SC Allows Withdrawal of Insolvency Application Against Builder Keeping In View Large Interest Of Homebuyers

|

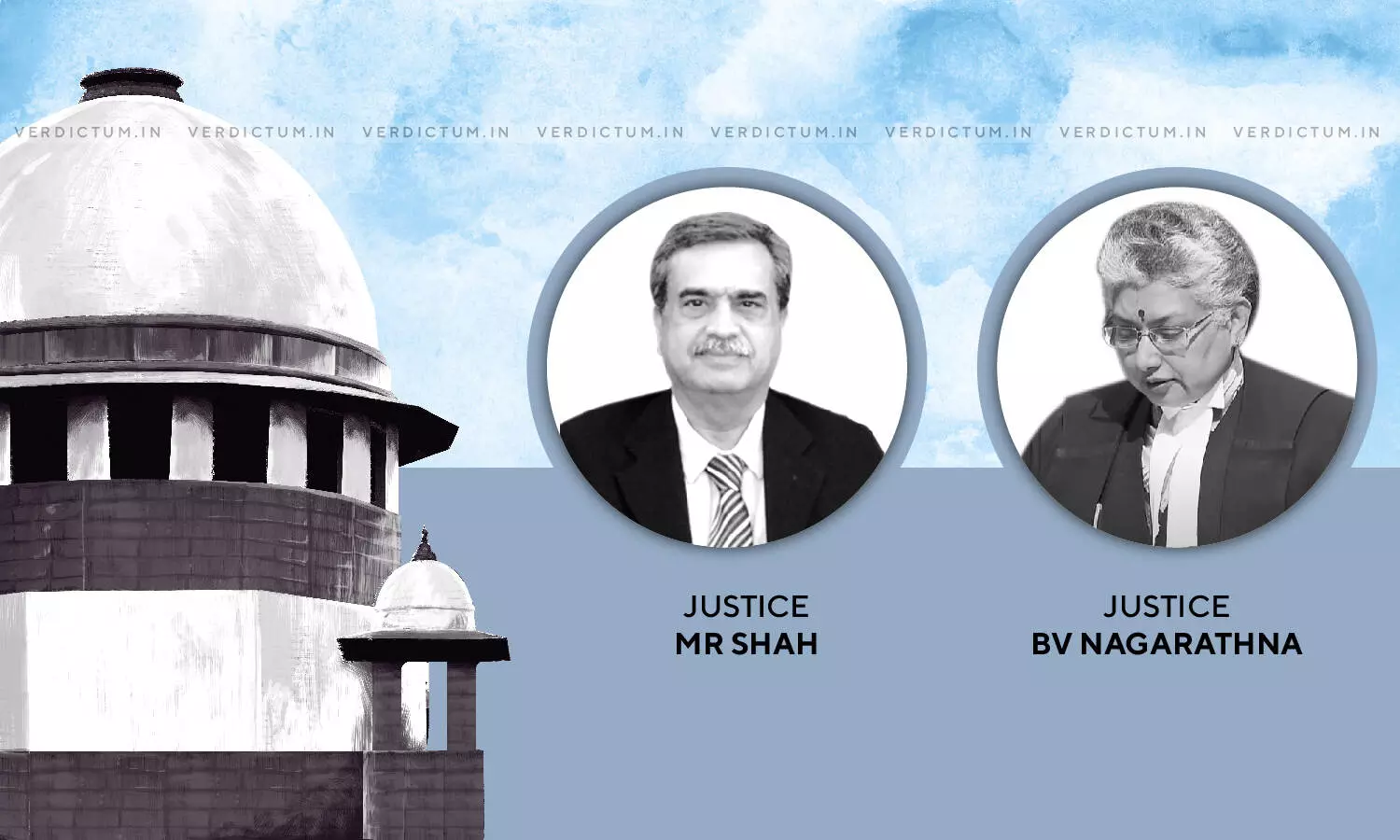

|The Supreme Court bench comprising of Justice M. R. Shah and Justice B. V. Nagarathna has recently allowed an appeal filed to exercise the powers under Article 142 of the Constitution of India read with Rules 11 and 12 of the National Company Law Tribunal Rules, 2016 and permit to withdraw the CIRP proceedings filed in a matter regarding the construction of a housing project and handing over of the possession of the property.

