TPA: Rents Payable By IL&FS Tenants, Lessees And Licensees Are Debts Which Stood Transferred To Creditor- SC Dismisses Appeal Against HDFC

|

|The Supreme Court has rejected the appeal of Infrastructure Leasing and Financial Services Ltd. (IL&FS) against the HDFC Bank Ltd. under the Transfer of Property Act, 1882 (TPA) on the ground that the rents payable by IL&FS tenants, lessees, and licensees are debts, which stood transferred to the creditor i.e., HDFC.

An appeal was preferred by IL&FS as it was aggrieved by an order of the National Company Law Appellate Tribunal (NCLAT). The point in issue was whether the documents executed by IL&FS by which rents were made over to the respondent, i.e., HDFC constituted an assignment and thus fell outside the scope of an asset and security freeze order made by the NCLAT.

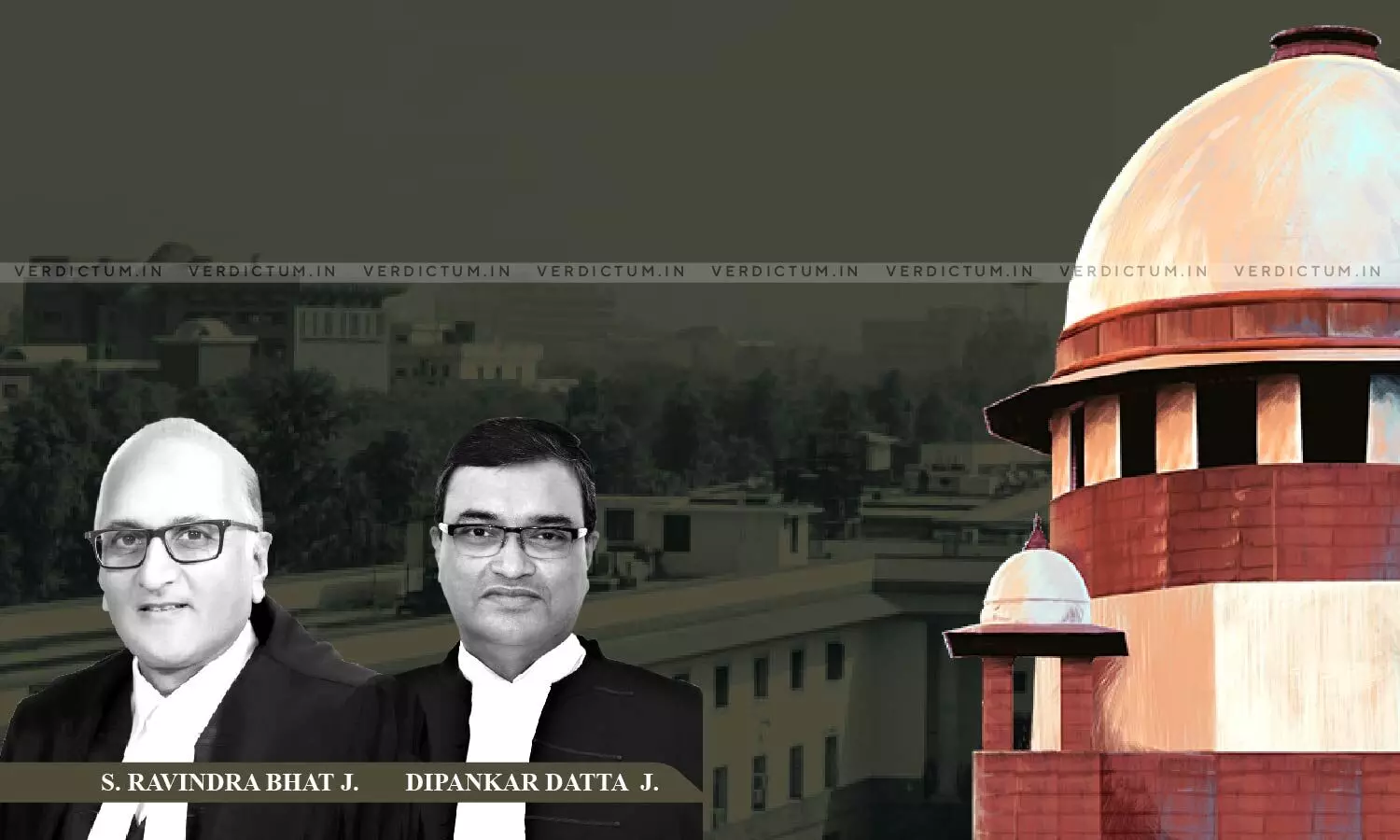

The two-Judge Bench of Justice S. Ravindra Bhat and Justice Dipankar Datta held, “The earlier discussion in this judgment, about the true nature of the transaction in this case led this court to hold that it is an assignment and not a pledge. The reference to pledge, in some places in the documents, did not undermine the fact that the rents payable to and receivable by the lender (IL&FS) stood absolutely assigned to HDFC. The provisions of the TPA and the discussion of the various authorities support the conclusion that there can be a transfer of debts, which are defined as actionable claims. In the present case, the rents payable by IL&FS tenants, lessees and licensees are debts, which stood transferred to the creditor, i.e. HDFC Bank.”

The Bench said that the NCLAT’s conclusions are unexceptionable and the challenge to its correctness fails.

Senior Advocate Ramji Srinivasan appeared for the appellant/IL&FS while Senior Advocate Mukul Rohatgi appeared for the respondent/HDFC.

Brief Facts -

IL&FS had approached the HDFC for financial assistance and by Sanction Letter, the lender sanctioned a financial facility of ₹400 crores to the borrower. Thereafter, a “Master Facility Agreement” (MFA) was entered between IL&FS and HDFC for ₹400 crores and the MFA envisioned the creation of a separate escrow account with Housing Development Finance Corporation Bank Limited (hereinafter 'Escrow Bank') for opening of a separate escrow account with the Escrow Bank. Along with MFA, an “Assignment Agreement” (AA) was also executed between the parties. Under this document, the parties agreed that the authorised indebtedness of IL&FS in terms of the MFA, by way of the facility together with the interest thereon was payable from the gross income and revenue to be derived from the operation of the Business Centre Services Agreements/Lease/Leave and License Agreement/s.

