Recoveries With Respect To Secured Creditor Under SARFAESI Act Would Prevail Over Recoveries Under MSMED Act: SC

|

|The Supreme Court has observed that the recoveries with respect to secured creditors under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 ('SARFAESI Act') would prevail over the recoveries under the Micro, Small and Medium Enterprises Development Act, 2006 (‘MSMED Act’).

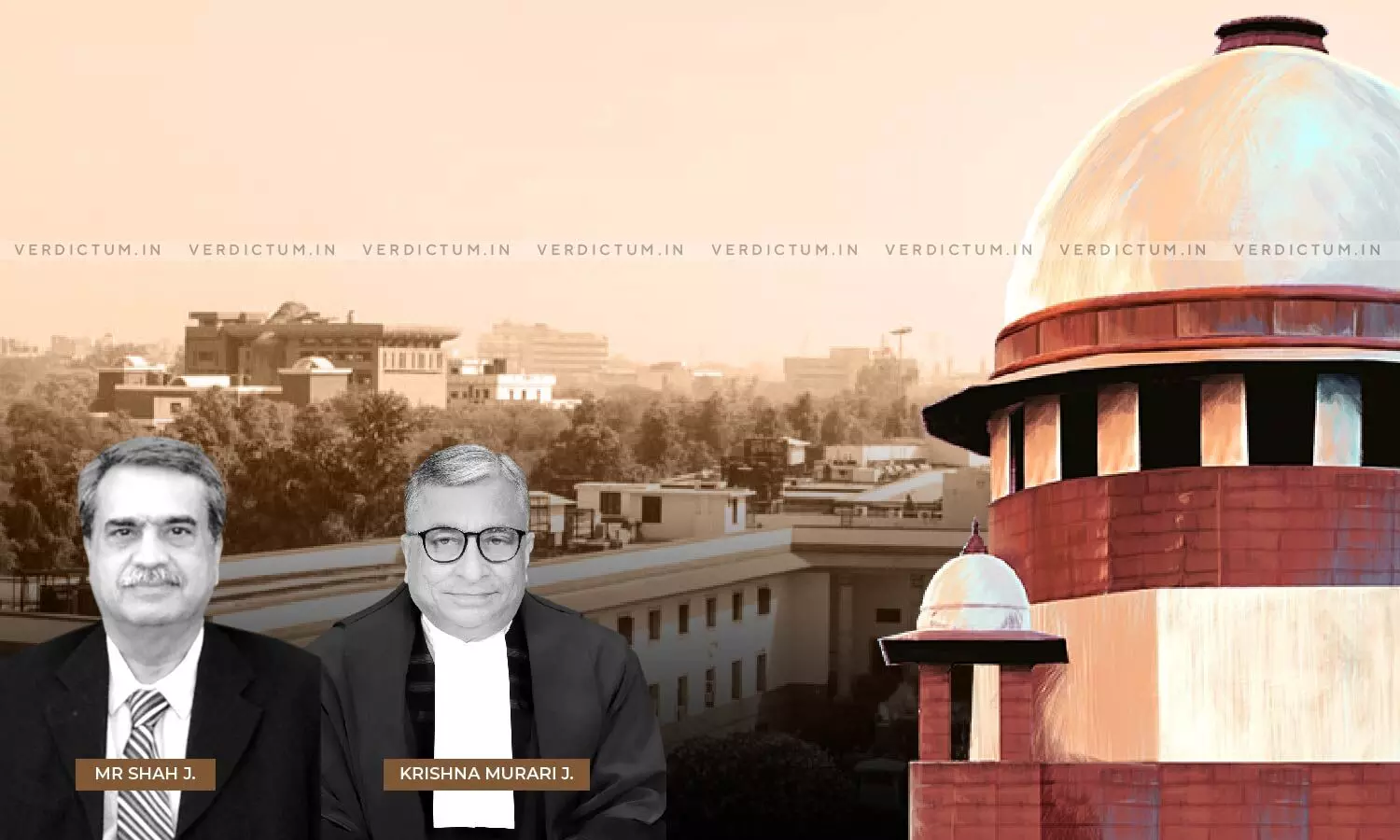

The Bench of Justice M.R. Shah and Justice Krishna Murari observed that “As per the settle position of law, if the legislature confers the later enactment with a non-obstante clause, it means the legislature wanted the subsequent / later enactment to prevail. Thus, a ‘priority’ conferred / provided under Section 26E of the SARFAESI Act would prevail over the recovery mechanism of the MSMED Act.”

In this case, the appeal was preferred against the order of Madhya Pradesh High Court wherein it was held that MSMED Act would prevail over the SARFAESI Act.

Advocate Amar Dave appearing for the appellant bank- secured creditor submitted that there was no express ‘priority’ envisaged for payments under the MSMED Act over the dues of secured creditors and that Section 26E of SARFAESI Act left no doubt that the legislature had expressly and unambiguously provided for a legal framework exclusively on the issue of 'priority' of payment of dues.

Senior Advocate Niranjan Reddy appearing for respondent no. 1 submitted that in view of Section 24 of the MSMED Act which provided for an overriding effect over other prevailing laws, the provisions with respect to recoveries under MSMED Act should prevail over the recoveries under SARFAESI Act. It was also submitted that the entire scheme of provisions under Chapter V – Sections 15 to 23 included delayed payments, recovery of amounts due, and establishment of Facilitation Council and its award, had an overriding effect on all other legislations including SARFAESI Act.

The Apex Court considering the relevant provisions of the MSMED Act and the SARFAESI Act observed that under provisions of the MSMED Act, more particularly Sections 15 to 23, no 'priority' was provided with respect to the dues under the MSMED Act, like Section 26E of the SARFAESI Act.

The Apex Court further observed that “Section 26E of the SARFAESI Act which has been inserted vide Amendment in 2016, it provides that notwithstanding anything inconsistent therewith contained in any other law for the time being in force, after the registration of security interest, the debts due to any secured creditor shall be paid in ‘priority’ over all other debts and all revenue taxes and cesses and other rates payable to the Central Government or State Government or Local Authority.”

The Apex Court also considered the object and purpose of the enactment of the SARFAESI Act and said that it had been enacted for providing specific mechanism / provision for the financial assets and security interest. “It is a special legislation for enforcement of security interest which is created in favour of the secured creditor – financial institution. Therefore, in absence of any specific provision for priority of the dues under MSMED Act, if the submission on behalf of respondent No.1 for the dues under MSMED Act would prevail over the SARFAESI Act, then in that case, not only the object and purpose of special enactment / SARFAESI Act would be frustrated, even the later enactment by way of insertion of 19 Section 26E of the SARFAESI Act would be frustrated. If the submission on behalf of respondent No.1 is accepted, then in that case, Section 26E of the SARFAESI Act would become nugatory and would become otiose and/or redundant. Any other contrary view would be defeating the provision of Section 26E of the SARFAESI Act and also the object and purpose of the SARFAESI Act.”

Accordingly, the appeal was allowed and the impugned judgment of the High Court was quashed and set aside.

Cause Title- Kotak Mahindra Bank Limited v. Girnar Corrugators Pvt. Ltd. & Ors.

Click here to read/download the Judgment