Educational Institutions Not Entitled To Approval U/s. 10(23C) Of IT Act If Objective Is Profit Oriented- SC

|

|The Supreme Court has observed that educational institutions are not entitled to approval under Section 10(23C) of the Income Tax Act where the objective is profit-oriented.

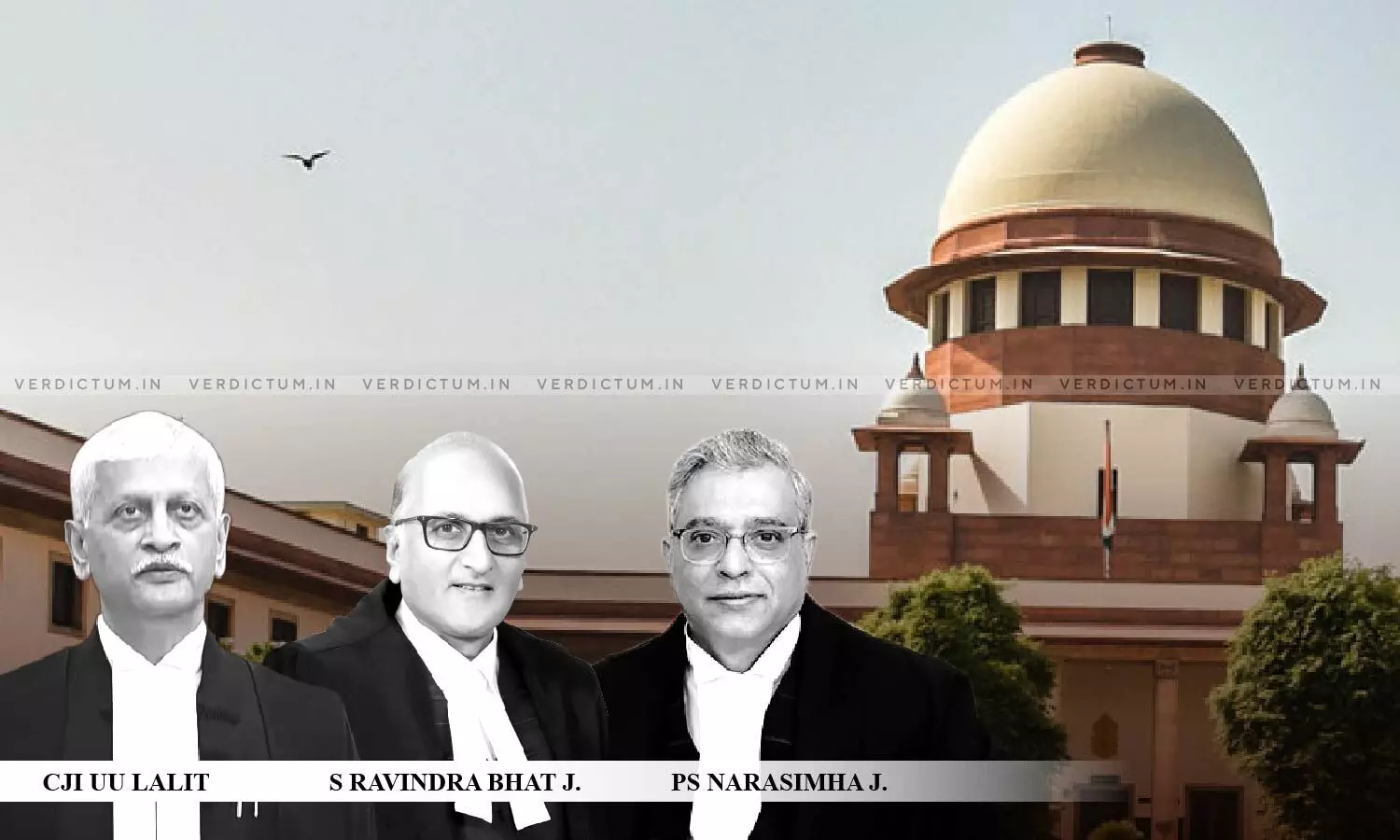

The Bench of CJI UU Lalit, Justice S. Ravindra Bhat, and Justice PS Narasimha observed –

"Where the objective of the institution appears to be profit-oriented, such institutions would not be entitled to approval under Section 10(23C) of the IT Act. At the same time, where surplus accrues in a given year or set of years per se, it is not a bar, provided such surplus is generated in the course of providing education or educational activities."

