Breaking: Supreme Court Reserves Order On Pleas Seeking Inquiry Into Hindenburg Report And Its Impact

|

|The Supreme Court today reserved its orders on pleas seeking an investigation into the situation that arose after the Hindenburg Report on the Adani Groups of companies.

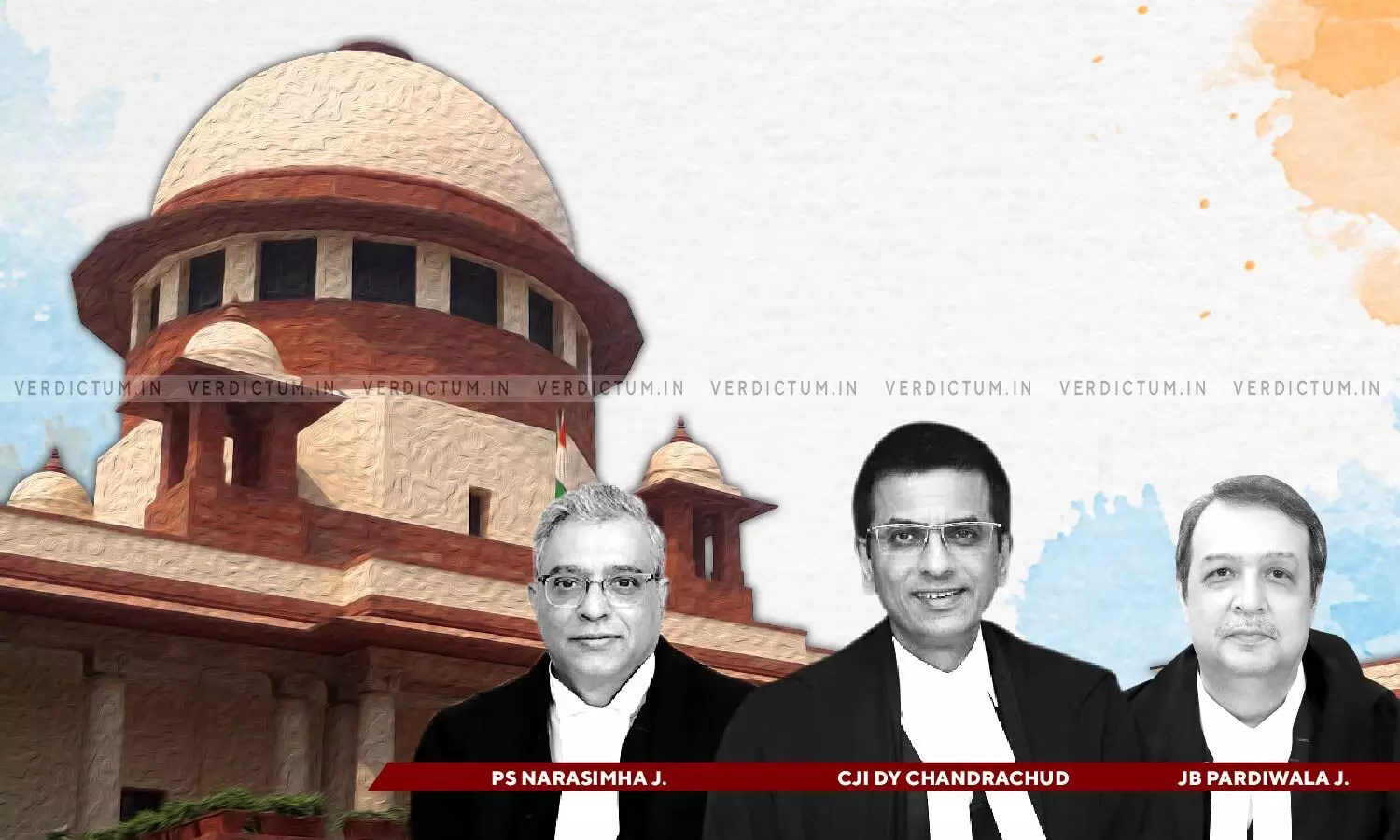

A Bench of Chief Justice DY Chandrachud, Justice PS Narasimha and Justice JB Pardiwala perused the document handed over by the Solicitor General containing the remit of the committee proposed to be constituted by the Court.

