Order XXI Rule 90 (3) CPC – Absence Or Defect In Attachment Of Property Sold Is Not Ground For Setting Aside Sale – SC

|

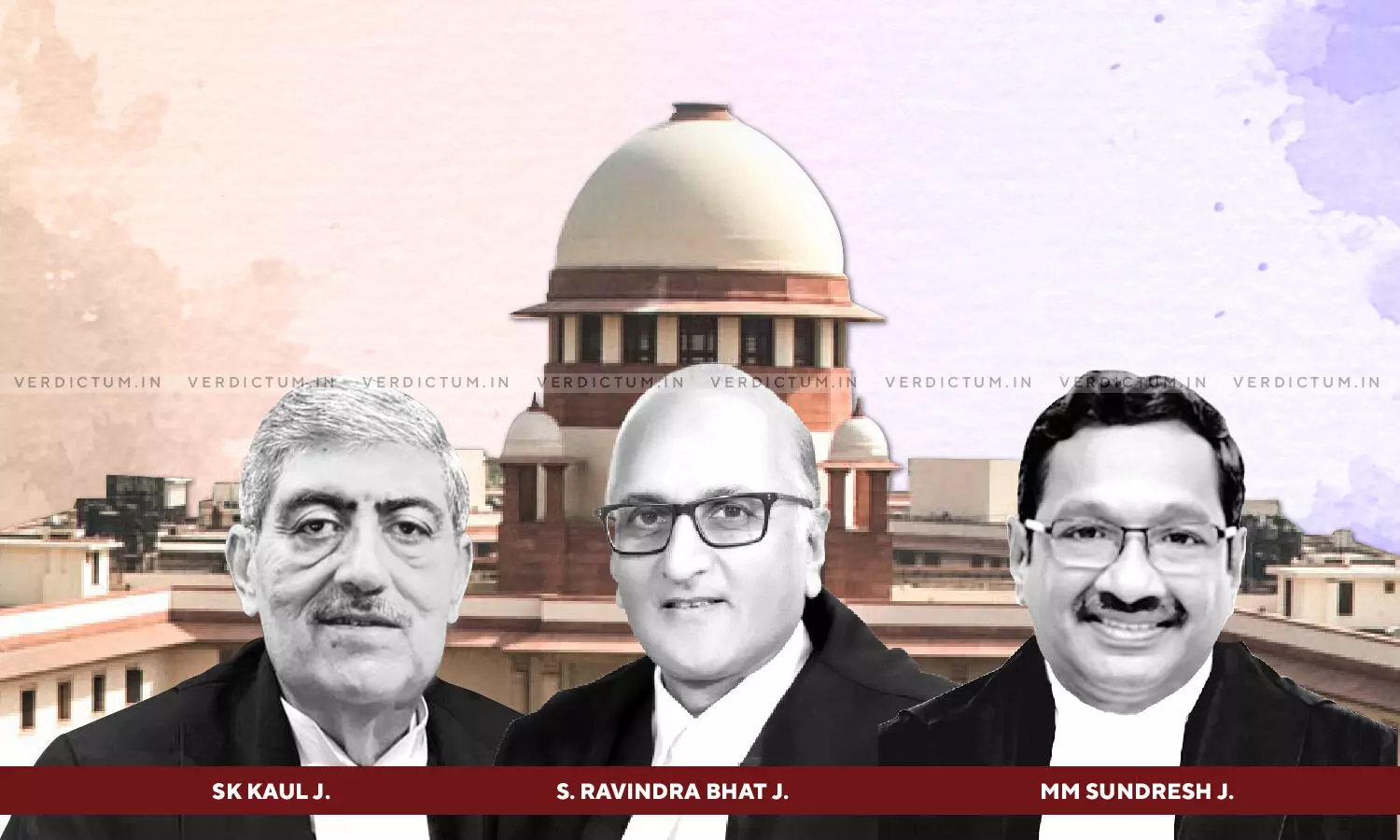

|A Supreme Court Bench of Justice Sanjay Kishan Kaul, Justice S. Ravindra Bhat, and Justice MM Sundresh heard a dispute regarding the non-payment for acquired land under the Land Acquisition Act 1984 which had spanned over more than three decades.

The Court held that "Learned senior counsel for the Appellant rightly drew the attention of this Court to Order XXI Rule 90 (3) of the said Code to contend that it is clearly stated that no application to set aside a sale on grounds of irregularity or fraud under the Rule can be entertained on any ground which the applicant would have taken on or before the date on which the proclamation of sale was drawn up. The Explanation to the Rule further says that mere absence of or defect in attachment of the property sold should not by itself be a ground for setting aside the sale under this Rule. The Judgment Debtor/Respondent Trust failed to avail any of these opportunities at different stages."

Senior Counsel Mr PS Patwalia appeared for the Appellant. Senior Counsel Mr Neeraj Kumar Jain appeared for the Respondent Trust.