The Respondent who is a corporate debtor, Jasmine Buildmart Pvt. Ltd. had come out with a Gurgaon-based housing project namely Krish Provence Estate which could not be completed even after a period of 8 years. Due to the non-completion of the project, the Respondents 1-3 (referred to as Original Applicants) preferred a Section 7 Application before the National Company Law Tribunal seeking initiation of Corporate Insolvency Resolution Process against the Corporate Debtor.

The Original Applicants sought a refund of an amount of Rs. 6,93,02,755 due to an inordinate delay in the completion of the project and failure to hand over the possession within the stipulated time. The National Company Law Tribunal appointed the Interim Resolution Professional and declared a moratorium. The appellant in this petition filed a petition challenging the order of the National Company Law Tribunal before the National Company Law Appellate Tribunal.

During the time when the proceedings went on in the National Company Law Appellate Tribunal, the appellant and the original appellant tried to settle the matter however the settlement did not go through and the National Company Law Appellate Tribunal dismissed the appeal and upheld the order passed by the National Company Law Tribunal.

The IRP issued the public announcement and constituted the Committee of Creditors. In the meantime, the appellant preferred the appeal, and the SC, while issuing notice in the appeal, stayed the operation and implementation of the impugned order, subject to the appellant depositing the amount of Rs.2,75,55,186/- plus interest at the rate of 6% per annum in the Registry. The appellant deposited an amount of Rs. 3,36,02,000/-.

It was argued before the Court that the homeowners and the original applicants and their Counsel have been trying to settle the matter and have reached an agreement that the Corporate Debtor shall complete the entire project and hand over the possession to the home buyers, within a period of one year. It was also contended on behalf of the original applicants that they have also settled the dispute with the appellant/Corporate Debtor and the appellant had agreed to refund the amount of Rs.3,36,02,000/- with accrued interest to the original applicants. Therefore, it was requested to record the settlement and permit the original applicants to withdraw CIRP proceedings pending before the National Company Law Tribunal and the court passed an order.

The original applicants then filed an IA under article 142 of the Constitution of India praying for permitting them to withdraw Corporate Insolvency Resolution Process proceeding on their being paid a sum of Rs.3,36,02,000/- along with applicable interest, out of the amount deposited by the appellant in the Registry of this Court. The Counsels appearing for the parties jointly submitted that a majority of the home buyers and the appellant and Corporate Debtor have settled the disputes and a joint statement regarding the proposed settlement plan signed by the respective parties has been filed in which it was undertaken that they shall complete the entire project within one year from the date of settlement and offer possession of the flats to the home buyers.

The Court while allowing the prayer observed that, "in the peculiar facts and circumstances of the case, where out of 128 home buyers, 82 home buyers will get the possession within a period of one year, as undertaken by the appellant and respondent No.4 – Corporate Debtor, coupled with the fact that original applicants have also settled the dispute with the appellant/Corporate Debtor, we are of the opinion that this is a fit case to exercise the powers under Article 142 of the Constitution of India read with Rule 11 of the NCLT rules, 2016 and to permit the original applicants to withdraw the CIRP proceedings. We are of the opinion that the same shall be in the larger interest of the home buyers who are waiting for the possession since more than eight years."

The Court also observed that "If the original applicants and the majority of the home buyers are not permitted to close the CIRP proceedings, it would have a drastic consequence on the home buyers of real estate project. if the CIRP fails, then the builder-company has to go into liquidation as per Section 33 of the IBC. The homebuyers being unsecured creditors of the builder company stand to lose all their monies that are either hard earned and saved or borrowed at high rate of interest, for no fault of theirs."

Click here to read/download the Judgment