Tests To Ascertain Whether A Contract Is Covered By Article 366(29A)(d) Of Constitution: Supreme Court Explains

|

|The Supreme Court has explained the tests to ascertain whether a contract is covered by Article 366(29A)(d) of the Constitution.

It held that there is no transfer of right to use the goods when substantial control over them remains with the owner.

The Court was dealing with a batch of civil appeals filed against the Oil and Natural Gas Corporation Limited (ONGC) concerning the liability to pay tax under the Assam General Sales Tax Act, 1993 and the Assam Value Added Tax Act, 2003 (VAT Act), respectively.

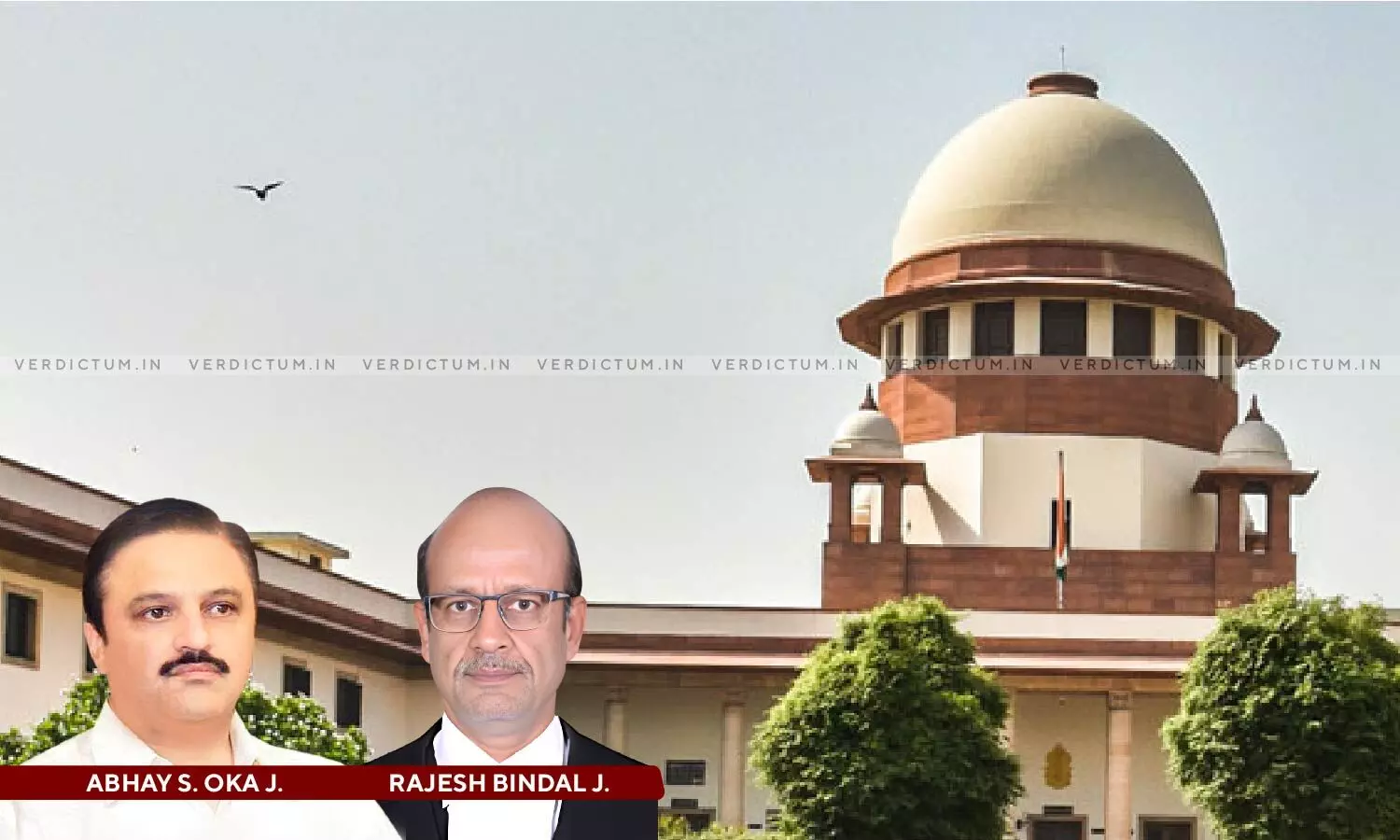

The two-Judge Bench comprising Justice Abhay S. Oka and Justice Rajesh Bindal observed, "... to decide the controversy involved in this group of appeals, the contract between the parties will have to be tested on the touchstone of the five tests laid down by Dr AR Laxmanan, J in the case of BSNL5. Thus, the contract will be covered by subclause (d) of Clause 29A of Article 366, provided all the five conditions laid down are fulfilled. This Court has made a distinction between transferring the right to use and merely a license to use goods."

The Bench added that in every case where the owner of the goods permits another person to use goods, the transaction need not be of the transfer of the right to use the goods and it can be simply a license to use the goods which may not amount to the transfer of the right to use.

“Essentially, the transfer of the right to use will involve not only possession, which may be granted at some stage (after execution of the contract), but also the control of the goods by the user. When the substantial control remains with the contractor and is not handed over to the user, there is no transfer of the right to use the vehicles, cranes, tankers, etc. Whenever there is no such control on the goods vested in the person to whom the supply is made, the transaction will be of rendering service within the meaning of Section 65(105) (zzzzj) of the Finance Act after the said provision came into force”, it said.

Advocate Hrishikesh Baruah represented the appellant while ASG Aishwarya Bhati represented the respondents.

In some cases, in the batch of appeals, the assessees had, under a contract, agreed to provide different categories of motor vehicles such as trucks, trailers, tankers, buses, scrapping winch chassis and cranes, to the ONGC. There were other cases where Indian Oil Corporation Limited (IOCL) had entered into agreements with transporters to provide tank trucks to deliver its petroleum products. The question was whether by hiring the motor vehicles/cranes, there is a transfer of the right to use any goods and if there is a transfer of the right to use the goods, will it amount to a sale in terms of Clause 29A(d) of Article 366 of the Constitution.

