions (RDB) Act, 1993 before the DRT, can file a counterclaim case in civil court against the lending financial institutions instead of filing it in the DRT itself.

The judgment came on a plea of the Bank of Rajasthan against a borrower who had moved Civil Court against the lending bank.

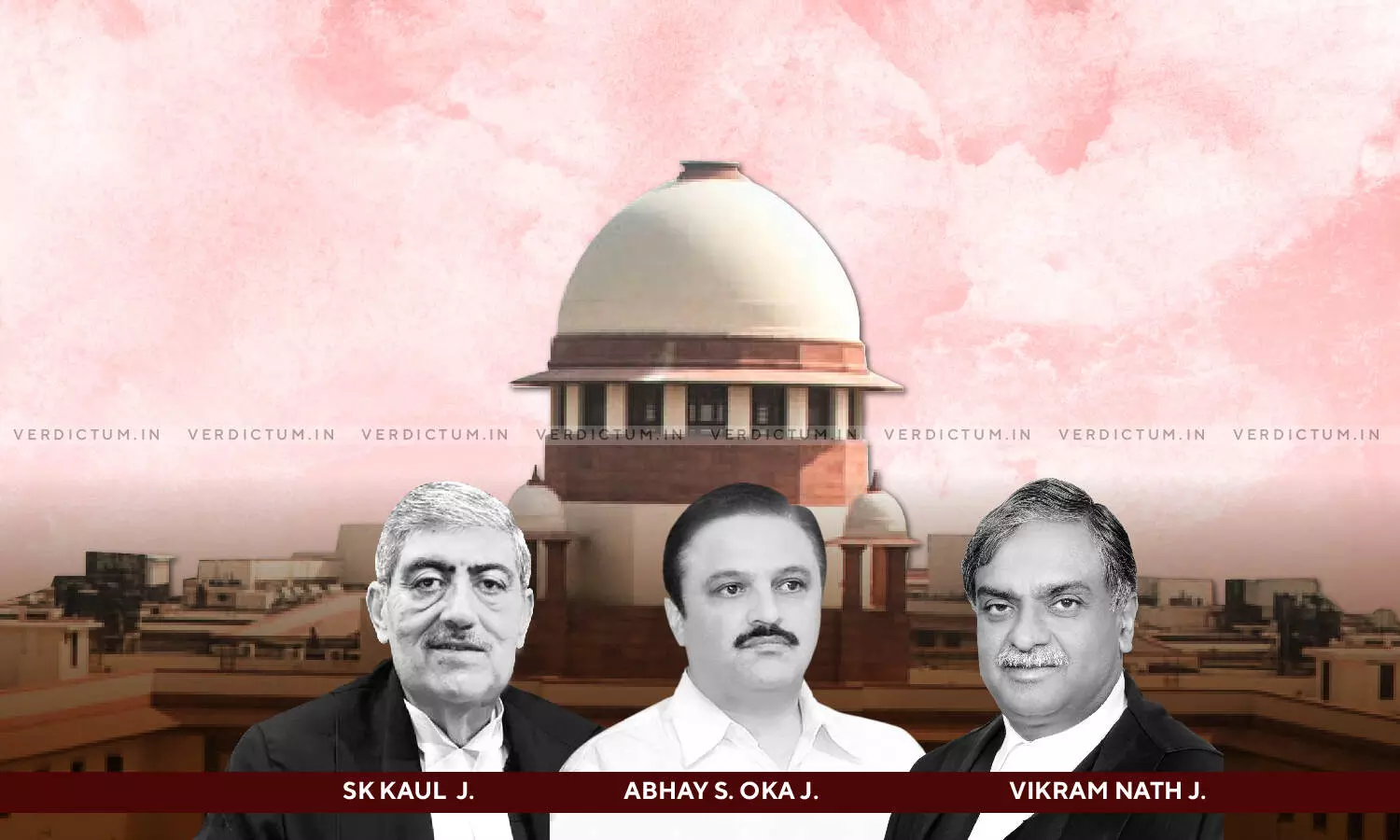

The Bench of Justice SK Kaul, Justice Abhay S. Oka, and Justice Vikram Nath observed that there is no provision in the RDB Act by which the remedy of a Civil Suit by the Defendant in a claim by the bank is ousted.

The issue dealt with by the Court was –

- Is the jurisdiction of a civil court to try a suit filed by a borrower against a bank or financial institution ousted by virtue of the scheme of the RDB Act in relation to the proceedings for recovery of debt by a bank or financial institution.

Senior Counsel V.V. Giri appeared for the Appellant while Senior Counsel Jaideep Gupta appeared for the Respondent before the Apex Court.

The Court while answering the issue in negative observed that there was no power under the Civil Procedure Code to transfer the independent suit filed by a borrower against a bank or financial institution, which has applied for the recovery of its loan against the plaintiff under the RDB Act, to the DRT.

The Court held, "Since there is no such power with the civil court, there is no question of transfer of the suit whether by consent or otherwise to the DRT."

The Court observed, "We are thus of the view that there is no provision in the RDB Act by which the remedy of a civil suit by a defendant in a claim by the bank is ousted, but it is the matter of choice of that defendant. Such a defendant may file a counterclaim, or may be desirous of availing of the more strenuous procedure established under the Code, and that is a choice which he takes with the consequences thereof."

The Bench, however, had a word of caution keeping in mind the nature of powers exercised by the DRT and the objective of its creation.

The Court held, "We certainly would not like that the process envisaged under the RDB Act be impeded in any manner by filing of a separate suit if a defendant chooses to do so. A claim petition before the DRT has to proceed in a particular manner and would so proceed. There can be no question of stay of those proceedings by way of a civil proceeding instituted by a defendant before the civil court…"

The Court noted that the DRT has been set up under the special RDB Act for expeditious disposal of the banks' claim before it and should not be impeded by filing a civil suit.

In this context, the Court added, "Thus, it is not open to a defendant, who may have taken recourse to the civil court, to seek a stay on the decision of the DRT awaiting the verdict of his suit before the civil court as it is a matter of his choice."

The Court finally observed, "The judgments in Abhijit Tea Co. (supra) and Ranjan Chemicals Ltd. (supra) are held not to be laying down the correct legal proposition. The judgments in Indian Bank (supra) and Nahar Industrial Enterprises (supra) are affirmed except to the extent that they allow the transfer of a suit from the Civil Court to the DRT."

Accordingly, the Court dismissed the appeals.

Cause Title – Bank of Rajasthan Ltd. v. VCK Shares & Stock Broking Services Ltd.

Click here to read/download the Judgment