Powers Conferred On SAT U/s. 15-T Confined To Examination Of Correctness And Legality Of Impugned Order Only: SC

|

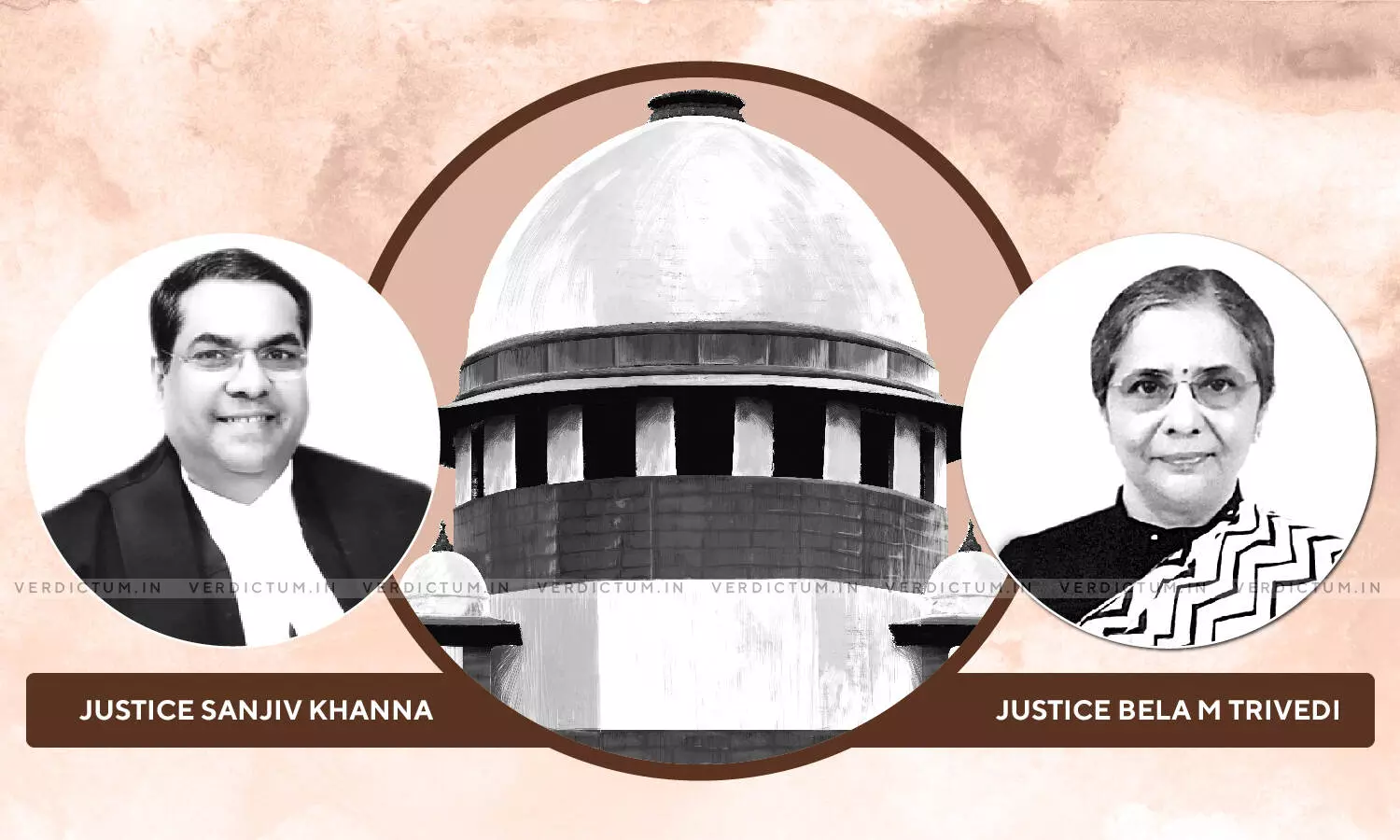

|A two-judge Bench of the Supreme Court comprising Justice Sanjiv Khanna and Justice Bela M. Trivedi while dismissing the appeals preferred by the Securities Exchange Board of India ["SEBI"] has held that the powers conferred on the Securities Appellate Tribunal ["SAT"] under Section 15-T of Chapter VI-A of the Act is confined to an examination of correctness and legality of the order under challenge.

