Business To Business Disputes Purely Commerical, Cannot Be Construed As Consumer Disputes Under COPRA - SC

|

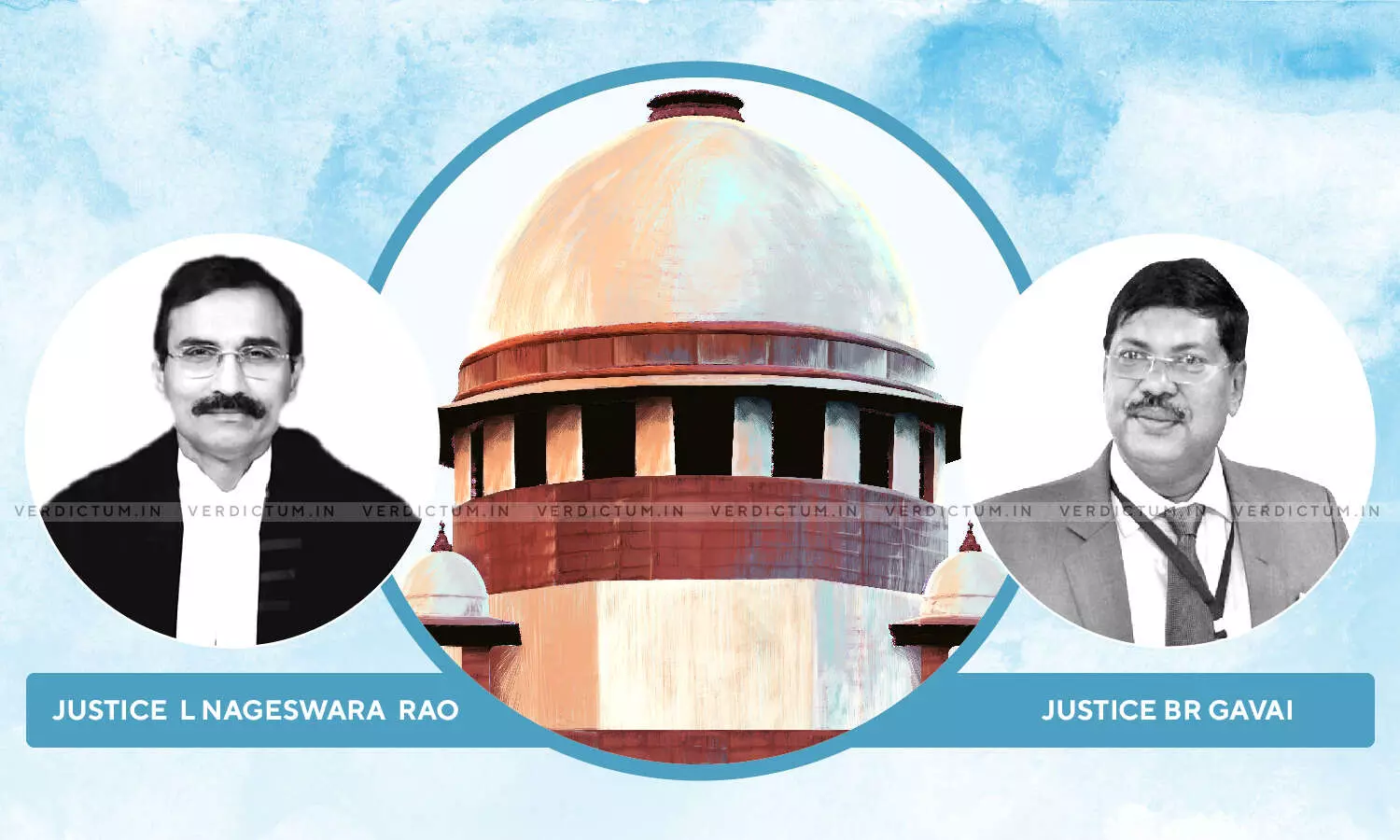

|A two-judge Bench of the Supreme Court comprising Justice L Nageswara Rao and Justice B.R. Gavai has held that if the interpretation as sought to be placed by the Appellant is to be accepted, then the 'business to business' disputes would also have to be construed as consumer disputes, thereby defeating the very purpose of providing speedy and simple redressal to consumer disputes.

Further, the Bench opined that there cannot be any straitjacket formula and the question concerning as to whether a commercial service would fall within the ambit of Consumer Protection Act, 1986 will have to be decided in the facts of each case.

The Court held that "When a person avails a service for a commercial purpose, to come within the meaning of 'consumer' as defined in the said Act, he will have to establish that the services were availed exclusively for the purposes of earning his livelihood by means of selfemployment."

Mr. Shyam Divan, Senior Advocate appeared on behalf of the Appellant while Mr. Dushyant Dave, Senior Advocate appeared on behalf of the Respondent-Bank.

