Courts & Judicial Forums Must Frame Guidelines Where Amounts With Registry Be Deposited In Banks/Financial Institutions: SC

|

|The Supreme Court has observed that all Courts and Judicial Forums should frame guidelines in cases where amounts are deposited with the office or registry of the Court or Tribunal, that such amounts should mandatorily be deposited in a bank or some financial institution, ensuring no loss in the future.

The Court was dealing with the appeals relating to the interest claimed by the complainant from the developer who had returned the Pay Order and the declining of the possession of the flat.

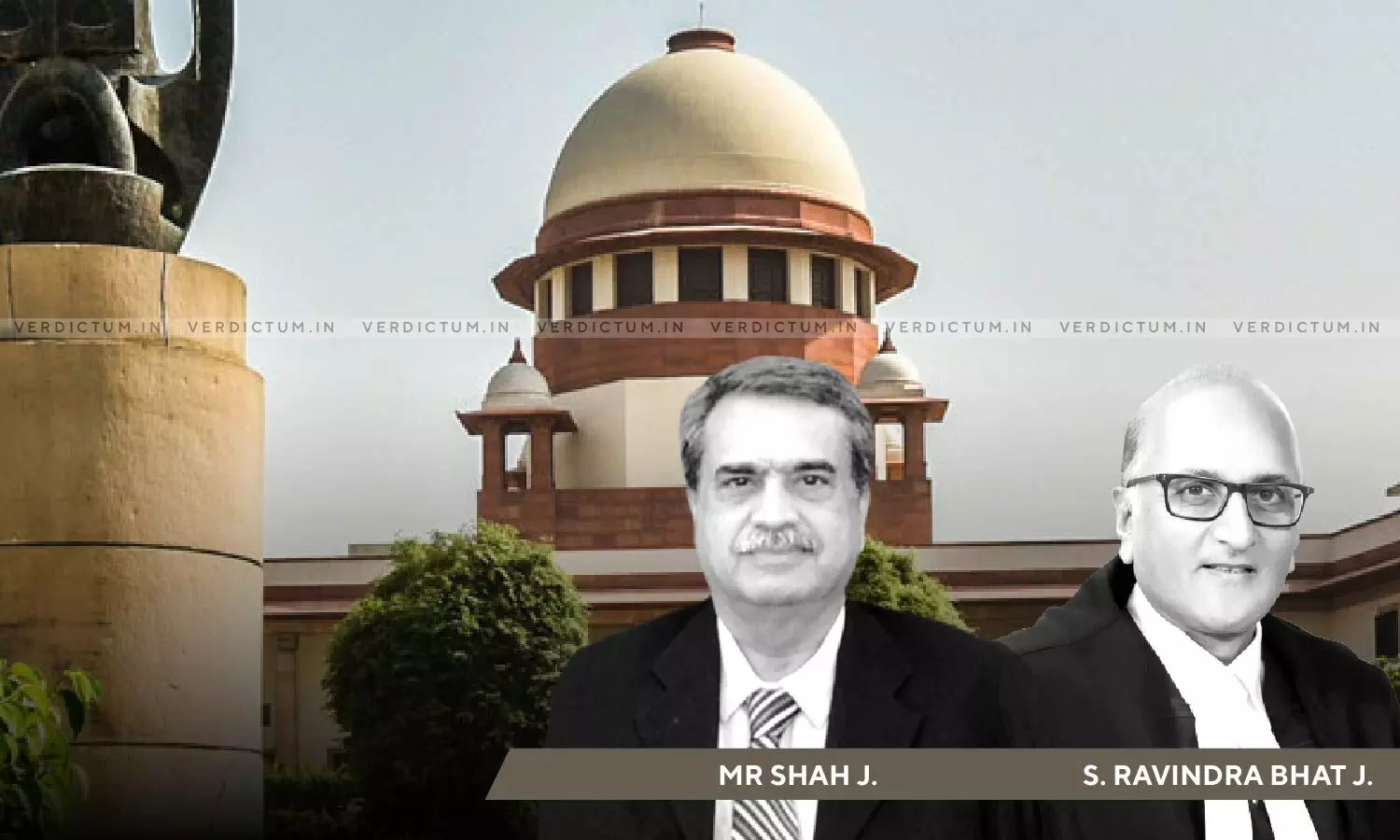

The two-Judge Bench comprising Justice MR Shah and Justice S. Ravindra Bhat held, “… this court is of the opinion that all courts and judicial forums should frame guidelines in cases where amounts are deposited with the office / registry of the court / tribunal, that such amounts should mandatorily be deposited in a bank or some financial institution, to ensure that no loss is caused in the future. Such guidelines should also cover situations where the concerned litigant merely files the instrument (Pay Order, Demand Draft, Banker’s Cheque, etc.) without seeking any order, so as to avoid situations like the present case.”

The Bench further said that such guidelines should be embodied in the form of appropriate rules, or regulations of each court, tribunal, commission, authority, agency, etc. exercising adjudicatory power.

Advocate Mohit Paul appeared on behalf of the appellants while Advocate Gaurav Goel appeared for the respondents.

Brief Facts:

The two appeals were preferred against a common order of the National Company Law Appellate Tribunal (NCLAT) by the buyer’s legal representative i.e., the complainant, and by the builder i.e., the developer. The developer enclosed a Pay Order for Rs. 4,53,750/- issued by Citibank towards a full refund of payments made by the complainant towards the flat.

The complainant demanded possession of the flat besides claiming Rs. 25 lakhs as compensation as a result of which the developer returned the Pay Order. A complaint was filed by the complainant under Section 36 of the Monopolies and Restrictive Trade Practices Act, 1969 (MRTP Act) alleging an unfair trade practice by the developer.

The matters pending before MRTP Commission were transferred to the Competition Appellate Tribunal (COMPAT). COMPAT by its order concluded that the developer had falsely represented to the general public (including the complainant) the time within which the project was to be completed, i.e., three years, but did not complete the construction for more than a decade and therefore, held the developer guilty of unfair trade practice. However, it also declined the relief of delivery of possession of the flat.

