Insured Must Act In Good Faith – Terms Of Insurance Policy Must Be Strictly Construed: Supreme Court

|

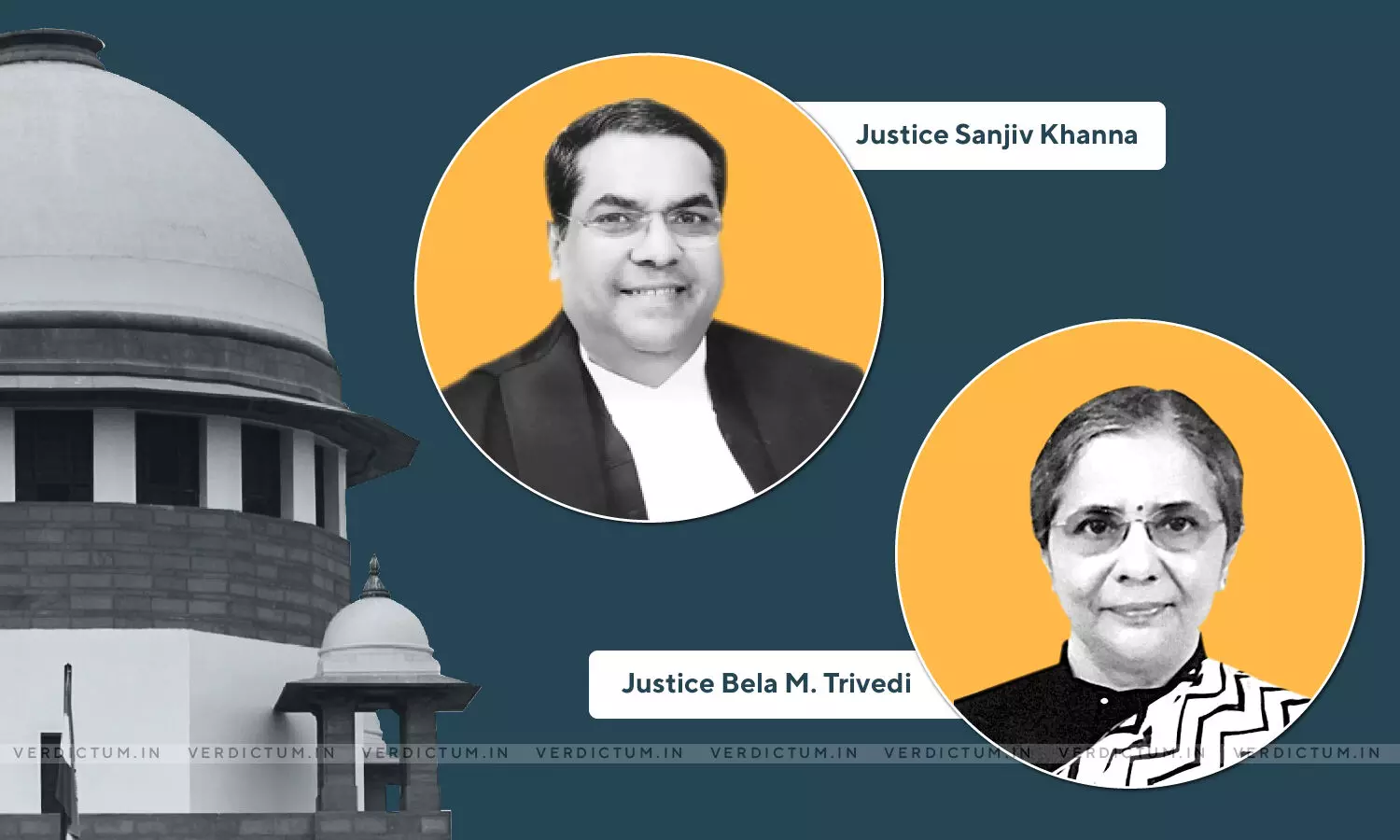

|A two-judge Bench of Justice Sanjiv Khanna and Justice Bela M. Trivedi has held that a contract of insurance is based on the legal principle of "Uberrima fides" i.e., good faith on the part of the assured and that the terms of the policy have to be strictly construed.

An appeal was preferred by the Life Insurance Corporation (LIC) against the judgment of the National Consumer Disputes Redressal Commission (NCDRC) which had upheld the judgment of the District Forum and allowed the claim of the Respondent.

In this case, the Respondent's husband had died in a road accident that happened on 6 March'12. While he was admitted to the hospital, he deposited the premium that had become due on October'11, on 9 March'12 for reviving his lapsed policy. After his death on 21 March, the Appellant paid a sum of Rs. 3,75,000 to the Respondent, however, did not pay additional Rs. 3,75,000 towards the accident claim benefit as per the terms of the policy.

When the matter went before the District Forum, it was contended by the Appellant that the day when the husband of the complainant met with an accident, the said policy had already lapsed on account of non-payment of the due premium. The claim of the complainant was allowed.

The State Commission, on appeal, however, reversed the findings of the District Forum and dismissed the complaint. The National Commission set aside the order of the State Commission and allowed the complaint on the basis of a ready reckoner of the Appellant.

The Appellant contended before the Supreme Court that it was not informed about the accident when the policy was revived. It was further argued that the Accident claim benefit was payable only when the policy was in force on the date of the accident, however, the policy had lapsed before that date. Also, there was a requirement of good faith on the part of the insured in the contract of insurance.

The Apex Court observed, "The said conduct on the part of the complainant and her husband in not disclosing about the accident to the corporation not only amounted to suppression of material fact and lacked bona fides but smacked of their mala fide intention, and therefore, the Accident benefit claim of the complainant was liable to be rejected on the said ground alone."

Further, the Bench opined, "It is clear that the terms of insurance policy have to be strictly construed, and it is not permissible to rewrite the contract while interpreting the terms of the Policy."

The Court additionally held that as per the terms of the contract, the policy was not in force on the date of the accident; therefore, the claim for extra accident benefit was rightly rejected by the Appellant-Corporation.

In the light of these observations, the Court set aside the impugned order of NCDRC and allowed the appeal.