GPMC Act: Educational, Social Institutions Run By Public Charitable Trusts Cannot Be Treated At Par With Hospitals/Maternity Homes- SC

|

|The Supreme Court has held that under the Gujarat Provincial Municipal Corporations Act 1949 (GPMC Act) and its related Rules, educational and social institutions run by public charitable trusts cannot be treated at par with hospitals and maternity homes under the Taxation Rules.

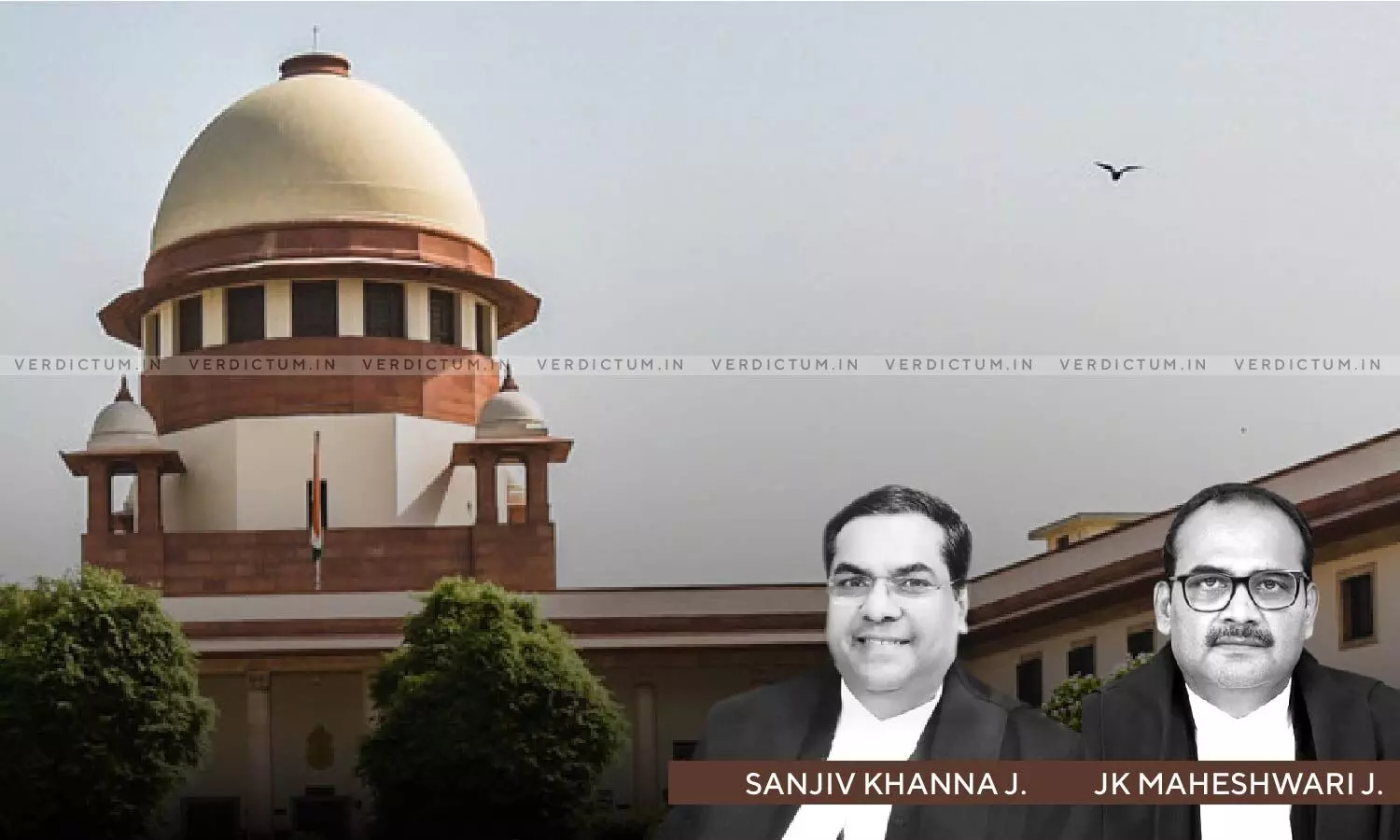

The Bench of Justice Sanjiv Khanna and Justice JK Maheshwari has held that "Sub-clause (iv) to clause (a) to sub-rule (4) of Rule 8B of the Taxation Rules applies to educational and social institutions run by public charitable trusts for the welfare of women, old people, deaf, dumb, blind, physically handicapped or mentally retarded people. These are separate categories and cannot be confused and treated similarly and at par with hospitals, clinics, maternity homes, etc, as elucidated in sub-clause (i) to clause (a) to sub-rule (4) of Rule 8B of the Taxation Rules."

Counsel Deepak Anand appeared for the Appellant, while Counsel Hemantika Wahi appeared for the Respondent.

In this case, the common question of law that arose was whether the appellants were entitled to exemption from the levy of general tax in terms of Section 132(1)(b) in cases where the Corporation had exercised the option to levy property tax on carpet area method under Section 141AA of the Gujarat Provincial Municipal Corporations Act, 1949. An additional issue that arose for consideration in the appeal related to the challenge to Rule 8B(4)(i) of the Taxation (Amendment) Rules 2001, as applicable to the Ahmedabad Municipal Corporation, on the ground that it is unconstitutional, illegal and arbitrary as it violates the principle of equality enshrined under Article 14 of the Constitution of India.

Addressing the first issue, the Court took the stance that it was crystal clear that Sections 129 to 141A of the GPMC Act are grouped together and are applicable when a property tax is payable on annual letting value/annual rateable value, whereas provisions from Sections 141AA to 141F of the GPMC Act apply when property tax is payable on the basis of carpet area method. In furtherance of the same, the Court said that "We do not find any good ground and reason to hold that clause (b) to sub-section (1) of Section 132 of the GPMC Act, which grants exemption to buildings and lands or portions thereof solely occupied and used for public worship or for public charitable purposes, would apply when property tax is calculated and is payable on the basis of the carpet area method, which is to be computed and calculated in accordance with the provisions of Section 141AA to Section 141F of the GPMC Act. This aspect has been examined threadbare in the two impugned judgments passed by the Gujarat High Court, with which we agree."

Addressing the second issue, the Court found that it was an undisputed position that Appellant No. 2 Trust was using portions of the property/building as a hospital or a clinic. In view of the aforesaid position, the Court was of the opinion that "sub-clause (i) to clause (a) to sub-rule (4) of Rule 8B of the Taxation Rules would be applicable and thereby, the designated rate has to be increased by applying the multiplier of 7.0."

In furtherance of the same, the Court made the observation that "in the present case, all hospitals, dispensaries, clinics, maternity homes etc., have been classified under one head, and thereby the levy of taxation in such cases simplifies and is uniform. Discretion is eliminated. Examination of facts, etc. is not required. We do not, therefore, think that the classification made vide sub-clause (i) to clause (a) to sub-rule (4) of Rule 8B of the Taxation Rules is discriminatory and violative of Article 14 of the Constitution of India. The object and purpose of this classification is to avoid litigation and complexities which may arise in case there is a distinct and separate taxation of hospitals, clinics, maternity homes, etc., stated and claimed to be run for charitable purpose."

Therefore, the Court held that there was no merit in the appeals and consequently dismissed the same. No orders were passed as to costs.

Cause Title: Parivar Seva Sanstha vs Ahmedabad Municipal Corporation

Click here to read/download the Judgment