The Supreme Court while dealing with the two separate appeals filed by both the complainant and the developer challenging the COMPAT’s order noted, “It cannot be for a moment disputed that the complainant was perhaps under a belief that filing such an original Pay Order established that she was not interested in receiving refund, but was interested only to secure possession of the flat. Nevertheless, it was necessary for her to apply through counsel for an appropriate order to ensure that the amount was deposited in an interest-bearing account.”

The Court further noted that the Tribunal accepted the explanation of Citibank that since the Pay Order in question had become stale, its proceeds/funds were moved to its ‘Unclaimed Sundry Account’, and did not attract any interest in terms of the RBI directions.

“… no order contemporaneously was sought from the MRTP Commission, which would have protected the interests of the complainant with respect to the money received even while ensuring that her contentions on the merits with respect to entitlement towards the flat were preserved. Many avenues / alternatives were available”, the Court observed.

The Apex Court referred to the case of Gurpreet Singh v. Union of India, 2006 (8) SCC 457 which dealt with the modes of payment under decrees and stipulated when interest shall cease to “run” i.e., not be payable.

The Court further observed, “… the developer’s argument that the rule embodied in Order XXI, Rule 4 CPC, is applicable, is merited. The developer cannot be fastened with any legal liability to pay interest on the sum of ₹ 4,53,750/- after 30th April 2005.”

It was also noted by the Court that the complainant’s argument that on account of the omission of the developer, she was wronged, and was thus entitled to receive interest, cannot prevail and that the complainant did not take steps to protect her interests.

The Court asserted, “… the complainant cannot claim interest from the developer, who had returned the Pay Order. … at the time of filing of the complaint, she could have chosen one among the various options to ensure that the amount presented to her was kept in an interest-bearing account, without prejudice to her rights to claim interest later. In these circumstances, no equities can be extended to her aid.”

The Court, therefore, set aside the order and dismissed the appeal preferred by the complainant.

Accordingly, the Apex Court allowed the appeal filed by the developer.

Cause Title- K.L. Suneja & Anr. v. Dr. (Mrs.) Manjeet Kaur Monga (D) through her LR & Anr.

Click here to read/download the Judgment