The appellant company agreed to provide services of truck-mounted hydraulic cranes with crew, etc. to ONGC for carrying out its various operations. It had to approach the High Court on the threat given by ONGC to deduct tax at source under the VAT Act in respect of the services provided by it. The Single Judge dismissed the petitions by holding that the contract was for the transfer of the right to use the goods, and therefore, there is a liability under the VAT Act and Sales Tax Act. Therefore, writ appeals were filed before the Division Bench, which also dismissed the same. Hence, the matter was before the Apex Court.

The Supreme Court in view of the above facts noted, “The entire controversy revolves around the question of whether the transactions reflected from the agreements subject matter of these appeals amount to a sale within the meaning of sub-clause (d) of Clause 29A of Article 366 of the Constitution of India and, consequently, whether it is a “sale” within the meaning of clause (iv) of sub¬section (43) of Section 2 of the VAT Act. The definition of “sale” under the Sales Tax Act, in sub-section (33) of Section 2, incorporates the requirement of transfer of property in goods.”

The Court referred to the case of Bharat Sanchar Nigam Limited & Anr. v. Union of India & Ors. (2006) 3 SCC 1, in which the concurring view was taken by Dr. AR Laxmanan, J. It was held that, to constitute a transaction for the transfer of the right to use the goods, the transaction must have the following attributes:

(a) there must be goods available for delivery;

(b) there must be a consensus ad idem as to the identity of the goods;

(c) the transferee should have a legal right to use the goods—consequently all legal consequences of such use including any permissions or licences required therefor should be available to the transferee;

(d) for the period during which the transferee has such legal right, it has to be the exclusion to the transferor—this is the necessary concomitant of the plain language of the statute viz. a “transfer of the right to use” and not merely a licence to use the goods;

(e) having transferred the right to use the goods during the period for which it is to be transferred, the owner cannot againtransfer the same rights to others.

