Section 138 NI Act: Standard Of Proof For Rebutting Presumption Is That Of Preponderance Of Probabilities: SC Reiterates

|

|The Supreme Court while reversing the order of the Madras High Court of convicting the accused under Section 138 of the Negotiable Instruments Act, 1881 (NIA) has reiterated that the standard of proof for rebutting the presumption is that of the preponderance of probabilities.

The Court while hearing two appeals together confirmed the order of the Trial Court in which the appellants were acquitted of the charges under the NIA.

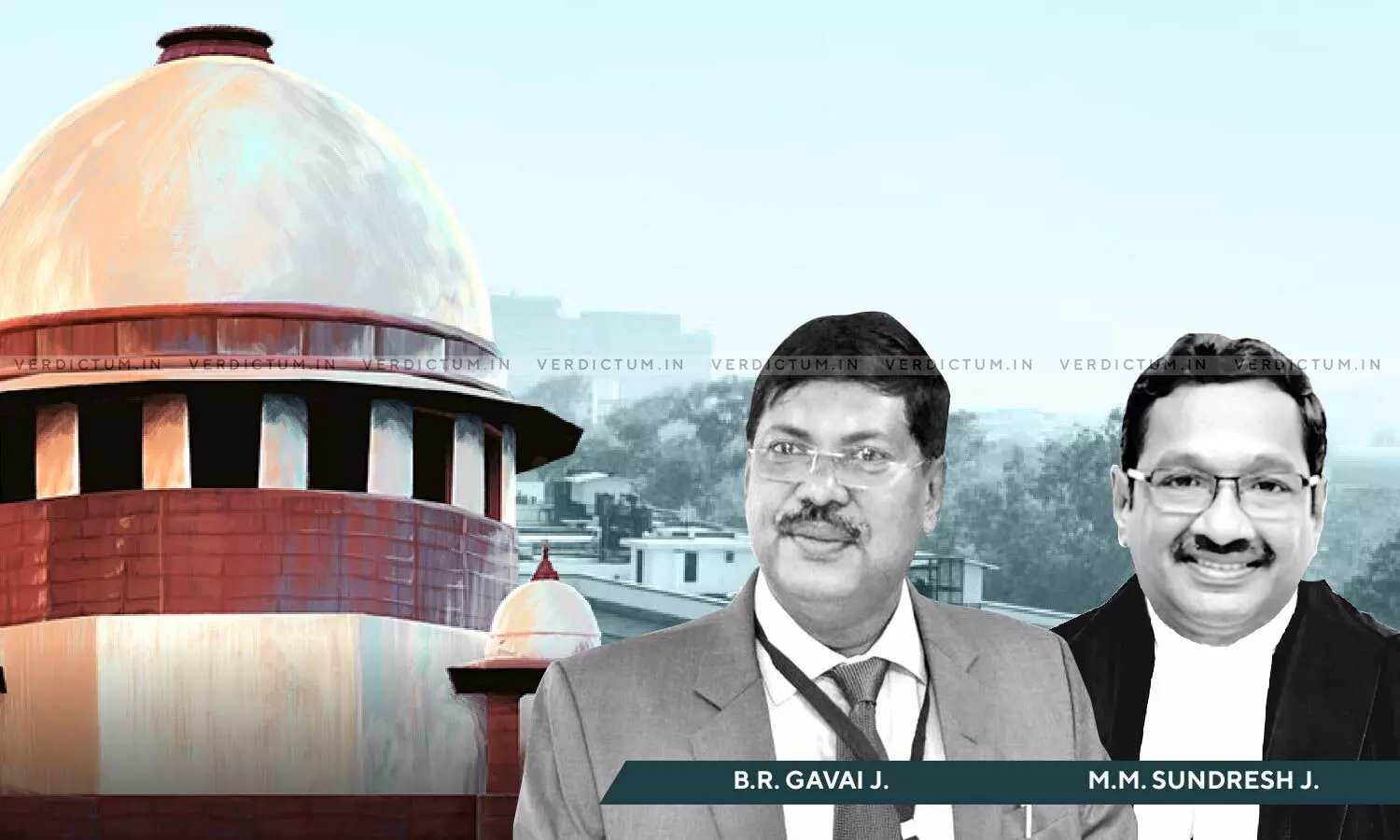

A Bench comprising Justice B.R. Gavai and Justice M.M. Sundresh observed, “The standard of proof for rebutting the presumption is that of preponderance of probabilities. Applying this principle, the learned Trial Court had found that the accused had rebutted the presumption on the basis of the evidence of the defence witnesses and attending circumstances. … we are further of the considered view that the High Court was not justified in reversing the order of acquittal of the appellant.”

The Bench further held that the decree of the High Court needs to be modified restricting it to the amount already deposited by the appellants in both proceedings with interest accrued thereon.

“Criminal Appeal Nos. 1978 of 2013 and 1990 of 2013 are allowed and the common judgment of conviction dated 28th October 2008 and order of sentence dated 30th October 2008 respectively are quashed and set aside. The judgments and orders dated 10th July 2011 passed by the learned Trial Court is confirmed”, the Court ordered.

Advocate Neha Sharma appeared on behalf of the appellants while Advocate V. Prabhakar appeared for the respondents.

Facts –

The appellants in this case had challenged the judgments passed by the High Court whereby the suits filed by the respondents for the recovery of money based on the promissory notes were decreed. The appellants were convicted and were sentenced to a fine of Rs. 7 lakhs in respect of two cheques for an amount of Rs. 3.5 lakhs.

However, earlier the Trial Court found that from the income which was shown in the Income Tax Return, which was duly exhibited, it was clear that the appellants did not have the financial capacity to lend money as alleged. Hence, it acquitted the appellants by applying the principle of preponderance of probabilities.

The Supreme Court noted, “… the accused appellant had examined Mr. Sarsaiyyn, Income Tax Officer, Ward No.18, Circle (II) (5), who produced certified copies of the Income Tax Returns of the complainant for the financial year 1995¬96, 1996¬97, 1997¬98 and 1998-99. The certified copies of the Income Tax Returns established that the complainant had not declared that he had lent Rs.3 lakh to the accused.”

It was observed by the Apex Court that the High Court was not justified in reversing the order of the acquittal of the appellants.

“… while in the criminal proceedings the complainant had failed to produce the promissory notes, in the civil proceedings, the complainant had proved the promissory notes… We, therefore, find no reason to interfere with the judgments and orders passed by the High Court in the Civil Appeals. However, in the facts and circumstances of the case, we are inclined to modify the decree”, the Court further asserted.

The Court also relied upon the case of Baslingappa v. Mudibasappa (2019) 5 SCC 418 in which the principles of Sections 118(a) and 139 of the NIA were summarised by the Apex Court.

It was, therefore, ordered by the Court that the respondents would be entitled to withdraw 50% of the amount each from the amount deposited with interest accrues up to date.

Accordingly, the Court confirmed the order of the Trial Court and acquitted the appellants.

Cause Title- Rajaram v. Muruthachalam

Click here to read/download the Judgment