Striking Off Defence Of Tenant On Non-Payment Of GST- SC Sets Aside Order After Tenant Deposits Balance Amount

|

|The Supreme Court has set aside the order passed by the Madhya Pradesh High Court and Trial Court striking off the defence of a tenant on non-payment of the balance amount of GST.

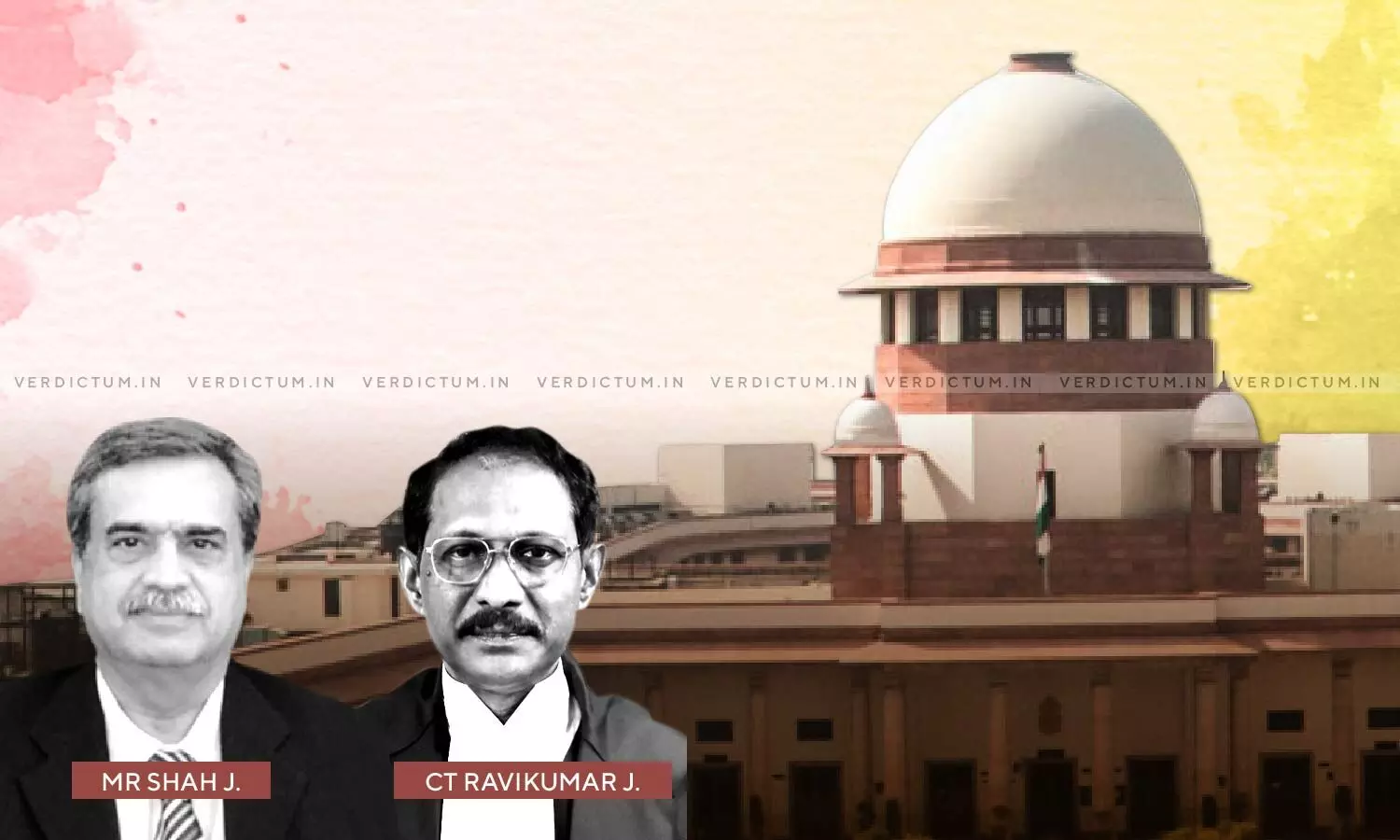

The bench of Justice MR Shah and Justice CT Ravikumar was dealing with a case where as per the Lease Agreement, the tenant was liable to pay the rent @ Rs.58,650/- per month and also the maintenance charges and GST.

The tenant, though paid the rent and the other maintenance charges, however, did not deposit/pay the GST.

Therefore, the original plaintiff – landlord filed an application before the Trial Court under Section 13(6) of the M.P. Accommodation Control Act, 1961 and prayed to strike off the defence of the appellant - tenant.

The Trial Court struck off the defence of the tenant and the appeal before High Court came to be dismissed.

Aggrieved the appellant approached Supreme Court.

Advocate Ardhendumauli Kumar Prasad appeared on behalf of the appellant whereas Advocate Rukhmini Bobde appeared on behalf of the respondent.

The Apex Court observed that the appellant deposited the balance amount of GST after the order was passed by the Court in the year 2018.

However, the Apex Court also considered the fact that there shall be a periodical increase of the rent @ 15% every three years and therefore tenant must pay the rent being enhanced by giving a periodical rise of 15%.

Thus the Court ordered – "…. the impugned judgment and order passed by the High Court and that of the learned Trial Court striking off the defence of the appellant is quashed and set aside and the appellant is permitted to defend the eviction suit/suit…"

The Court also directed the tenant to pay the rent/enhanced rent by giving periodical rise by 15%.

"The learned High Court is hereby directed to finally decide and dispose of the suit expeditiously and within a period of six months from the date of receipt of the present order. Present appeal is accordingly allowed/ disposed of in terms of the above", the Court ordered further.

Cause Title – M/s Fashion World v. Banshidhar Multi Builders Pvt. Ltd.

Click here to read/download the Judgment