The Court also held that all the objects of society, trust, etc., must relate to imparting education or be in relation to educational activities.

The Court pronounced its verdict on a batch of appeals that raised the issue of rejection of the Appellants' claim for registration as a fund or trust or institution or any university or other educational institution set up for the charitable purpose of education, under the Income Tax Act, 1961.

The appeals were filed against the judgment delivered by the Andhra Pradesh High Court which had held that the appellant trusts which claimed the benefit of exemption under section 10 (23C) of the IT Act were not created 'solely' for the purpose of education.

Counsel Prabha Swami appeared for R.R.M Educational Society, Counsel Daisy Hannah appeared for some of the Appellants and ASG N. Venkataraman appeared for the Revenue before the Apex Court.

The issue which was dealt with by the Court was to interpret the correct meaning of the term 'solely' in section 10 (23C) (vi) of the Act which exempts income of university or other educational institutions existing solely for educational purposes and not for purposes of profit.

The Bench noted that education ennobles the mind and refines the sensibilities of every human being. It aims to train individuals to make the right choices and thus further observed-

"Its primary purpose is to liberate human beings from the thrall of habits and preconceived attitudes. It should be used to promote humanity and universal brotherhood. By removing the darkness of ignorance, education helps us discern between right and wrong. There is scarcely any generation that has not extolled the virtues of education, and sought to increase knowledge."

The Bench added that in a knowledge based, information driven society, true wealth is education and access to it.

The Apex Court further held, "the requirement of the charitable institution, society or trust etc., to 'solely' engage itself in education or educational activities, and not engage in any activity of profit, means that such institutions cannot have objects which are unrelated to education."

The Bench also overruled two previous judgments of the Supreme Court to the extent of reasoning and conclusions pertaining to the interpretation of expression 'solely.'

"The reasoning and conclusions in American Hotel (supra) and Queen's Education Society (supra) so far as they pertain to the interpretation of expression 'solely' are hereby disapproved. The judgments are accordingly overruled to that extent," the Court observed.

The Court also held that to ascertain the genuineness of the institution and the manner of its functioning, the Commissioner or other authority is free to call for the audited accounts or other such documents for recording satisfaction where the society, trust or institution genuinely seeks to achieve the objects which it professes.

While dismissing the appeals, the Court observed –

"This court is further of the opinion that since the present judgment has departed from the previous rulings regarding the meaning of the term 'solely', in order to avoid disruption, and to give time to institutions likely to be affected to make appropriate changes and adjustments, it would be in the larger interests of society that the present judgment operates hereafter. As a result, it is hereby directed that the law declared in the present judgment shall operate prospectively."

The Bench further held, "The basic provision granting exemption, thus enjoins that the institution should exist 'solely for educational purposes and not for purposes of profit'. This requirement is categorical."

The Court held that wherever registration of trust or charities is obligatory under state or local laws, the concerned trust, society, other institution, etc. seeking approval under section 10(23C) should also comply with the provisions of such state laws.

"Our Constitution reflects a value which equates education with charity. That it is to be treated as neither business, trade, nor commerce, has been declared by one of the most authoritative pronouncements of this court in T.M.A Pai Foundation (supra). The interpretation of education being the 'sole' object of every trust or organization which seeks to propagate it, through this decision, accords with the constitutional understanding and, what is more, maintains its pristine and unsullied nature," the Bench observed.

Accordingly, the Court dismissed the appeals.

Cause Title – M/s. New Noble Educational Society v. The Chief Commissioner of Income Tax 1 & Anr.

Click here to read/download the Judgment