Solicitor General Tushar Mehta handed over the suggested remit of the committee proposed to be constituted by the Court. He said that it is so couched with two intentions. One that the truth comes out and the other that no unintended impact is caused on the security market. He also said that it may not be in the larger interest to delay the exercise.

The court said that it would not accept the sealed cover suggestion saying that it wants full transparency. Even if we have not accepted your suggestion, they may say that it is a government-appointed committee, the CJI said. If you don't want to disclose to the other side, then we will come out with our own suggestions.

Advocate Vishal Tiwari submitted that he wants the committee to inquire into high-power loans given to corporates and whether auditing is being properly conducted.

Advocate ML Sharma submitted that the short-selling method has been adopted in the case. The Court then asked Sharma to explain 'short selling' and remarked that the petition has been filed without research. Sharma said that persons responsible for crashing the market should be punished.

Advocate Prashant Bhushan said that he wants an enquiry into the Adani group for involvement in market manipulation using offshore entities. The CJI replied that his plea presumes illegalities. Bhushan said that the allegations in the Hindenburg report should be investigated. He said that the source of funds of shell companies and investment by LIC in the Adani group should be inquired into.

Bhushan submitted that retired judges of the Apex Court who "command public confidence" should be on the committee.

Tushar Mehta objected to the submission stating that all retired judges command public confidence and that they do not need Bhushan's certificate.

Bhushan objected to the names mentioned in the document handed over by the Solicitor General. The Solicitor General submitted that there are no allegations against anyone whose name is mentioned in the document.

Tushar Mehta submitted that there is no objection to an investigation into the contents of the report as wanted by Bhushan. He said that SEBI and all regulators have discharged their duties vigilantly.

On Monday, the Solicitor General said that “existing structures are fully equipped to take care of the situation”. The Solicitor General informed the Court that the Union Government has no objection as far as the constitution of the committee is concerned. “We can suggest remit of the committee of names in a sealed cover. Remit would be very relevant”, added SG Mehta, apprehending that the constitution of such a committee could have “impact on flow of money”.

“You come back with the proposed remit of the committee on Friday. We can reflect on it”, said CJI Chandrachud while posting the matter for further hearing on Friday.

The Court, on last Friday, sought instructions from the Centre and the SEBI about the situation which has been caused by the Hindenburg Report and said that it wants to ensure that the resultant loss to Indian investors does not happen again in future.

Solicitor General who appeared for SEBI told the Court that SEBI is seized of the matter and said "It will be premature for me to answer. The trigger point was a report which was from beyond our territorial jurisdiction. We are also concerned about the investors".

Advocate Vishal Tiwari, the petitioner-in-person appeared before the Supreme Court along with Advocate Manohar Lal Sharma, the other petitioner-in-person who has filed a similar plea.

In his plea, Sharma has alleged that “short sellers, i.e. Anderson resident of USA and his Indian entities hatched a criminal conspiracy did short sale in hundreds of billion dollars prior and thereafter on 25th January 2023 they released a concocted news as research report qua to the Adani Group of the companies, got crash share market and squared up their short sell position at the lowest rate. They secured billions of profits by butchering citizen of India”.

The plea seeks inquiry to prosecute by registering F.I.R. against Anderson and his associates.

In his PIL, petitioner-Vishal Tiwari has also sought directions to set up a Committee under the Chairmanship of a retired Supreme Court Judge to investigate and form a special committee for sanction of high-power loans. The plea states that after the publication of the Hindenburg Report, various investors have lost massive amounts who invested their savings in such shares. Thus, the petitioner has sought directions for forming a Committee under the monitoring of the retired Supreme Court Judge to enquire into the Hindenburg Research Report.

The petitioner has also prayed to set up a special committee for overseeing sanction policy for high-power loans of more than 500 crores that are given to big corporates.

Cause Title- Vishal Tiwari v. Union of India & Ors.