Exclusivity U/s. 40(a)(iib) Of Income Tax Act To Be Viewed From Nature Of Undertaking On Which Levy Is Imposed And Not On The Number Of Undertakings: SC

|

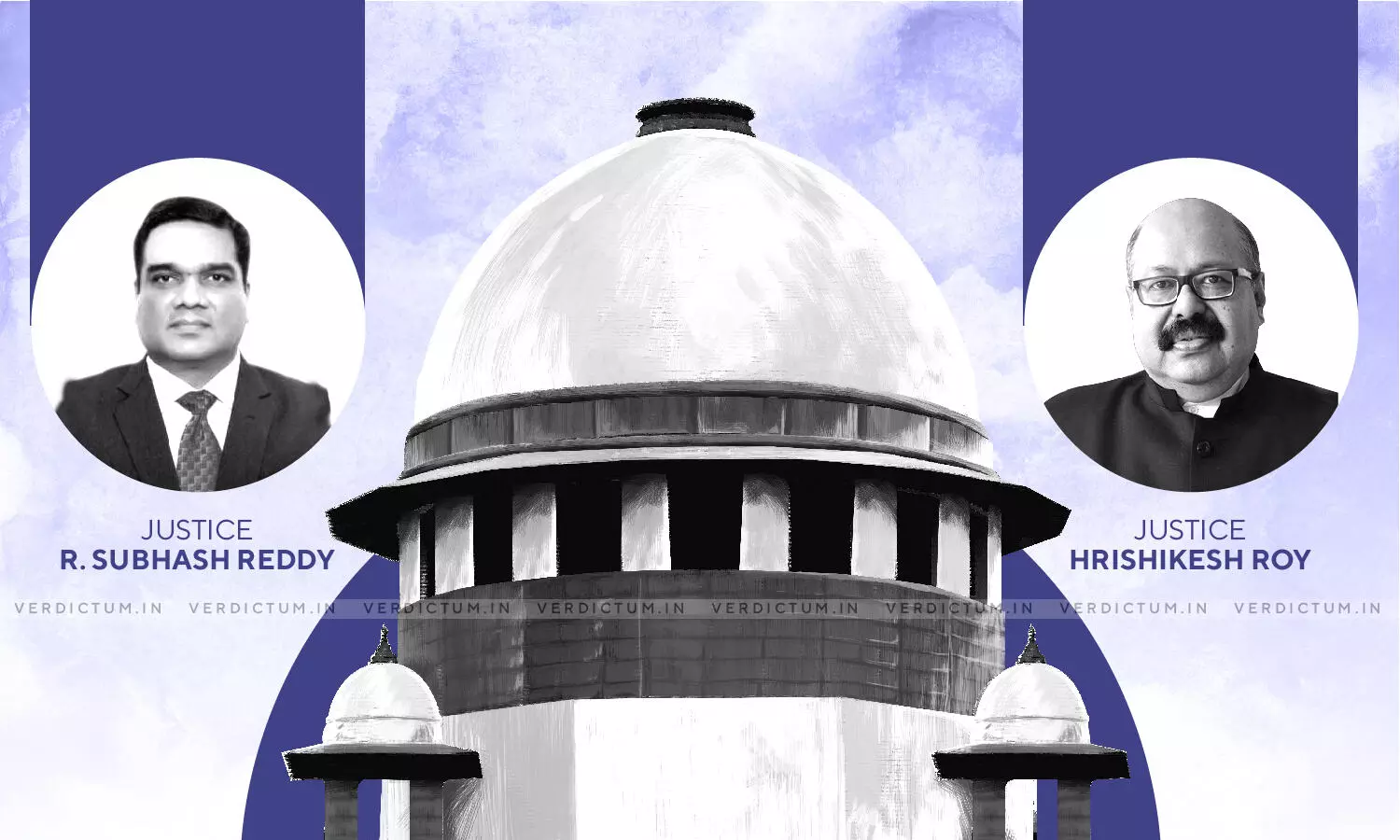

|A two-judge Bench of Justice R. Subhash Reddy and Justice Hrishikesh Roy has held that "The aspect of exclusivity under Section 40(a)(iib) is not to be considered with a narrow interpretation, which will defeat the very intention of Legislature, only on the ground that there is yet another player, viz., Kerala State Cooperatives Consumers' Federation Ltd. which is also granted licence under FL1."

