'Law Doesn’t Envisage Unlimited Tiers Of Scrutiny': SC Says Its Jurisdiction U/S 62 IBC Is Restricted To Question Of Law Akin To A Second Appeal

|

|The Supreme Court observed that its jurisdiction under Section 62 of the Insolvency and Bankruptcy Code is is restricted to a question of law akin to a second appeal.

The Court was dealing with an appeal filed by IFCI Limited which had made investments through Compulsorily Convertible Debentures (CCDs) for a Highway Project.

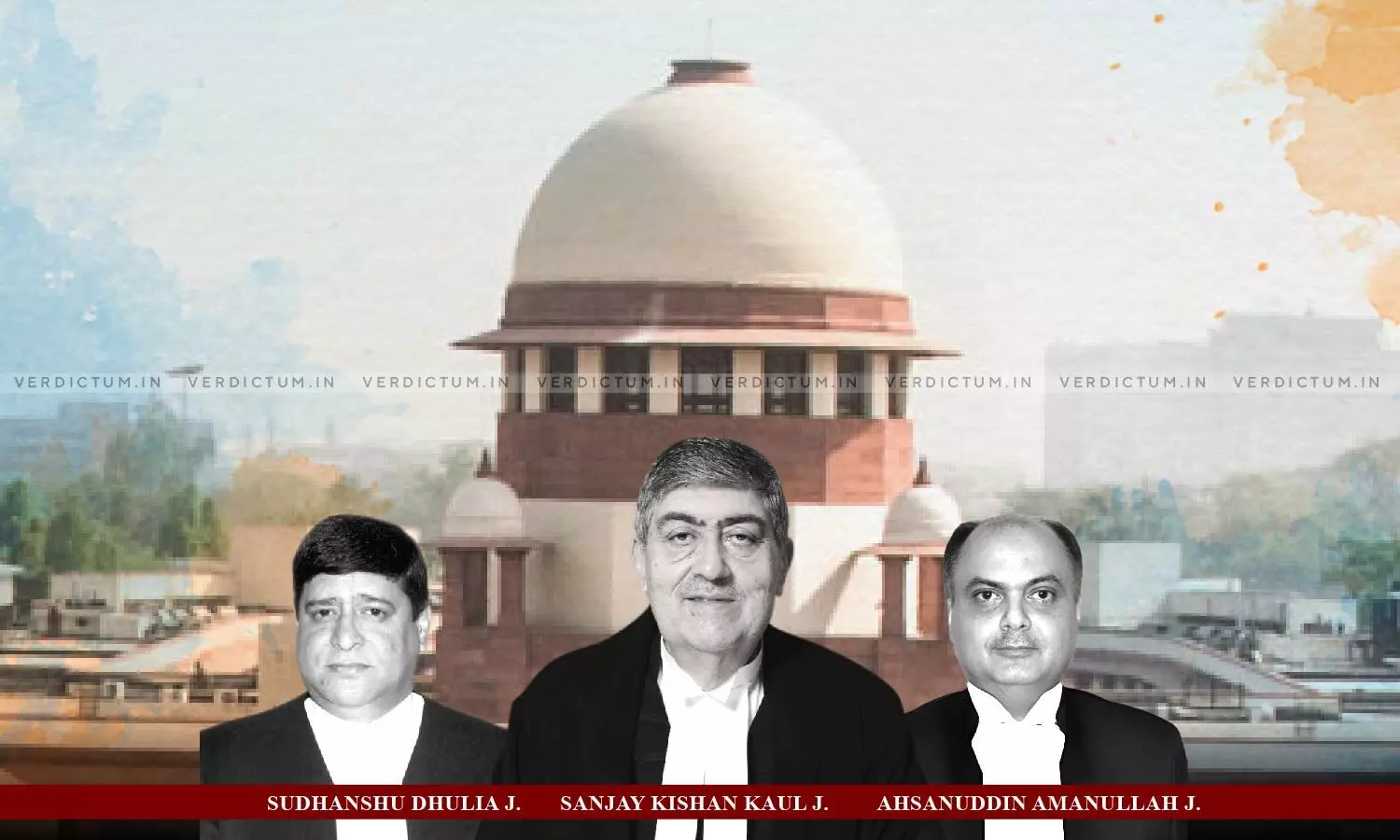

The three-Judge Bench comprising Justice S.K. Kaul, Justice Sudhanshu Dhulia, and Justice Ahsanuddin Amanullah observed, “The jurisdiction is restricted to a question of law akin to a second appeal. The law does not envisage unlimited tiers of scrutiny and every tier of scrutiny has its own parameters. Thus, the lis inter se the parties has to be analyzed within the four corners of the ambit of the statutory jurisdiction conferred on this Court.”

The Bench referred to the case of Nabha Private Limited v. Punjab State Power Corporation Limited (2018) 11 SCC 508 in which the aspect of interpretation of commercial documents was analysed.

Senior Advocate Vivek Chib represented the appellant while Senior Advocate Shyam Divan represented the respondents.

Brief Facts -

The National Highways Authority of India (NHAI) had awarded the Highway project in question in terms of a Concession Agreement executed between it and the IVRCL Chengapalli Tollways Ltd (ICTL). ICTL was in turn a subsidiary Company of IVRCL which was holding 100 per cent share capital of ICTL and a consortium of lenders had provided term loan facility to the ICTL to execute various documents including the company loan agreement, and the balance project was to be financed by IVRCL through equity infusion. As a part of the equity component of the project, the financing was to be obtained through CCDs and what the appellant subscribed to was the CCDs, albeit with other debentures being executed simultaneously. The date of conversion into equity from the CCDs was December, 2017 but the formal issuance of shares was not done after the said date.