The Court culled out the following issue for its consideration:

"Primary questions of law raised in these appeals relates to the interpretation of Regulation 10 of the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997; the power and exercise of the power by the Board under Regulations 44 read with 45 of the Takeover Regulations, 1997; and the power and jurisdiction of the Appellate Tribunal under Section 15T of the Securities and Exchange Board of India Act, 1992"

Counsel Bhargava V. Desai appeared for the Appellant while Counsel Mridula Ray Bhardwaj appeared for the Respondents before the Apex Court.

On the interpretation of Regulation 10 of the Takeover Regulations, the Court opined that the Regulation states no acquirer shall acquire voting rights which taken together with the shares or voting rights held by him or by a person acting in concert would entitle the acquirer to exercise 15% or more of the voting rights unless such acquirer makes public announcement to acquire shares in accordance with the regulations.

The Court noted that when a statutory enactment consciously defines a word or expression by enlarging or restricting the ordinary meaning then in the absence of clear indication to the contrary, the defined term would cover what is proposed, authorized, done or referred in the enactment.

The Court held that the principle of doubtful penalization would be applicable to the present case. The Court noted that this principle can be ignored when other interpretative factors weigh heavily to tilt the scales against application of the principle.

The Court also noted that it was a general rule of law of interpretation that unless explicitly mentioned, a law cannot be presumed to be retrospective.

The Court then discussed the issue of what would amount to reasonable period. The Court noted as follows:

"What would be the reasonable period would depend upon facts of each case, such as whether the violation was hidden and camouflaged and thereby the Board or the authorities did not have any knowledge. Though, no hard and fast rules can be laid down in this regard as determination of the question will depend on the facts of each case, the nature of the statute, the rights and liabilities thereunder and other consequences, including prejudice caused and whether third party rights have been created are relevant factors. Whenever a question with regard to inordinate delay in issuance of a show-cause notice is made, it is open to the noticee to contend that the show-cause notice is bad on the ground of delay and it is the duty of the authority/officer to consider the question objectively, fairly and in a rational manner. There is public interest involved in not taking up and spending time on stale matters and, therefore, exercise of power, even when no time is specified, should be done within reasonable time. This prevents miscarriage of justice, misuse and abuse of the power as well as ensures that the violation of the provisions are checked and penalised without delay, thereby effectuating the purpose behind the enactment."

The Court noted that there was merit in the contention of SEBI that the Appellate Tribunal could not have imposed penalty under Section 15H when the proceedings under the said provision had not been invoked by the Board and there was no order rendered by the adjudicating authority that imposed penalty under Section 15H of the Act.

In the power of the Appellate Tribunal under Section 15T of the Act, the Court made following crucial observations:

"We have also referred to Regulation 45 which in sub-regulation (6) refers to different types of penalties which can be imposed on a person violating any of the provisions of the Regulations. The Appellate Tribunal does not have the power for the first time to initiate and thereupon, impose penalty for non-compliance of the provisions of the Regulations under Chapter VI-A of the Act while deciding an appeal against directions issued under Regulation 44 of the Takeover Regulations, 1997. That power is vested with the authority specified in the Act or the Regulations. The Appellate Tribunal is an appellate forum and not the authority empowered to initiate penalty proceedings under Section 15-H or suo moto issue directions under Section 11, 11B or 11(4)(d) of the Act. It can uphold or set aside the direction issued, or modify and substitute the direction issued under Regulation 44 of the Takeover Regulations 1997 read with Sections 11, 11B and 11(4)(d) of the Act. "

The Court accordingly dismissed the appeals of the Board with the clarification as to power given hereinabove. There was no order as to costs.

Click here to read/download the Judgment