If Revenue Is Losing Tax Lawfully Payable By Person Due To Erroneous Order Of ITO, It’s Prejudicial To Revenue’s Interests: SC

|

|The Supreme Court has recently held that if due to an erroneous order of the Income Tax Officer, the Revenue is losing tax lawfully payable by a person, it will be prejudicial to the interests of the Revenue.

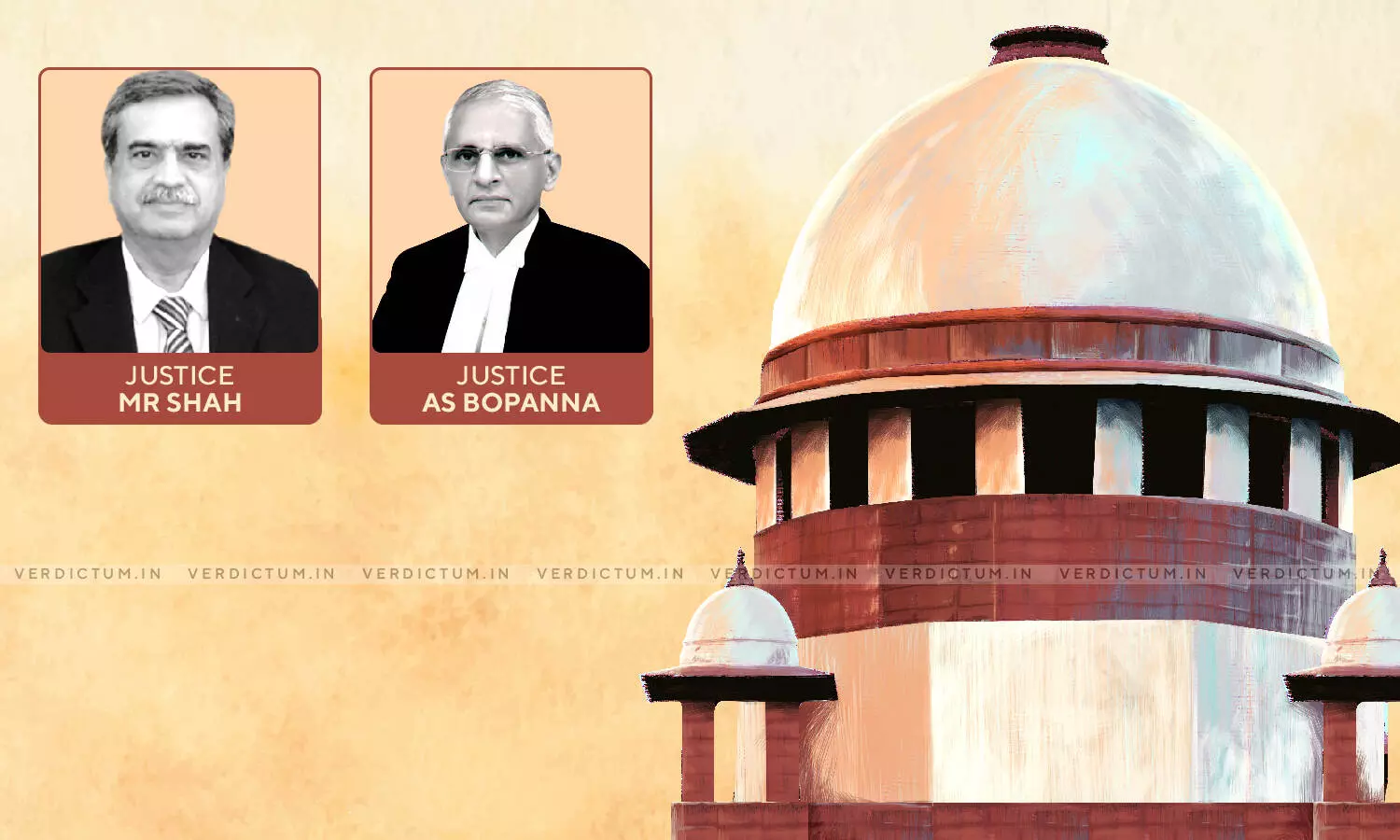

The two-Judge Bench comprising Justice M.R. Shah and Justice A.S. Bopanna observed, “… even as observed in paragraph 9 by this Court in the case of Malabar Industrial Co. Ltd. (supra) that the scheme of the Act is to levy and collect tax in accordance with the provisions of the Act and this task is entrusted to the Revenue. It is further observed that if due to an erroneous order of the Income Tax Officer, the Revenue is losing tax lawfully payable by a person, it will certainly be prejudicial to the interests of the Revenue.”

The Bench further held that only in a case where two views are possible and the Assessing Officer has adopted one view, such a decision, which might be plausible and it has resulted in a loss of Revenue, such an order is not revisable under Section 263 of the Income Tax Act, 1961.

ASG Balbir Singh appeared on behalf of the appellant/Revenue while Senior Advocate Firoze Andhyarujina appeared on behalf of the respondent/assessee.

Brief Facts -

Aggrieved with the judgment of the Bombay High Court by which it dismissed an appeal preferred by the Revenue, the Revenue preferred an appeal before the Apex Court. The assessee was engaged in the manufacture and export of garments, shoes, etc. and it filed its income tax return wherein it showed the sale of the property/building for an amount of Rs. 33 Crores.

The working computation of capital gains was accepted by the Assessing Officer (AO) and the assessment was completed by the AO under Section 143(3) of ITA accepting the long-term capital gains as per the sheet attached in computation of income, however, a notice was issued by the Commissioner of Income Tax (CIT) to remove encumbrances. The assessee approached the Income Tax Appellate Tribunal (ITAT) against the order of the CIT which allowed its plea and thereafter, the Department’s appeal against the ITAT’s order got dismissed by the High Court confirming the ITAT’s findings.

The Supreme Court in view of the above facts noted, “Applying the law laid down by this Court in the case of Malabar Industrial Co. Ltd. (supra) to the facts of the case on hand and even as observed by the Commissioner, the order passed by the Assessing Officer is erroneous as well as prejudicial to the interest of the Revenue.”

The Court after going through the assessment order and CIT’s order further noted that the assessment order was not only erroneous but prejudicial to the interest of the Revenue also and it cannot be said that the Commissioner exercised the jurisdiction under Section 263 not vested in it.

“The erroneous assessment order has resulted into loss of the Revenue in the form of tax. Under the Circumstances and in the facts and circumstances of the case narrated hereinabove, the High Court has committed a very serious error in setting aside the order passed by the Commissioner passed in exercise of powers under Section 263 of the Income Tax Act”, said the Court.

Accordingly, the Court allowed the appeal, set aside the judgment of the High Court, and restored the order of the CIT.

Cause Title- The Commissioner of Income Tax 7 v. M/s. Paville Projects Pvt. Ltd.