Section 138 Of NI Act Covers Cases Where Debt Is Incurred After Drawing Of The Cheque But Before Its Encashment: Supreme Court

|

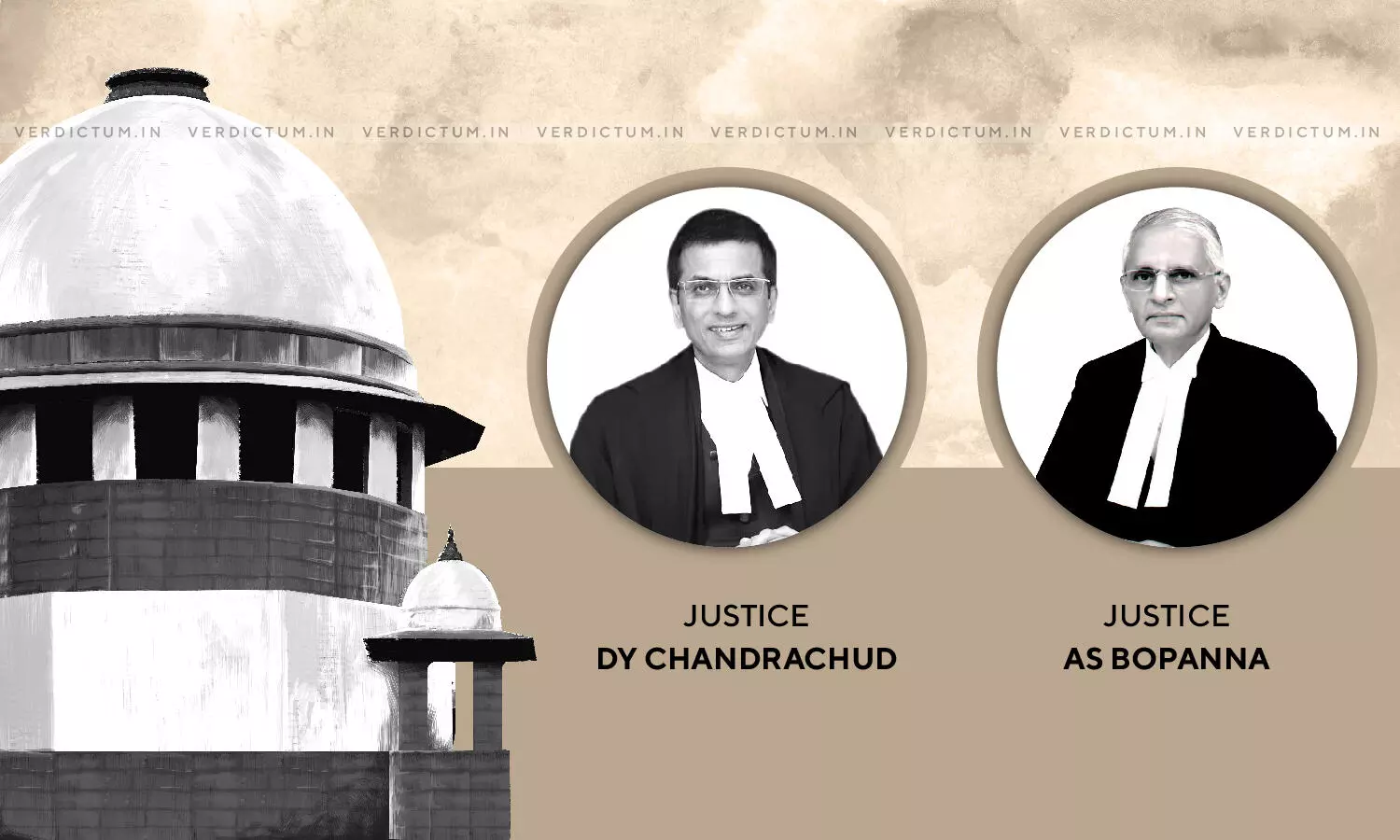

|A Division Bench of the Supreme Court comprising of Dr. Justice DY Chandrachud and Justice AS Bopanna held in a judgment of December 3, 2021 that the object of the NI Act is to enhance the acceptability of cheques and inculcate faith in the efficiency of negotiable instruments for transaction of business and the purpose of the provision would become otiose if it is interpreted to exclude cases where debt is incurred after the drawing of the cheque but before its encashment.

A Single Bench of the High Court of Gujarat had dismissed the petitions filed by the appellants [before the Apex Court] under Section 482 CrPC to quash the criminal complaint under Section 138 of the NI Act. The complaint arose from the dishonor of a cheque amounting to Rs. 2,67,84,000/-.