It was also agreed that ‘all the receivables derived/to be derived from the operation of the Borrower's Contracts, a sufficient portion of which, to pay the principal and interest as and when the same shall become due’ in terms of the said MFA was assigned and pledged and was to be ‘set aside for that purpose on the same day’ and a Power of Attorney by way of Security Interest was also executed between the parties. By an order, the NCLT in a petition, filed by the Union of India (UOI) under Sections 241 and 242 of the Companies Act, 2013 ordered to supersede the existing board of directors of the IL&FS. By the impugned order, NCLAT held that so far as part of the receivables deposited in the Escrow Account which were sufficient to meet the principal and interest assigned by the said borrower to HDFC, no proprietary interest continued -with IL&FS nor could it exercise any right over that part of the Escrow Account which was assigned.

The Supreme Court in view of the above facts observed, “The borrower is correct in arguing that the expression LRD is nowhere used in any of the documents executed at the time. Yet, as discussed earlier in the judgment, it is the nature and substance of the transaction which is determinative. An application of the rule that all the contemporaneous documents are to be read together, to discern the true purport of the contract, it is evident that what the parties intended was the assignment of the debt, i.e., the rents payable.”

The Court said that it would be necessary to consider whether such amounts payable on a future date are to be considered property and, therefore, capable of transfer. Under the Transfer of Property Act, 1882, Section 5 states generally that all manner of property is capable of transfer. Section 6 lays out what are the kinds of properties or actions which are not transferable: these are “personal claims” in the nature of tortious claims and “choices in action” cannot be transferred.

Accordingly, the Apex Court dismissed the appeal.

Cause Title- Infrastructure Leasing and Financial Services Ltd. v. HDFC Bank Ltd. & Anr. (Neutral Citation: 2023 INSC 929)