SC Directs AO To Examine Documents To Ascertain Whether Respondent Is Charitable Trust Entitled To Benefit Of Exemption

|

|The Supreme Court while dealing with an appeal filed by the Principal Commissioner of Income Tax against the judgment of the Delhi High Court has directed the Assessing Officer to examine the documents and remitted back the matter for fresh consideration.

The High Court had earlier upheld the decision of the ITAT i.e., Income Tax Appellate Tribunal in which the respondent organization i.e., the assessee was regarded as a charitable trust entitled to the benefit of exemption and that it is registered under Section 12AA and 80G of the Income Tax Act.

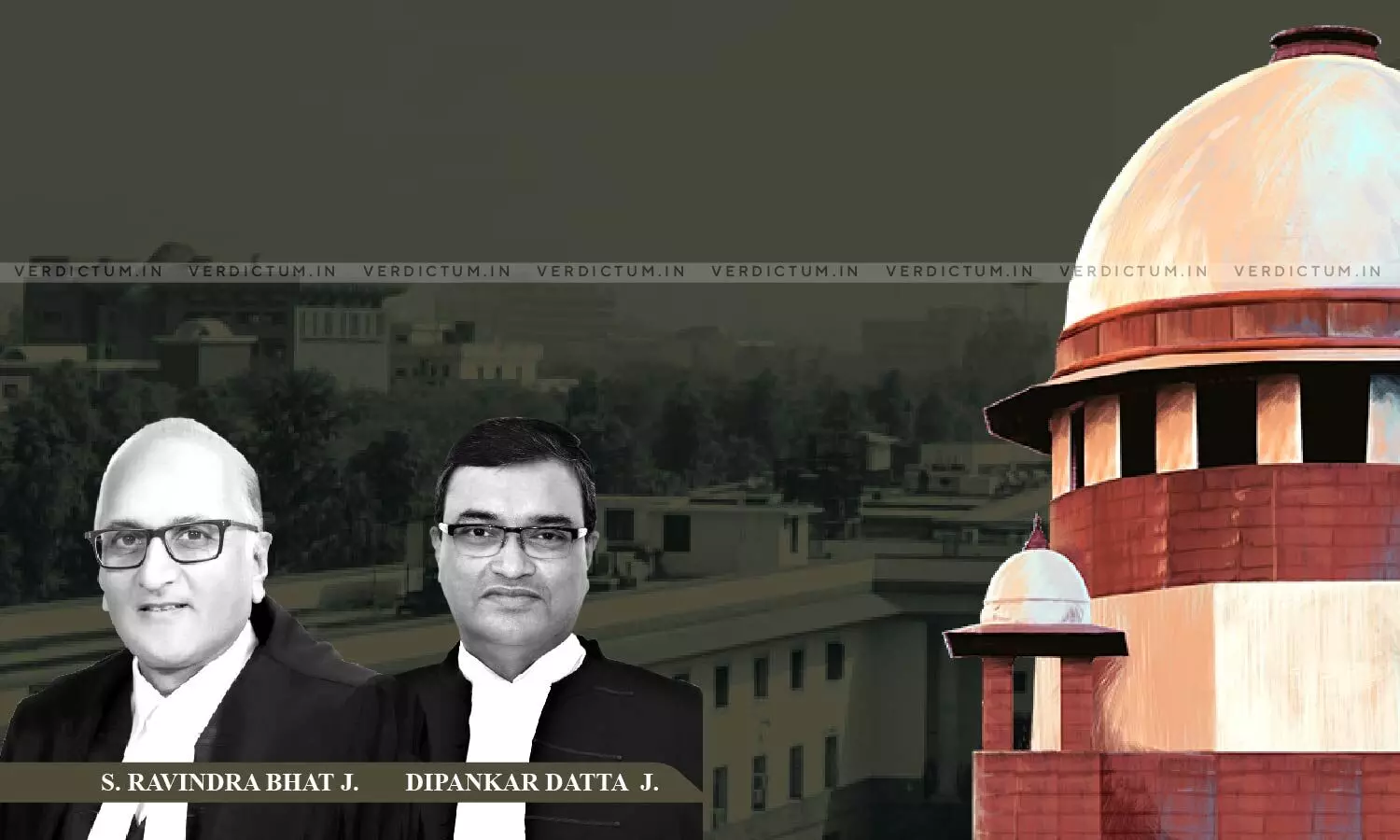

The two-Judge Bench comprising Justice S. Ravindra Bhat and Justice Dipankar Datta held, “… this court is of the opinion, that matter should be remitted for fresh consideration of the nature of receipts in the hands of the assessee, in the present case. As a result, the matter requires to be re-examined, and the question as to whether the amounts received by the assessee qualify for exemption, under Section 2 (15) or Section 11 needs to be gone into afresh. … The AO shall examine the documents and relevant papers and render fresh findings on the issue whether respondent is a charitable trust, entitled to exemption of its income.”

The Bench also directed that the AO shall complete the hearing and pass orders within four months.

Advocate Raj Bahadur Yadav appeared on behalf of the appellant while Advocate Mahesh Babu appeared for the respondent.

In this case, the assessee society was enjoying exemption under Section 11 of the ITA but the same was denied during the A.Y. 1973-74 and later allowed by the ITAT and affirmed by the High Court. The assessee was also earlier allowed an exemption for three years i.e. 1990-91 to 1992-93 under Section 10(23C)(iv) of the ITA.

The assessee was also allowed exemption under Section 11(1) but the same got denied during the A.Y. 2010-11 and 2011-12 by the AO. The assessee argued that it was primarily a non-profit institution involved in charitable activities and did not engage in any trade, commerce, business, or such activity. The assessee approached the Appellate Commissioner who allowed its plea and the same decision was upheld by the ITAT and High Court.

The Supreme Court in the above context observed, “In the present case, the Appellate Commissioner, the ITAT and the High Court merely followed the judgment of the Delhi High Court in India Trade Promotion Organisation. However, the law with regard to interpretation of Section 2 (15) has undergone a change, due to the decision in Ahmedabad Urban Development Authority (supra).”

Accordingly, the Apex Court partly allowed the appeal of the Revenue.

Cause Title- Pr. Commissioner of Income Tax (Exemptions) Delhi v. Servants of People Society

Click here to read/download the Judgment