The High Court had, however, allowed quashing petitions filed by a nominee director who was not in-charge of the day-to-day management of the company in question and a woman non-executive director.

Mr. Sidharth Luthra and Ms. Meenakshi Arora, Senior Advocates appeared for the appellants while Mr. Mohit Mathur and Ms. Rebecca John, Senior Advocates appeared for the complainant. Ms. Aastha Mehta appeared on behalf of the State.

The Court culled out the following issues for its consideration:

"(i) Whether the dishonor of a cheque furnished as a 'security' is covered under the provisions of Section 138 of the NI Act;

(ii) Whether the Magistrate, in view of Section 202 CrPC, ought to have postponed the issuance of process; and

(iii) Whether a prima facie case of vicarious liability is made out against the appellants"

The Court relied upon Sampelly Satyanarayana Rao v. Indian Renewable Energy Development Agency Limited, (2016) 10 SCC 458 wherein it was held that if on the date of the cheque, a liability or debit exists or the amount has become enforceable, Section 138 would stand attracted and not otherwise. It was also held in Sampelly (supra) that whether the cheques were given as security constitutes the defences of the accused and is a matter of trial. The Court thus, interpreted Section 138 of the NI Act as follows.

"The explanation to Section 138 of the NI Act provides that 'debt or any other liability' means a legally enforceable debt or other liability. The proviso to Section 138 stipulates that the cheque must be presented to the bank within a period of six months from the date on which it is drawn or within its period of validity. Therefore, a cheque given as a gift and not for the satisfaction of a debt or other liability, would not attract the penal consequences of the provision in the event of its being returned for insufficiency of funds."

The Court then proceeded to analyse as to whether Section 138 only covers a situation where there is an outstanding debt at the time of the drawing of the cheque or includes drawing of a cheque for a debit that is incurred before the cheque is encashed. The Court held that the purpose of the provision would become otiose if the provision is interpreted to exclude cases where debt is incurred after the drawing of the cheque but before its encashment.

The Court placed reliance upon M/s Womb Laboratories Pvt Ltd v. Vijay Ahuja, Criminal Appeal Nos 1382-1383 of 2019, decided on 11 September 2019 wherein the Court had held that handing over of the cheques by way of security per se would not extricate the accused from discharge of liability arising from such cheques.

On the issue concerning Section 202 CrPC, the Court held as follows.

"The provisions of Section 202 which mandate the Magistrate, in a case where the accused is residing at a place beyond the area of its jurisdiction, to postpone the issuance of process so as to enquire into the case himself or direct an investigation by police officer or by another person were introduced by Act 25 of 2005 with effect from 23 June 2006. The rationale for the amendment is based on the recognition by Parliament that false complaints are filed against persons residing at far off places as an instrument of harassment."

The Court relied upon Vijay Dhanuka vs. Najima Mamtaj, (2014) 14 SCC 638 wherein the Court had dwelt on the purpose of the amendment to Section 202. The Court had held that the Magistrate was duty bound to apply his mind to the allegations together with the statements recorded while determining as to whether there is a prima facie sufficient ground for proceeding. The Court had also held that exercise by the Magistrate for the purpose of deciding whether or not there is sufficient ground for proceeding against the accused is nothing but an enquiry envisaged under Section 202 of the Code.

The Court also relied upon an order dated 16 April 2021 of a Constitution Bench in Re: Expeditious Trial of Cases under Section 138 of N.I. Act 1881. The Constitution Bench, in that case, had considered the divergence of view between High Courts wherein some High Courts had held it was mandatory to conduct an inquiry under Section 202 before issuing process in complaints under Section 138.

The Court held that "if the Magistrate holds an inquiry himself, it is not compulsory that he should examine witnesses and in suitable cases the Magistrate can examine documents to be satisfied that there are sufficient grounds for proceeding under Section 202."

The Court then discussed various materials adverted to by the Magistrate. In the eyes of the High Court, it was prima facie established that the accused were triable for dishonour of cheque. The Court observed as follows.

"The test to determine if the Managing Director or a Director must be charged for the offence committed by the Company is to determine if the conditions in Section 141 of the NI Act have been fulfilled i.e., whether the individual was in-charge of and responsible for the affairs of the company during the commission of the offence. However, the determination of whether the conditions stipulated in Section 141 of the MMDR Act have been fulfilled is a matter of trial. There are sufficient averments in the complaint to raise a prima facie case against them. It is only at the trial that they could take recourse to the proviso to Section 141 and not at the stage of issuance of process."

Thus, the Court came to the conclusion that the principal grounds of challenge were all matters of defence at trial. Hence, the appeals were dismissed.

Click here to read/download the Judgment