Onus To Prove That A Transaction Is Fictitious Or Fraudulent In On The Person Alleging It – Supreme Court Reiterates

|

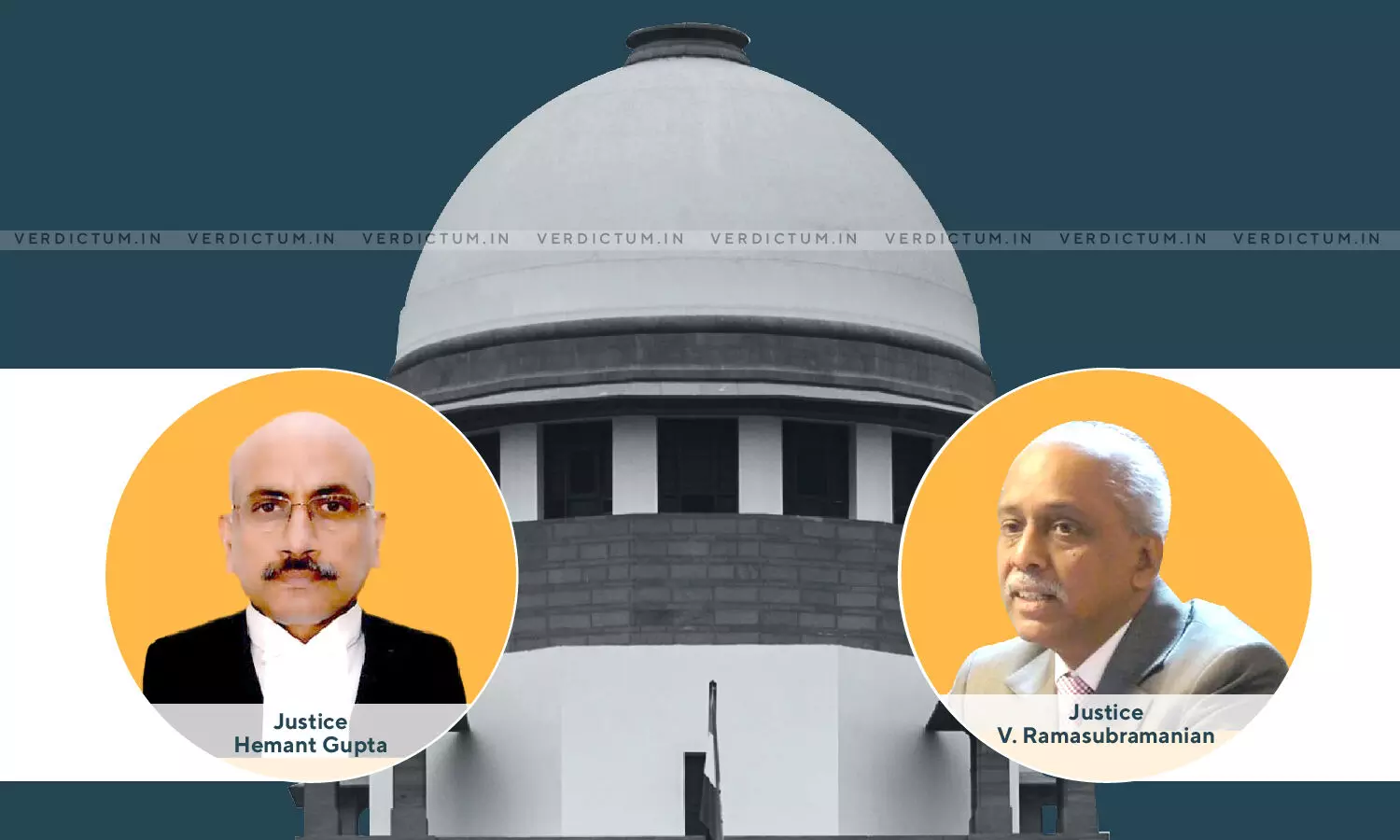

|A two-judge Bench of Justice Hemant Gupta and Justice V Ramasubramanian has held that the person who alleges that a transaction is a sham, bogus or fictitious must also prove the same as the onus lies on him.

