Contract Of Insurance Is For Indemnity Of Defined Loss, Insured Cannot Profit And Take Advantage By Double Insurance: SC

|

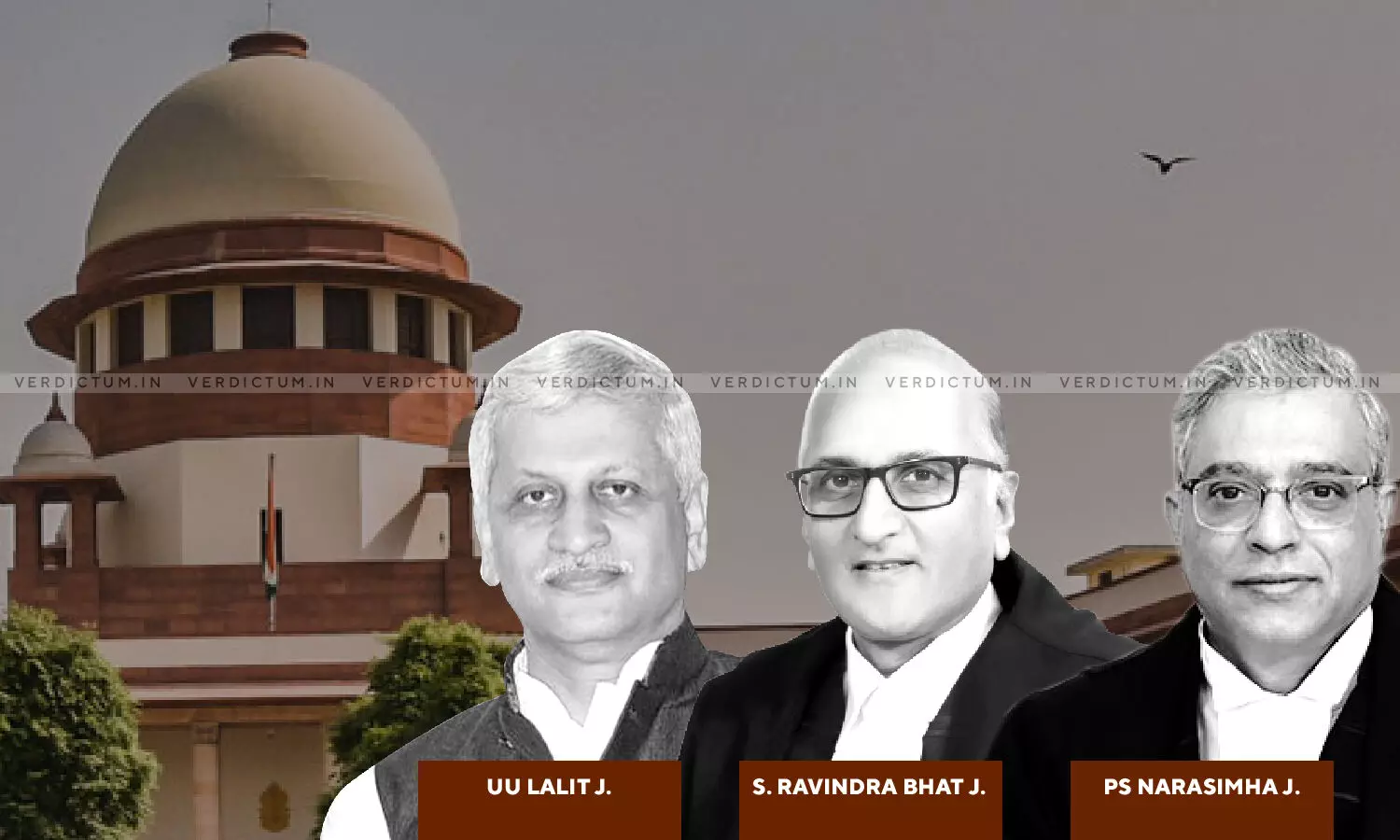

|The Supreme Court bench comprising Justice U. U. Lalit, Justice S. Ravindra Bhat, and Justice P. S. Narasimha recently set aside the order of the National Consumer Disputes Redressal Commission (NCDRC) concerning an insurance claim of Levis.

The Bench held, "A contract of insurance is and always continues to be one for indemnity of defined loss, no more no less. In the case of specific risks, such as those arising from loss due to fire, etc., the insured cannot profit and take advantage by double insurance."

The Supreme Court had in its judgment reinforced what Brett LJ had held that the contract of insurance is a contract of indemnity and this contract means that the assured, in the case of a loss shall be fully indemnified, but shall never be more than fully indemnified.

