Insurance Cannot Be Claimed If Vehicle Was Not Validly Registered At The Time Of Theft: Supreme Court

|

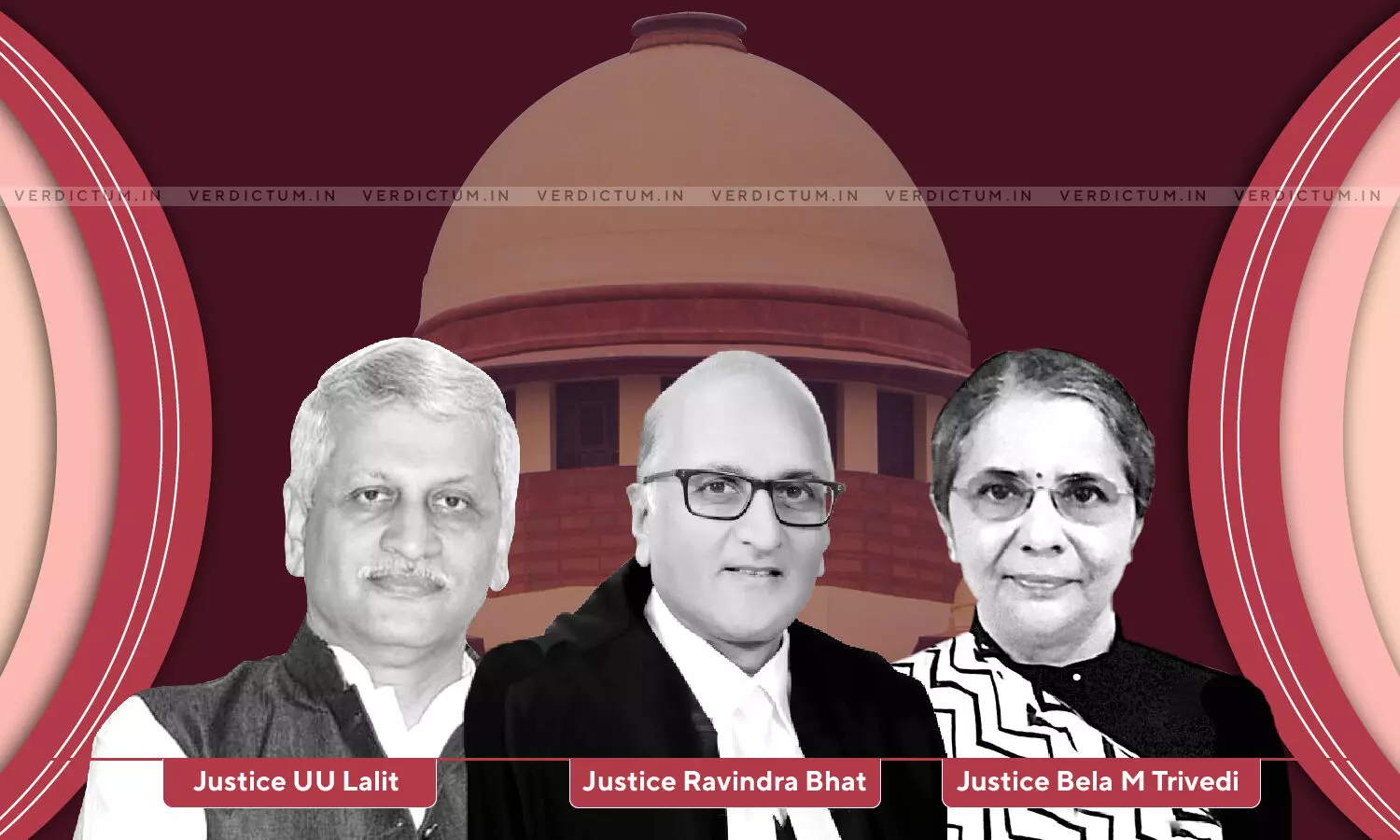

|A three-judge Bench of Justice UU Lalit, Justice S. Ravindra Bhat, and Justice Bela M. Trivedi has held that if the vehicle is driven or used without legal registration, it would amount to a clear violation of Sections 39 and 192 of the Motor Vehicles Act, 1988 and it results in a fundamental breach of the terms and conditions of the policy, entitling the insurer to repudiate the policy.

An appeal was preferred against the dismissal of the revision petition filed by the Appellant (Insurer) before the National Consumer Disputes Redressal Commission, New Delhi (NCDRC) which had upheld the decision of the State Commission directing that the Respondent-Complainant be paid the insurance amount along with interest from the date of filing of the complaint and also, litigation costs.

In this case, the Respondent had obtained an insurance policy from the Appellant for his car. The vehicle was temporarily registered, and the tenure of registration had already expired. The car of the Respondent was stolen from outside the guest house premises where he was staying. A case under section 379 of IPC was also registered via FIR lodged by the Respondent.

The Respondent claimed insurance from the Appellant. However, the insurer repudiated his claim citing the following reasons –

1. Delayed intimation to the insurer regarding the theft of a vehicle that was violating the insurance policy;

2. Temporary registration of vehicle already expired and Respondent did not get it permanently registered;

3. The vehicle was left unattended outside the guesthouse in violation of the policy.

The Bench opined, "In the present case, the temporary registration of the respondent's vehicle had expired on 28-07-2011. Not only was the vehicle driven, but also taken to another city, where it was stationed overnight in a place other than the respondent's premises. There is nothing on record to suggest that the respondent had applied for registration or that he was awaiting registration."

The Apex Court while relying upon the precedent of Narinder Singh Vs. New India Assurance Co. Ltd, held, "What is important is this Court's opinion of the law, that when an insurable incident that potentially results in liability occurs, there should be no fundamental breach of the conditions contained in the contract of insurance."

The Court while allowing the appeal held that the orders passed by NCDRC cannot be sustained.

"Furthermore, the NCDRC should not have overlooked and disregarded a clear binding judgment of this Court – it also should not have disregarded its ruling in Naveen Kumar (supra), as well," the Bench noted.

In the light of these observations, the Court set aside the impugned order of NCDRC and dismissed the Respondent's complaint.