IFCI had agreed to subscribe to the CCDs at the request of ICTL and amount of Rs. 1,25,00,00,000/- in terms of a Debenture Subscription Agreement. The project ran into financial difficulties and ICTL even suggested a one-time settlement which was agreed to but even terms thereof were not honoured. Corporate guarantees of IVRCL were invoked by IFCI and Corporate Insolvency Resolution Process (CIRP) was initiated. The process under the Insolvency and Bankruptcy Code, 2016 (IBC) was thereby triggered. IFCI claimed that the amount owing to it had a status of a debt, and lodged a claim in that behalf, however, it was rejected by the Resolution Professional and an entire amount claimed was refused.

The Supreme Court after considering the submissions of the counsel said, “The definition of debt under Section 3(11) of the Code would be the liability or obligation in respect of a claim which is due from any person. ICTL does not have a liability or obligation qua the appellant because the appellant is actually an equity participant and does not have a debt to be repaid. The success of a commercial venture pays benefit to the equity participants but with income, which would not inhere in case of the the failure of the venture.”

The Court further noted that if it was a simpliciter debenture, it would have fallen under the category of a financial debt along with bonds etc.

“We must note that the complexities of commercial documents depending on the nature of business. These are not layman’s agreements but agreements vetted by experts and thus each of the parties knows its obligations and the benefits which can arise from the agreement. We thus find it difficult to read into or add to what the document says about a CCD”, also said the Court.

The Court added that it is an unfortunate scenario where the appellant is being left high and dry as there is nothing which it can recover from the sponsor company, there being no assets and funds.

“Commerce has evolved. The documents forming the base of commerce have also evolved and created a hybrid nature of documents. Thus, what was earlier labelled as a debenture, now has hybrid versions such as partly convertible debentures, optionally convertible debentures and Compulsorily Convertible Debentures (CCDs). We may note that traditionally debentures were treated as a floating security with a covenant for payment on a specified date”, the Court remarked.

Accordingly, the Apex Court dismissed the appeal.

Cause Title- M/s. IFCI Limited v. Sutanu Sinha & Ors. (Neutral Citation: 2023 INSC 1023)