In this case, Levi's had its stock insured by the insurer under a Standard Fire and Special Perils Policy for the period of one year which covered the stock while in storage for the sum of Rs. 30 crores. Levi's again obtained the policy for another year on similar terms. In the meanwhile, the parent company of Levi's obtained a global policy from Allianz Global Corporate and Speciality covering the stocks of all its subsidiaries through its Stock Throughout Policy (STP) for $10 million in any one vessel or conveyance and $50 million in any one location. The parent company also got an All Risks Policy issued by Allianz for the same period covering the stock of its subsidiaries throughout the world with a liability of $100 million.

On 13.7.2008 a fire broke out in one of the warehouses containing Levi's stock against which on 18.7.2008 Levi's claimed Rs. 12.20 crores from the insurer. The claim form valued the extent of loss to be slightly higher at Rs. 12.50 crores. However, on the instructions of the global insurer, the surveyor submitted a report assessing the loss at Rs. 14.30 crore. The appellant also appointed a surveyor who submitted a report assessing the net loss at Rs. 11.34 crores. The report recommended that it was not liable for the claim due to the policies issued by Allianz which were covered under Condition 4 of the Policy. After considering the report the insurer repudiated the claim of Levi's.

Levi's approached NCDRC under Section 21 and 22 of the Consumer Protection Act of 1986 where it was alleged that under Section 25 of the General Insurance Business (Nationalization) Act of 1972 it was obligated to obtain a policy issued by a domestic insurer to cover various risks. The NCDRC allowed the complaint of Levi's and held that to the extent of the insured risk being covered by the domestic policy, coverage by the STP Policy stood excluded.

The impugned order was based on the reasoning that there was a difference in the perils insured and the conditions and/or limits of liability under the domestic policy and the STP Policy. Therefore, the loss of profit that Levi would have earned on the sale of the damaged/destroyed cost was payable to it by Allianz, whereas the loss suffered by Levi to the extent of the cost of those goods would be reimbursable under the domestic policy issued by the insurer. This impugned order led to an appeal before the Supreme Court.

The Supreme Court had framed certain questions which were to be answered. The first question that the Court had to decide was regarding the nature of the STP Policy issued by Allianz. The insurer had argued before the Apex Court that it was a marine policy.

The Court held that "STP Policy was a marine policy which comprehensively covered voyage, transit, transportation and warehouse perils." The Court also observed that "Condition No. 4 of the SFSP Policy, which constituted a contract between the parties, precisely contemplated a situation whereby in the event of occurrence of an insurance risk, if Levi was entitled to claim under a marine policy, the insurer was not to be held liable."

Another question raised by the court was what is the meaning of the term "obligated by legislation" and was Levi Obligated by Indian Law to Cover its Risks.

The Court observed that, "The argument on behalf of Levi was that Section 25 prohibits the foreign insurers from taking or bringing any policy of insurance in respect of any property in India and as a result it was compelled to take out the SFSP Policy. If the plain meaning of the expression "obligated by law" or "obliged by law" is to be understood, there should be an express requirement in law, which compels the insured to obtain a policy." It was held by the Court that, "it is not Levi's position that there exists any legislation which compelled it to obtain insurance to cover risks which it sought to get covered by the SFSP Policy. In this context, a mere prohibition in Section 25 of the Nationalization Act clearly did not apply to Levi's parent company, which conducts business overseas (and not only in India) and obtain a marine cover which catered to all risks, (including marine risks as well as risks to the goods in transit and when they were warehoused). Therefore, the prohibition in Section 25 per se does not apply. Equally, there was no specific provision requiring Levi to obtain a domestic policy, in the conduct of its business."

The Court while adjudicating the matter observed, "What is in issue in this present case has been characterized as "double insurance", i.e., where an entity seeks to cover risks for the same or similar incidents through two different - overlapping policies. There is a wealth of international jurisprudence on the various nuances of double insurance. Such double insurance is per se not frowned upon in law. The courts however, adopt a careful approach in considering policies which seeks to exclude liability on the part of the insurer."

The Supreme Court thus allowed the appeal and set aside the impugned order of the NCDRC and held that "Levi could not have claimed more than what it did, and not in any case, more than what it received from Allianz. Its endeavour to distinguish between the STP Policy and the SFSP Policy, i.e., that the former covered loss of profits, and the latter, the value of manufactured goods, is not borne out on an interpretation of the terms of the two policies."