Supreme Court Clarifies Its Previous Order On Pensionary Benefits For Short Service Commission Officers

|

|The Supreme Court clarified the directions given in a previous order concerning pensionary benefits in favour of Short Service Commission Officers.

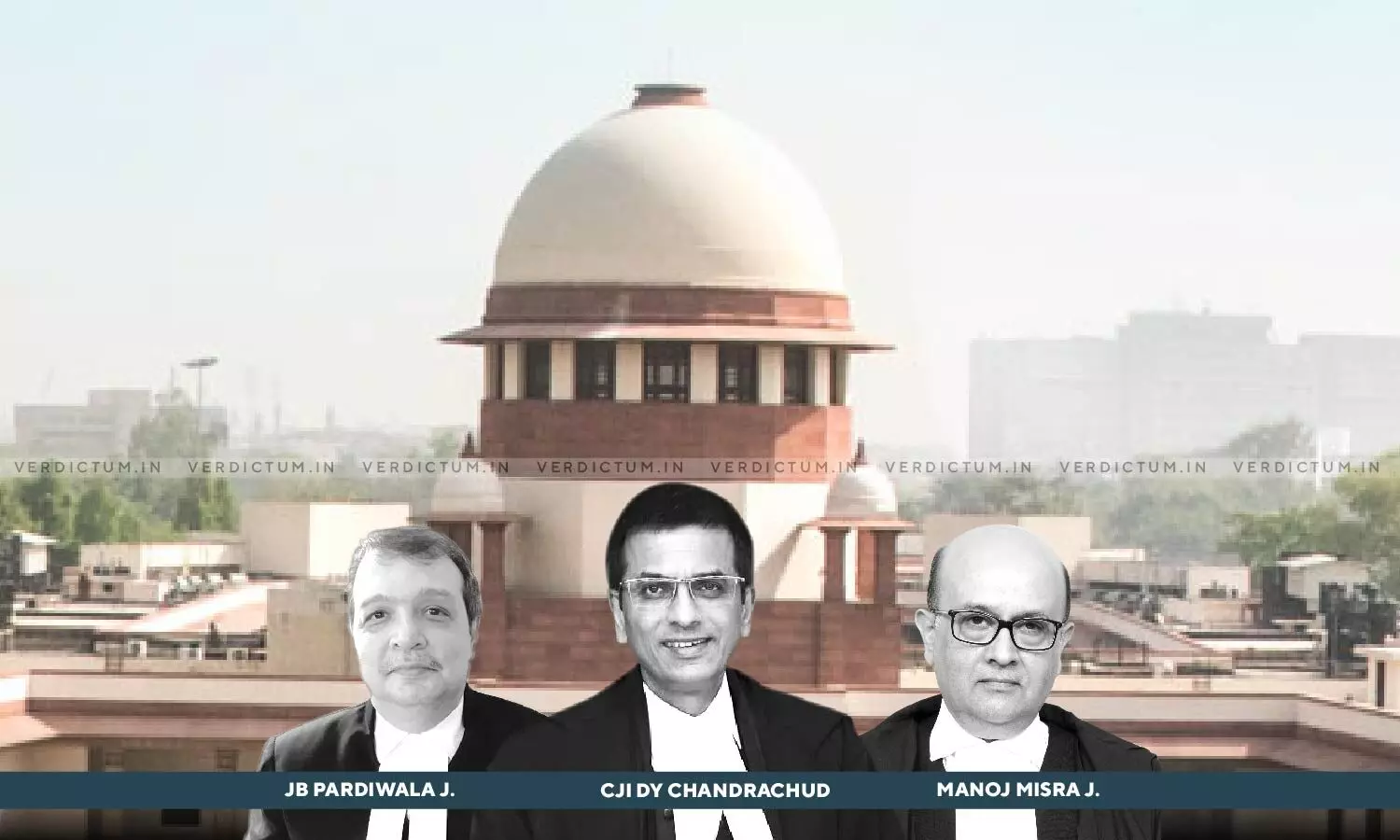

The bench of Chief Justice D Y Chandrachud, Justice J.B. Pardiwala and Justice Manoj Misra was hearing a miscellaneous application arising out of Supreme Court Judgment in Wg Cdr A U Tayyaba (retd) & Ors v Union of India & Ors.

Advocate Pooja Dhar appeared for the Appellant and Senior Advocate R. Balasubramanian appeared for the Respondent.

The Court noted that the women officers were released from service at the end of the fourteenth year and the salary for the purpose of computing the pension was taken as the last drawn salary as of the date of the release. No increments have been granted to the applicants between the date of release and the date on which they are deemed to have completed twenty years of service in terms of the judgment of this Court.

The Supreme Court noted that the first direction that was issued was that all the women Short Service Commissioned Officers governed by the batch of cases would be considered for the grant of one-time pensionary benefits “on the basis that they have completed the minimum qualifying service required for pension”. The minimum qualifying service for pension is twenty years.

According to the Court, this was subject to the further stipulation in another direction that they will not be entitled to any arrears of salary, but the arrears of pension would be payable with effect from the date on which they are deemed to have completed twenty years of service.

The Court further clarified the issues of the computation of the commuted value of the pensionary payment, encashment of annual leave and grant of ECHS benefits.

The Court stated that the commuted value shall be computed as on the date of the deemed completion of twenty years. The commutation factor shall, therefore, be that which was applicable on the date of the deemed completion of twenty years.

The Court further stated as regards the encashment of annual leave, according to the Court if any of the officers is found to have accumulated the maximum of 300 days in respect of which encashment is allowable, the difference between the encashable quantum of 300 days and the amount which has already been released shall be computed and paid.

The Court further stated that the officers governed by this batch and other similarly placed officers would be entitled to ECHS benefits as retired officers.

Accordingly, the Court disposed of the Miscellaneous Application.

Cause Title: Wg Cdr A U Tayyaba (retd) & Ors v. Union of India (Neutral Citation: 2024 INSC 311)

Appearance:

Appellant: Adv. Pooja Dhar

Respondent: Senior Adv. R Balasubramanian