For Claiming Benefit/Deduction U/s. 80-IB Of IT Act, End Product Manufactured Has To Be Considered- SC

|

|The Supreme Court held that for claiming deductions under Section 80-IB of the Income Tax Act, the assessee has to prove that what is ultimately manufactured is not an article classifiable in the Eleventh Schedule (entry 25).

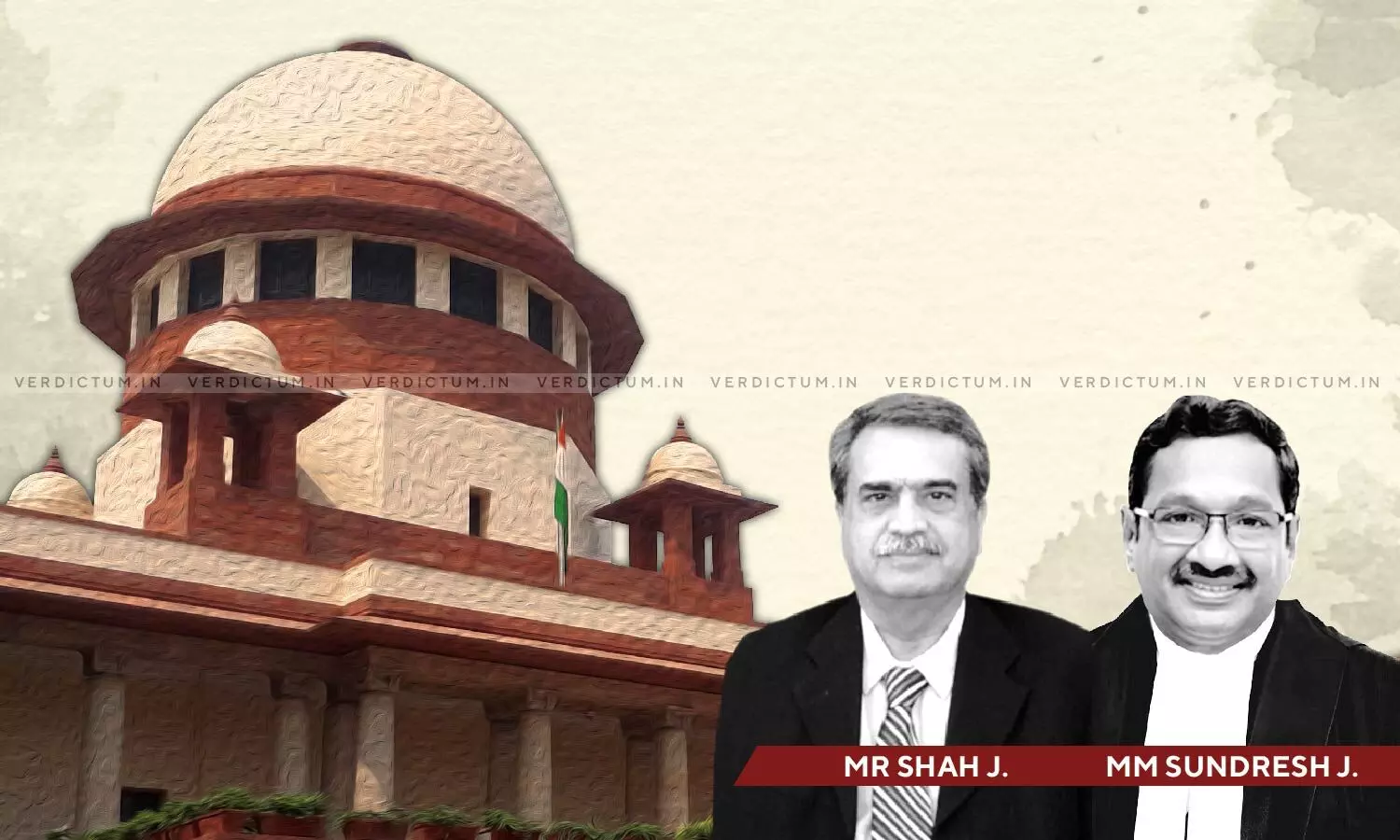

The Bench of Justice M.R. Shah and Justice M.M. Sundresh observed that "Merely because the assessee is using the chemicals and ultimately what is manufactured is polyurethane foam and the same is used by assembly operators after the process of moulding as car seats, it cannot be said that the end product manufactured by the assessee is car seats/automobile seats."

In this case, the appeal is preferred against the order of the Karnataka High Court whereby the appellant/assessee was denied the deduction claimed under Section 80-IB of the IT Act and observed that the nature of the business of the assessee was "manufacturer of polyurethane foam seats" which falls under entry 25 to the Eleventh Schedule of the IT Act and therefore the assessee should not be entitled to deduction under Section 80- IB of the IT Act.

Senior Advocate Preetesh Kapur appeared on behalf of the assessee and submitted that the relevant pre-condition for the assessee to be eligible for the benefit under Section 80-IB of the IT Act is that the final product manufactured and sold by the assessee should not be an article classifiable in the Eleventh Schedule and that the final product manufactured by the assessee is not polyurethane foam, but automobile seat in which polyurethane foam is used. It was also submitted that the Tribunal has returned a finding of fact that the manufacturing process resulted in the emergence of a final product which is commercially distinct and different from polyurethane foam and is known in the market as car seats and not as polyurethane foam.

Additional Solicitor General of India Balbir Singh appeared on behalf of the revenue and submitted that what is manufactured by the assessee is polyurethane foam in different shapes/designs and what is sold is different sizes/designs of polyurethane foam which ultimately is being used by the assembly operator for manufacturing of car seats/automobile seats and the same is used as an ingredient and after the process of moulding etc., the seats are manufactured. It was also submitted that the assessee produces polyurethane foam seats which are used for making end products to be fixed in different vehicles.

The Issue dealt with is-

Whether the assessee is eligible for the benefit under Section 80-IB of the IT Act?

The Apex Court observed that the assessee manufactured and sold polyurethane foam which was manufactured by injecting two chemicals, namely, Polyol and Isocyanate and the foam so produced is used as an ingredient for manufacturing automobile seats. It cannot be said that the end product manufactured by the assessee is car seats/automobile seats.

"There must be a further process to be undertaken by the very assessee in manufacturing of the car seats. No further process seems to have been undertaken by the assessee except supplying/selling the polyurethane foam in different sizes/designs/shapes which may be ultimately used for end product by others as car seats/automobile seats."

The Apex Court further observed that "when the articles/goods which are manufactured by the assessee, namely, polyurethane foam is an article classifiable in the Eleventh Schedule (entry 25), considering Section 80- IB(2)(iii), the assessee shall not be entitled to the benefit under Section 80-IB of the IT Act."

Accordingly, the Apex Court dismissed the Appeal.

Cause Title- M/s Polyflex (India) Pvt. Ltd. V The Commissioner of Income Tax & Another

Click here to read/download the Judgment