Gujarat Stamp Act - Once Deed Of Assignment Is Subjected To Stamp Duty It Cannot Be Levied Again On Same Instrument - SC

|

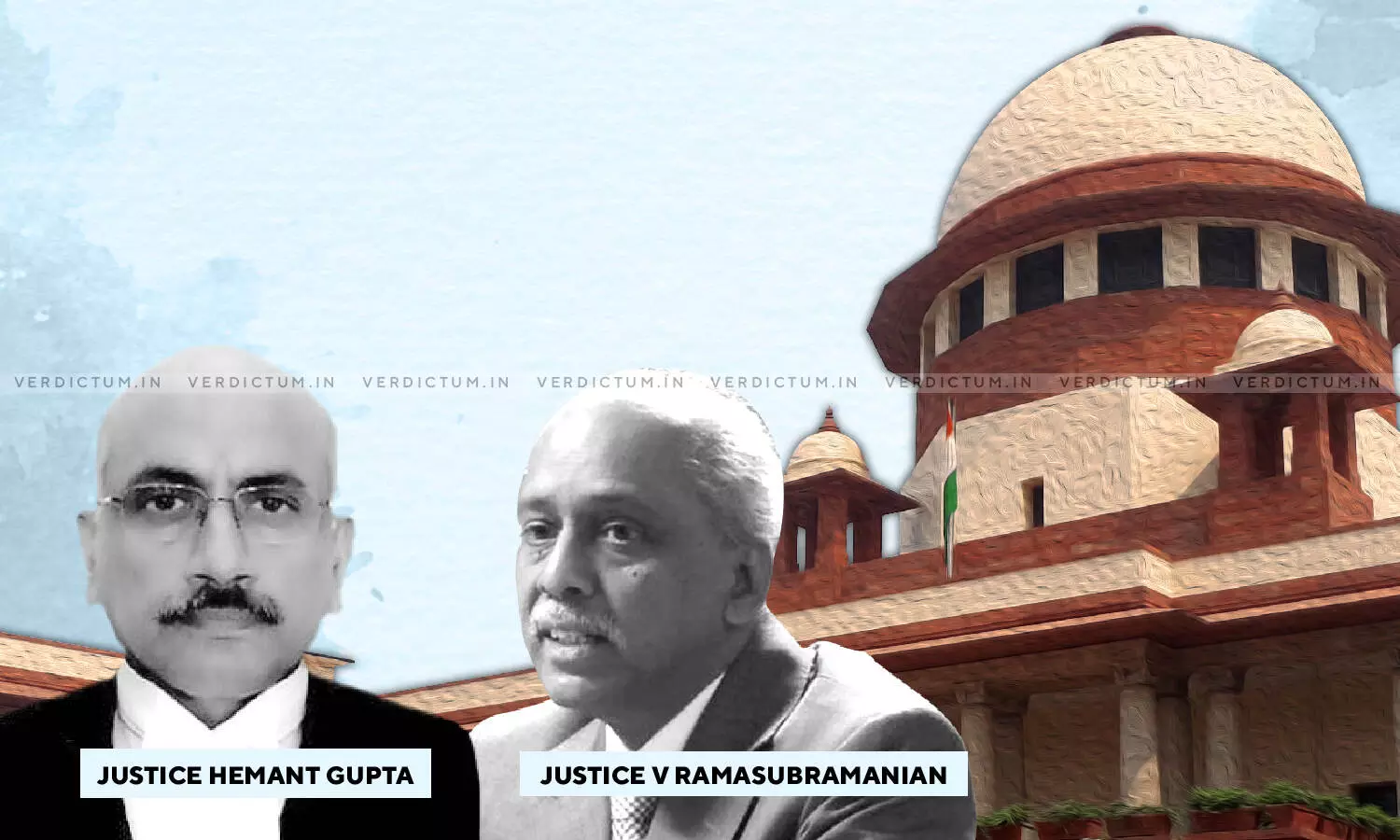

|A Supreme Court Bench of Justice Hemant Gupta and Justice V. Ramasubramanian heard a matter relating to the Gujrat Stamp Act, where it set aside the order of the Gujarat High Court, holding that "after having accepted the deed of assignment as an instrument chargeable to duty as a conveyance under Article 20(a) and after having collected the duty payable on the same, it is not open to the respondent to subject the same instrument to duty once again under Article 45(f)".

The Appellant approached the Supreme Court aggrieved by an opinion rendered by the Gujarat High Court in a Stamp Reference under Section 54(1)(a) of the Gujarat Stamp Act, 1958 made by the Respondent.

Senior Counsel Mr. V. Chitambaresh appeared on behalf of the Appellant and Ms. Archana Pathak Dave appeared on behalf of the Respondent-State.

The Bank had granted certain facilities to a borrower and the borrower committed default in repayment. Since the Bank was unable to recover the loan, by way of an agreement, the Bank assigned the debt in favour of the Appellant, which is an Asset Reconstruction Company. The registration of the document was preceded by an adjudication under Section 31 of the Act.

An audit objection was raised on the ground that the deed of assignment had a reference to a Power of Attorney, which was chargeable to stamp duty Article 45(f) of Schedule I to the Act. A demand for the deficit stamp duty was raised. The Deputy Collector referred the matter to the Respondent, who issued a notice to the Appellant. After considering the reply of the Appellant, the Respondent set aside the order of adjudication and directed recovery of the deficit stamp duty. The Respondent moved before the High Court.

The High Court opined that merely because the power to sell forms part of the deed of assignment, the Appellant could not escape the charge of duty and the Power of Attorney is required to be considered independently. Therefore, the High Court held that the Appellant has to pay the stamp duty.

The Supreme Court opined that the reasoning of the High Court could not be accepted. It was found that the Assignment Agreement only contained the format of an irrevocable Power of Attorney.

The Court opined that the High Court overlooked the fact that there was no independent instrument of Power of Attorney, and that in any case, the power of sale of a secured asset flowed out of the provisions of the Securitisation Act, 2002 and not out of an independent instrument of Power of Attorney.

Further, the Court opined that the conditions required to invoke Article 45(f) had not been satisfied, since (i) the Power of Attorney had not been given for consideration and (ii) the authorization to sell any immovable property did not flow out of the instrument.

Holding that "a single instrument has been charged under a correct charging provision of the Statute, namely Article 20(a), the Revenue cannot split the instrument into two, because of the reduction in the stamp duty facilitated by a notification of the Government issued under Section 9(a).", the Court opined that since the High Court did not address these issues and solely depended on the interpretation of Article 45(f), the impugned order was unsustainable.

Accordingly, the appeal was allowed and the impugned order was set aside.

Click here to read/download the Judgment