Persons Other Than Searched Persons Shall Be Liable To Pay Interest On Late Filing Of Return Even In Absence Of Notice U/s. 158BC Of IT Act- SC

|

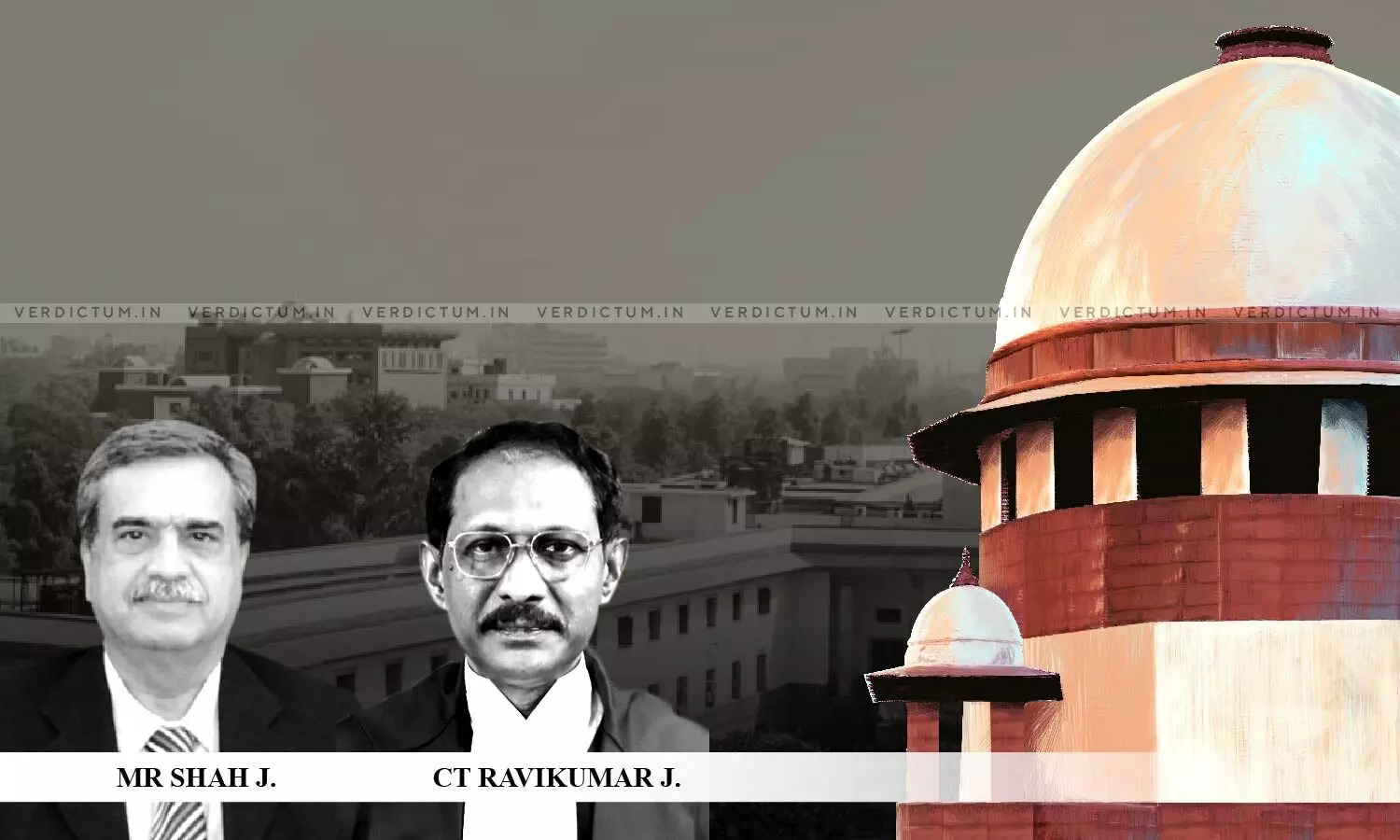

|A Supreme Court Bench of Justice MR Shah and Justice CT Ravikumar has held that "persons other than searched persons shall be liable to pay the interest on late filing of the return under Section 158BC even in absence of a notice under Section 158BC of the Income Tax Act and even for the period prior to 01.06.1999"

Senior Advocate Preetesh Kapur appeared on behalf of the Assessee-Appellant, and ASG Balbir Singh appeared for the Revenue.

In this case, the dispute arose with respect to the levy of interest under Section 158BFA(1) of the Income Tax Act in respect of assessment completed under Section 158BD of the Act for belatedly filing the return of income for the block period and also the levy of surcharge under Section 113 of the Income Tax Act.

The Supreme Court noted that there were two questions of law posed for consideration, which were:

(i) levy of interest under Section 158BFA(1) of the Income Tax Act for late filing of the return for the block period in absence of any notice under Section 158BC of the Act and for the period prior to 01.06.1999?

(ii) the levy of the surcharge under proviso to Section 113 of the Income Tax Act.

With regard to the first issue, the Supreme Court relied on the case of Commissioner of Income Tax (Central)I, New Delhi Vs. Vatika Township Private Limited, and subsequently observed that persons other than searched persons shall be liable to pay the interest on late filing of the return under Section 158BC even in the absence of a notice under Section 158BC of the Income Tax Act and even for the period prior to 01.06.1999.

With regard to the second issue, the Court noted that "the said issue is now not res integra in view of the decision of this Court in the case of Vatika Township Private Limited (supra)." In that context, the Court held that "the question of law with respect to levy of the surcharge under proviso to Section 113 of the Income Tax is held in favour of the assessee and against the revenue. It is observed and held that in the present case the assessee is not liable to pay the surcharge under proviso to Section 113 of the Income Tax Act."

Subsequently, the appeal was allowed in part. No orders were passed as to costs.

Cause Title: K.L. Swamy vs The Commissioner of Income Tax & Anr.

Click here to read/download the full Judgment