The Supreme Court was hearing an appeal against the impugned judgment of the Division Bench of the Delhi High Court which had set aside the judgment and decree passed by the Single Judge and dismissed the appeal of the Appellant.

The Single Judge had decreed the suit of the Appellant for a sum of Rs. 96,41,765.31 along with simple interest @ 15% p.a. from the date of institution of the suit i.e., 5.10.1987, till the date of payment, on the principal amount of Rs.71,82,266/-.

In this case, the Appellant had filed a suit for recovery of Rs. 96,41,765.31 alleging that Respondent No. 1 had purchased huge stocks from the former but did not make the payments. Also, some of the hundi documents of the Respondent were dishonored. The goods were duly received by Respondent No. 1 with the signatures of Respondent No. 2 but they had defaulted in making the payments.

While the Respondents had alleged that Appellant had not rendered true and proper receipts and a sum of Rs. 45 lacs were due from the Appellant. It was further alleged that the bills raised by the Appellant were based on fictitious transactions that were tainted with fraud, deceit, and circumvention of the law. Hence, such transactions were therefore against public policy and void ab initio.

The Single Judge had decreed the suit on the basis of the evidence led by the parties. While the Division Bench of the High Court had allowed the appeal on the ground that the Appellant had failed to prove that it was registered as a dealer with the Sales Tax Authorities and it failed to prove to have any godown in Delhi.

The issue which was framed after the completion of pleadings was whether the alleged bills forming the claim in the suits have been raised on the basis of the fictitious and fraudulent transactions.

The Respondents had contended before the Supreme Court by relying upon the case of Subhra Mukherjee and Another v. Bharat Coking Coal Ltd. and Other, where it was held that onus of proof whether transactions were genuine and bonafide had to be discharged by the Appellant.

Further, reliance was placed by the Respondents on the case of Ishwar Dass Jain v. Sohan Lal to contend that the appellant has not produced account books but only extracts which are not admissible in evidence and hence the suit was rightly dismissed by the High Court in appeal.

The Apex Court noted that the High Court had gravely erred in law in accepting the appeal of the Respondents on wholly erroneous and untenable grounds. In this context, the Court held –

"Each of the invoices produced bears the registration No. S.T. No. 36/102499/08/84 and also bears the stamp and signatures of the Managing Director/ Director of the respondents. Apart from such invoice, the appellant has proved the debit note which has also been stamped and signed by the Managing Director/ Director."

Further, the Bench observed, "The respondents have alleged that the alleged bills have been raised on the basis of fictitious and fraudulent transactions. Since such stand was of the respondents, the onus of proof of such issue was on the respondents."

"It is not a case of mere exhibition of documents. Such documents were proved by a witness as such documents were kept by the appellant in their ordinary course of business. All these documents are stamped and counter-signed by the representatives of the respondents," the Court held.

The Court also held that the witness of the Respondent had admitted the execution of all the invoices, debit notes, and ST-1 Form which bore their stamp and also the signatures of the authorized representative. Hence, the reasoning given by the High Court is bereft of any merit.

"It is the respondent, who have alleged the transaction as fraudulent. In fact, in the aforesaid case, the transaction of sale was found to be bogus and appeal of the alleged purchasers was dismissed. Thus, the onus of proof was on the respondents but the respondents have failed to discharge the same, the Court opined.

Additionally, the Bench added, "The debit notes stamped and signed by the respondents were in respect of trade discount on the wholesale price mentioned in the invoice. Having accepted the trade discount, which is evident from the stamp and signatures not only on the debit notes but also on the invoice as well as on ST-1 Form, shows that the goods were actually lifted by the respondents for which payment has not been made."

Accordingly, the Court allowed the appeal and set aside the impugned order of the Division Bench of the High Court. The Court decreed the suit for the recovery of Rs.96,41,765.31 and future interest on the principal sum of Rs.71,82,266/- @9% p.a. from the date of filing of the suit till realization.

Click here to read/download the Judgment