Mr. S. Ganesh, Senior Advocate appeared for Kerala State Beverages Manufacturing and Marketing Corporation while Mr. N. Venkataraman, ASG appeared for revenue.

The first appeal before the Supreme Court was preferred by a State-owned Undertaking, i.e., Kerala State Beverages Manufacturing and Marketing Corporation while the other three appeals were preferred by revenue.

In this case, for AY 2014-15, the DCIT had finalized the assessment of income under Section 143(3) of the Income Tax Act. The PCIT exercised revision and set aside the order of assessment to the extent it failed to disallow the debits made in the P&L Account with respect to the amount of surcharge on sales tax and turnover tax paid to the State Government which ought to have been disallowed under Section 40(a)(iib) of the Act. Appellant filed an appeal before the ITAT.

For AY 2015-16, the assessment was completed under Section 143(3) of the Act by the ACIT. Debits contained in the Profit & Loss Account of the Appellant with respect to payment of gallonage fee, licence fee, shop rental (list), and surcharge on sales tax, amounting to a total sum of Rs.811,90,88,115/were disallowed under Section 40(a)(iib) of the Act.

An appeal was filed before CIT(A) that was dismissed. The matter was carried to ITAT. Both appeals were dismissed by the ITAT.

An MA was filed on the ground that the Tribunal had failed to consider the issue agitated against the disallowance of the surcharge on sales tax. The said MA was allowed and a fresh order was passed finding the issue against the appellant and dismissing the appeal.

Aggrieved by these 3 orders, appeals were filed before the High Court. Question of law was answered partly in favor of the assessee and partly in favor of revenue.

The issue which was dealt with by the Supreme Court was -

While it is the case of the assessee/appellant that the gallonage fees, licence fee and shop rental (kist) for FL9 licence and FL1 licence, the surcharge on sales tax and turnover tax do not fall within the purview of the abovesaid amended Section, the case of the revenue is that all the aforesaid amounts are covered under Section 40(a)(iib) as such, such amounts are not deductible for the purpose of computation of income, for the assessment years 2014-2015 and 2015-2016.

The Court then proceeded to discuss Section 40 of the Act. The Court held that if the amended provision under Section 40(a) would be read as interpreted by the High Court, that will defeat the purpose behind the amendment. The Court observed -

"The aspect of 'exclusivity' under Section 40(a)(iib) has to be viewed from the nature of undertaking on which levy is imposed and not on the number of undertakings on which the levy is imposed. If this aspect of exclusivity is viewed from the nature of undertaking, in this particular case, both KSBC and Kerala State Cooperatives Consumers' Federation Ltd. are undertakings of the State of Kerala, therefore, levy is an exclusive levy on the State Government Undertakings. Therefore, we are of the considered view that any other interpretation would defeat the very object behind the amendment to Income-tax Act, 1961."

The Court held that interpretation is to be in the manner that would promote and subserve the object and intention behind the legislation.

Furthermore, the Court held that it is settled that a surcharge on a tax is nothing but the enhancement of tax. On this score, the Court observed as follows.

"Thus it is clear that the surcharge which is sought to be levied is nothing but the enhancement of sales tax, which is levied under Section 5(1) of the KGST Act. When the basic sales tax paid by KSBC under Section 5(1)(b) of the KGST Act, deduction was allowed, there is no reason not to allow deduction of surcharge on sales tax. If the revenue does not consider Section 40(a)(iib) is applicable to the basic sales tax paid by KSBC under Section 5(1)(b) of the KGST Act, it is not known how the surcharge on sales tax, which is nothing but the sales tax, can be brought in the net of Section 40(a)(iib)(A) or 40(a) (iib)(B) of the Act."

The Court held that when the Statute uses different terms and expressions, it is clear that the legislature is referring to distinct and different things.

The Court concluded that the gallonage fee, licence fee and shop rental will squarely fall within the purview of Section 40(a)(iib). The Court held that a surcharge on sales tax and turnover tax is not a fee within the said provisions as it cannot be disallowed under the said provision.

The Court dismissed the appeal of the assessee and partly allowed the appeals filed by the revenue. The assessment relating to AY 2014-15 and 2015-16 were set aside and the AO was directed to pass revised orders within 2 months.

Click here to read/download the Judgment