When Nature & Character Of Possession Constitutes Primary Dispute, Court Is Excluded By Law From Examining Unregistered Deed: Apex Court

|

|The Supreme Court has held that when the nature and character of possession constitutes primary dispute, the court is excluded by law from examining unregistered deed.

The Court was deciding a civil appeal in which the main point to be addressed was as to what extent the court can take cognizance of a clause relating to purpose for which a lease is granted contained in an unregistered deed of lease for immovable property stipulating its duration for a period of five years.

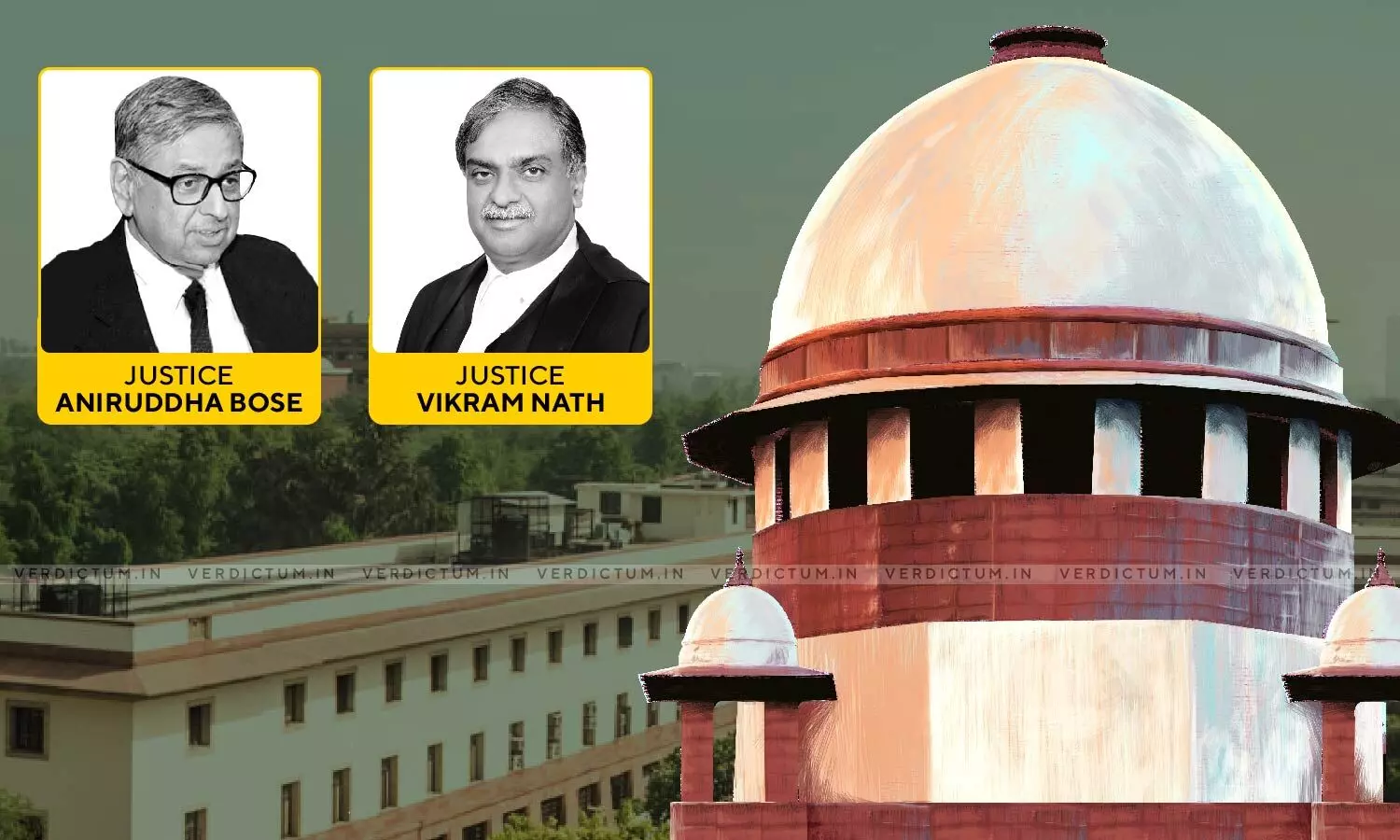

The two-Judge Bench comprising Justice Aniruddha Bose and Justice Vikram Nath observed, “In our opinion, nature and character of possession contained in a flawed document (being unregistered) in terms Section 107 of the 1882 Act and Sections 17 and 49 of the Registration Act can form collateral purpose when the “nature and character of possession” is not the main term of the lease and does not constitute the main dispute for adjudication by the Court. In this case, the nature and character of possession constitutes the primary dispute and hence the Court is excluded by law from examining the unregistered deed for that purpose.”

The Bench said that in respect of the suit out of which the appeal arises, purpose of lease is the main lis, not a collateral incident.

Advocate Shakti Kanta Pattanaik appeared for the appellant while Advocate Chanchal Kumar Ganguli appeared for the respondents.

Facts of the Case -

In 2003, a document captioned ‘Tenancy Agreement’ was executed by and between one landlady (deceased) and was represented before the court by her legal heirs being the respondents and an incorporated company. The said company was the appellant and the property in question comprised of approximately 16 cottahs of land situated within the city of Kolkata. The tenure of the agreement was for a period of five years and there was a stipulation for further renewal of such period.

First five years stood completed and a letter was sent by the landlady seeking enhancement of rent and the appellant raised a plea that such rent used to be collected on behalf of the landlady on due date but the same was stopped after October 2007. The notice was served by the landlady requiring the appellant to vacate the subject-premises. The letter was projected by the respondents as notice for 15 days as per stipulation of Section 106 of the Transfer of Property Act, 1882 (TOPA). The tenant had not delivered the vacant possession as a result of which the suit gave rise to the appeal was instituted by the landlady before the Civil Judge. The Trial Court found that the tenancy of the appellant was month by month governed under TOPA and thereafter the High Court found no reason to interfere with the Trial Court’s judgment.

The Supreme Court after hearing the contentions of the counsel noted, “The lease was for use by the predecessor of the appellants “for the purpose of his business and/or factory.” The property was described in the schedule to be estimated 16 cottahs of land “with a factory shed/godown space”. Such description would not be sufficient to establish that the same was for manufacturing purpose.”

The Court said that the onus would be on the appellant to establish the fact that manufacturing activity was being carried on from the demised premises

“A mere statement by the DW-1 to which we have referred earlier or the purpose of lease as specified in the lease agreement would not be sufficient to demonstrate the purpose of lease to be for manufacturing. This could be proved by explaining what kind of work was being carried on in the factory shed. In such a situation also, the registration of the deed would have been necessary”, held the Court.

The Court added that in absence of registration, tenancy would have been of “month to month” character and hence, the High Court had not erred in law in dismissing the appellant’s appeal.

Accordingly, the Apex Court dismissed the appeal.

Cause Title- M/s. Paul Rubber Industries Private Limited v. Amit Chandra Mitra & Anr. (Neutral Citation: 2023INSC854)