The Court said that as per the terms of the contract, the contractor has an option of replacing the cranes in case one of the cranes was not working properly and that only the contractor is liable to take care of the legal consequences of using the cranes. It added that the contractor must maintain the cranes, and it is for the contractor to pay for consumables like fuel, oil, etc., and even the cranes must be moved and operated by the crew members appointed by the contractor.

“Moreover, in case of any mishap or accident in connection with the cranes or connection with the use of the cranes or as a consequence thereof, the entire liability will be of the contractor and not of the ONGC. Thus, in short, the contract is for providing the service of cranes to ONGC. The reason is that the transferee (ONGC) is not required to face legal consequences for using the cranes supplied by the contractor. Therefore, the tests laid down in clauses (c) and (d) of paragraph 97 of the decision of Dr AR Laxmanan, J are not fulfilled in this case”, it noted.

Furthermore, the Court observed that the use of the cranes provided by the contractor to ONGC will be by way of only a permissive use and though the cranes are used for carrying out the work as suggested by ONGC, the entire control over the cranes is retained by the contractor, inasmuch as it is the contractor who provides crew members for operating the cranes, it is the contractor who has to pay for fuel, oil, etc. and for maintenance of any loss or damage to the equipment of the contractor, staff of the contractor, any third party and staff and property of ONGC.

“Therefore, we find that as regards the contract to provide cranes, the finding of the High Court that there was a transfer of the right to use cranes was not correct as the transactions do not satisfy all the five tests referred to above. … In this case, like the other contracts, Clause 2 provides that the supply of equipment will not be by way of lease or transfer or right to use the equipment. All the other clauses are practically the same. Even in this case, also, the reasons which are recorded earlier will squarely apply. The contracts do not reflect the intention on the part of the contractor to transfer the right to use the goods”, it also said.

The Court concluded by saying that there is no intention transfer the use of any particular tank truck in favour of ONGC and that the contract is to provide tank trucks for the transportation of goods. It added that once the tank trucks provided by the contractor are loaded with goods, the entire responsibility of their safe transit, including avoiding contamination, delivery, and unloading at the destination, is of the contractor.

Accordingly, the Apex Court allowed the appeals and held that the contracts are not covered under the Sales Tax Act and VAT Act.

Cause Title- M/s. K.P. Mozika v. Oil and Natural Gas Corporation Ltd. & Ors. (Neutral Citation: 2024 INSC 27)

Appearance:

Appellant: Senior Advocate B.K. Mishra, Advocates Kumar Kshitij, Hitesh Kumar Sharma, Akhileshwar Jha, Amit Kumar Chawla, Virendra Mohan, Niharika Dwivedi, Sandhya Mishra, AORs Mohan Pandey, Anil Shrivastav, Ananga Bhattacharyya, Advocates Devahuti Tamuli, Krishanu Barua, Manish Goswami, AORs Rameshwar Prasad Goyal, Raj Bahadur Yadav, Sumeet Lall, Advocates Uday Gupta, Shivani Lal, Hiren Dasan, M.K. Tripathi, Rajeev Kumar Gupta, AORs R. C. Kaushik, Shibu Devasia Olickal, and Jagjit Singh Chhabra.

Respondents: Advocates Raj Bahadur Yadav, Nisha Bagchi, Shashank Bajpai, Ruchi Kohli, Prashant Singh Ii, Sabarish Subramanium, AORs Raj Bahadur Yadav, Ananga Bhattacharyya, Anil Shrivastav, Advocate Sangeeta Bharti, AOR Prerna Mehta, Advocates Saurav Agrawal, Rajeev Kumar Dubey, AOR Kamlendra Mishra, Sr. A.A.G. Nalin Kohli, Advocates Saurabh Tripathi, Ankit Roy, Nimisha Menon, Aastik Dhingra, AOR Shuvodeep Roy, ASG N. Venkatraman, Senior Advocate Arijit Prasad, AOR Mukesh Kumar Maroria, Advocates Ruchi Kohli, Nisha Bagchi, AORs Krishna Prasad, Ruchi Kohli, and Corporate Law Group.