In this case, the land belonging to Respondents No. 2 to 5 was acquired by Respondent No. 1 - Ludhiana Improvement Trust.

The compensation determined by the Respondent Trust was not acceptable to the land owners, thus, reference was sought in terms of Section 18 of the LA Act. The Land Acquisition Tribunal made an award enhancing the compensation to the owners by determining the compensation as Rs.4,27,068/- along with future interest at 9%, per annum, from the date of the application. The Respondent Trust, however, did not pay the amount while it continued to enjoy the land.

The Respondent Trust did not oblige despite multiple requests and therefore, the owners filed an execution petition. The petition was dismissed as unsatisfied. However, the order showed no reason for the dismissal of the petition.

Thereafter, the owners filed a second execution application for recovery of the compensation amount, along with interest, seeking to make the recovery through attachment of property.

In the application filed under Order XXI Rule 66 of the Code of Civil Procedure, 1908 read with Section 151 of the said Code, a proclamation of the sale of the property was sought. The tentative cost of the property, as stated in the application, was about Rs. 8 lakhs, which was sufficient to cover the recovery of Rs.4,27,068/- along with interest at the rate of 9% per annum.

A notice was served to the Respondent Trust once again, but elicited no response. The Court of Civil Judge issued a warrant for sale of the attached property. Consequently, the attached property was sold to the Appellant by way of auction for a consideration of Rs. 22.65 lakhs.

Thereafter, the Respondent Trust filed an application before the Court of the Senior Sub Judge, under Order XXI Rule 90 of the said Code to set aside the ex parte attachment and auction of the Trust's property. Even during this period of time, the payments were not made to the land owners.

The Executing Court dismissed the objections and upheld the sale of the land to the Appellant.

The Respondent Trust approached the Additional District Judge, which dismissed its objections. The Revision Petition met the same fate before the High Court.

The matter was brought before the Supreme Court and the appeal was decided in 2010 in Improvement Trust, Ludhiana v. Ujagar Singh and Others.

The impugned orders were set aside and the matter was remitted to the Executing Court for deciding the application under Order XXI Rule 90 of the said Code at an early date. However, being conscious of the fact that the Appellant had been put to inconvenience and had already deposited a huge amount of Rs.22.65 lakhs in 1992 but has not been able to get the fruits thereof, Rs.50,000/-, as costs, were imposed on the Respondent Trust.

The objects were rejected once again by the Executing Court. The endeavor of the Respondent Trust to assail the order of the Executing Court was rejected by the First Appellate Court. The Respondent Trust approached the High Court, which set aside the orders of the Executing Court and the First Appellate Court.

The Appellant approached the Supreme Court again.

The Supreme Court noted that the dragging of the proceedings for three decades was a grave injustice to the Appellant - who was deprived of the enjoyment of the property despite having paid the full auction price 30 years back.

The Court stressed that the right to property is a Constitutional right under Article 300A of the Constitution, and held that "The acquisition proceedings in respect of the land in question sought to deprive the owners of their land which had to be paid for in terms of the provisions of the LA Act. The amount of compensation was determined by the reference court under Section 18 of the LA Act and the matter was not taken further. Thus, both the owner and acquiring beneficiary agreed to the compensation as determined by the Tribunal. The next step should have been to immediately pay the amount to the owners which did not happen. On the other hand, the owners were made to run from pillar to post and ultimately the execution proceedings were filed six years after the amount had been so determined. This conduct of the Respondent Trust itself is not condonable and this is what resulted in the proceedings for execution, the auction and the matter being dragged on for decades."

Further, the Court observed that despite various opportunities the Respondent Trust had not made amends, and that "the Respondent Trust would have saved the day even at that time by depositing the amount due to the owners. It did not do so. The fact that ultimately the property fetched a larger price cannot be held against the Appellant who participated in the process and offered the appropriate price, which was accepted. The Respondent Trust did not even comply with the requirement of Order XXI Rule 89 by depositing the decretal amount along with 5 per cent of the auction amount. The Respondent Trust behaved as if it had some superior right to appropriate the property of the owners without paying for it contrary to the mandate of the LA Act. That would be hardly called a case of fraud in such a situation."

Setting aside the judgment of the High Court, the Supreme Court held that "We must note in the end that Order XXI of the said Code is exhaustive and in the nature of a complete Code as to how the execution proceedings should take place. This is the second stage after the success of the party in the civil proceedings. It is often said in our country that another legal battle, more prolonged, starts in execution proceedings defeating the right of the party which has succeeded in establishing its claim in civil proceedings. This is exactly what has happened in the present case. The various stages of Order XXI of the said Code when violated cannot given right to some extra indulgence merely because the Respondent Trust is an Improvement Trust. There cannot be a licence to prolong the litigation ad infinitum."

The Court also granted costs to the Appellant against Respondent No.1 quantified at Rs.1 lakh.

Cause Title - M/s. Jagan Singh & Co. v. Ludhiana Improvement Trust & Ors.

Click here to read/download the Judgment