In appeal, before the Apex Court, was the judgment of the NCDRC which held that the Appellant was not a consumer under Section 2(1)(d) of the Consumer Protection Act, 1986. The complaint of the Appellant was dismissed as being not maintainable.

The Appellant had opened an account with erstwhile Nedungadi Bank Ltd. in 1998. The Appellant is a stockbroker by profession who applied for an overdraft facility in connection with his day-to-day share and stock transactions.

The said facility was sanctioned for an amount of Rs. 1 crore for which Appellant pledged shares worth more than Rs. 1 crore as security. On request, this was enhanced to Rs. 5 crores. This was further enhanced to Rs. 8 crores for a period of one week.

The Bank called upon the Appellant to pledge additional shares to regularize the overdraft amount. 37,50,000 shares of Ansal Hotels Ltd. were pledged.

During 2001, overdraft accounts became irregular. On failure to regularize, the Bank called upon Appellant to pay Rs. 600.61 lakhs along with interest thereon.

The Appellant averred that he had advised the Bank to sell the pledged shared to close the account but the Bank did not do so. He averred that the shares were sold later when the market value was lowest which resulted in a huge loss.

The successor in interest of the Bank filed a recovery petition before DRT against the Appellant. This was decreed. The matter was however settled and an OTS was reached on payment of Rs. 2 crores. No due certificate was issued and the recovery proceedings were withdrawn.

The Appellant issued notice to the Bank seeking the release of the shares. The Appellant was also working as a stockbroker of Respondent bank. The Bank had initiated arbitration proceedings against the Appellant which, as per the Appellant, were decided in his favor.

The Appellant lodged a complaint alleging deficiencies in services on part of the Bank praying a direction to return the shares with dividends and all accretions thereon.

A preliminary objection was raised on the ground that the Appellant was not a consumer. The NCDRC held that the Appellant had availed the services of Bank for commercial purposes and hence he was not a consumer. Hence, the appeal before the Apex Court.

The Court, while interpreting Section 2(1)(d) made the following observations.

"It could thus be seen that by the 2002 Amendment Act, the legislature clearly provided that a person, who avails of such services for any commercial purpose would be beyond the ambit of definition of the term 'consumer'. The Explanation, which is an exception to an exception, which earlier excluded a person from the term 'commercial purpose', if goods were purchased by such a person for the purposes of earning his livelihood by means of selfemployment, was substituted and the Explanation was made applicable to both clauses (i) and (ii). It can thus clearly be seen that by the 2002 Amendment Act, though the legislature provided that whenever a person avails of services for commercial purposes, he would not be a consumer; it further clarified that the 'commercial purpose' does not include use by a person of goods bought and used by him and services availed by him exclusively for the purposes of earning his livelihood by means of selfemployment."

The Court noted that a person who availed of services for commercial purpose exclusively for the purposes of earning his livelihood by means of self employment was kept out of the term commercial purpose and brought into the ambit of the consumer by bringing him on pay with the similarly circumstanced person who bought and used goods for purposes of earning a livelihood.

On the intention of the legislature, the Court noted that "it could thus be seen that the legislature's intent is clear. If a person buys goods for commercial purpose or avails services for commercial purpose, though ordinarily, he would have been out of the ambit of the term 'consumer', by virtue of Explanation, which is now common to both Sections 2(1)(d)(i) and 2(1)(d)(ii), he would still come within the ambit of the term 'consumer', if purchase of such goods or availing of such services was exclusively for the purposes of earning his livelihood by means of selfemployment. With this legislative history in background, we will have to consider the present case"

The Court discussed earlier judgments and the approach of the NCDRC that where a person purchases goods "with a view to using such goods for carrying on any activity on a large scale for the purpose of earning profit" he will not be a 'consumer' within the meaning of Section 2(d)(i) of the Act.

It is in this context, the Court noted, that the parliament stepped in and added the explanation to the provision

The Court noted that whether a transaction is for a commercial purpose would depend upon the facts and circumstances of each case. The Court noted that "what is relevant is the dominant intention or dominant purpose for the transaction and as to whether the same was to facilitate some kind of profit generation for the purchaser and/or their beneficiary. It has further been held that if the dominant purpose behind purchasing the good or service was for the personal use and the consumption of the purchaser and/or their beneficiary, or is otherwise not linked to any commercial activity, then the question of whether such a purchase was for the purpose of "generating livelihood by means of selfemployment" need not be looked into".

The Court noted that the Appellant was already engaged in the profession of stockbroker much before availing the services of the bank. He sought enhancements of limits for the purposes of enhancing the profits therein. The Court held that it could not be said that the services were availed "exclusively for the purposes of earning his livelihood" "by means of selfemployment".

Hence, the Court did not find any errors with the findings of the Commission. The appeal was dismissed with no order as to costs.

Click here to read/download the Judgment