Recovery Of Excess Payments Cannot Be Made From Government Employees Due To Misinterpretation Of Service Rules - SC

|

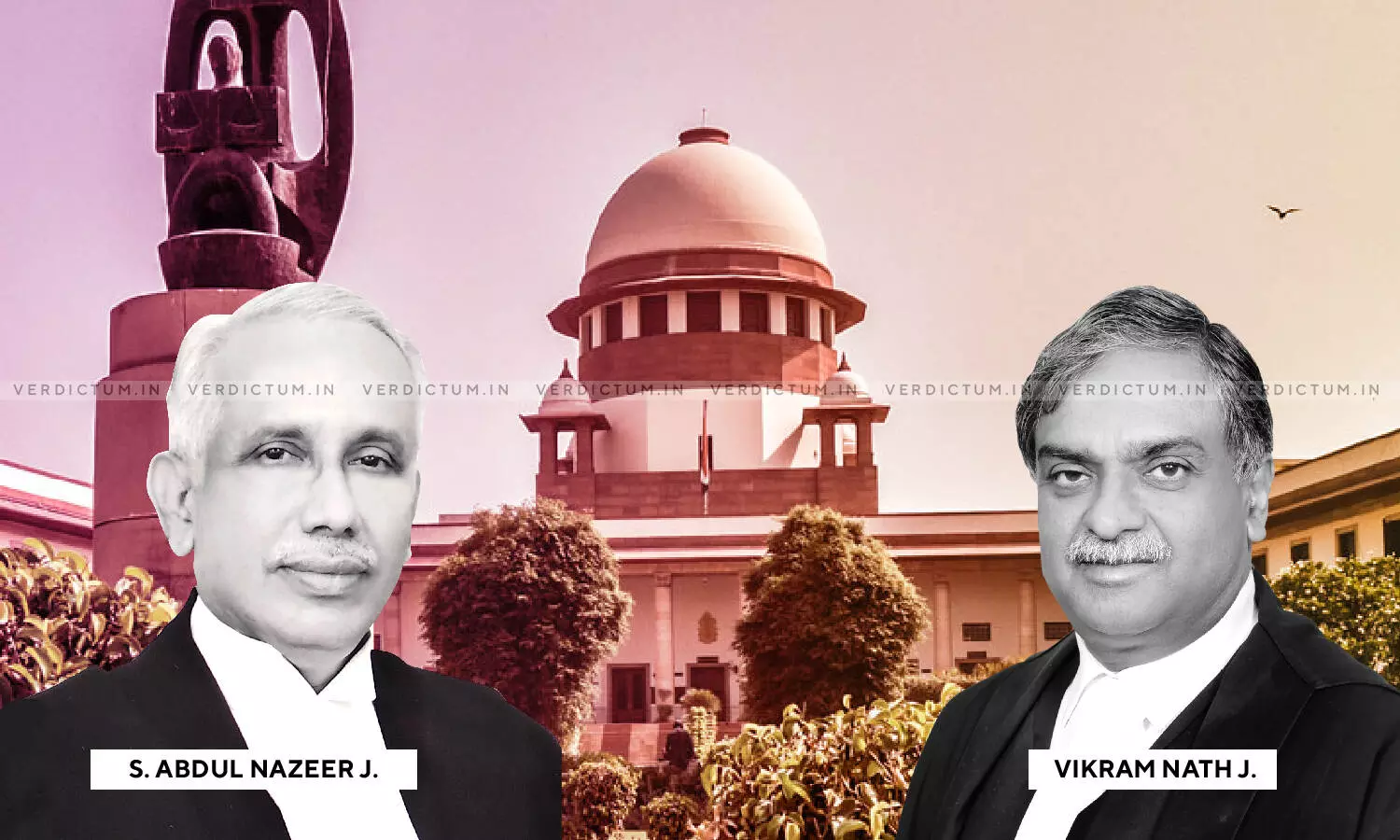

|A Supreme Court Bench of Justice S. Abdul Nazeer and Justice Vikram Nath dismissed a judgment passed by the Kerala High Court, regarding the recovery of increments granted to the Appellant almost 10 years after his retirement.

The Supreme Court took the view that "in general parlance, recovery is prohibited by courts where there exists no misrepresentation or fraud on the part of the employee and when the excess payment has been made by applying a wrong interpretation/understanding of a Rule or Order."

The Appellant had joined services as a High School Teacher at an aided school. During his tenure, he availed leave without allowance for about 15 months in total, for pursuing post-graduation. Later, he was promoted to Headmaster of the school and his pay scale was revised accordingly. Thereafter, a notice was served with an objection that the period of leave obtained by the Appellant should not be included while determining his total qualifying service, and the pay and subsequent increments granted to him should be recovered. Two years later, the Appellant retired and was neither paid pensionary benefits nor death-cum-retirement gratuity.

The Appellant filed a complaint before the Public Redressal Complaint Cell, but it was rejected, on the grounds that a postgraduation degree was not useful as per the Rule 91A Part I of the Kerala Service Rules in any manner to the public service, therefore, leave without allowance cannot be counted for service benefits.

In the meantime. The Deputy Director of Education sanctioned the release of 90% of the D.C.R.G. amount after withholding 10% of the said amount. Aggrieved, the Appellant approached the High Court. During the pendency of the Petition, the remaining amount of D.C.R.G. was released to the Appellant. However, the Respondents had submitted in their counter affidavit where they took the stand that the period during which the appellant was on leave without allowance cannot be counted for the purpose of grant of increments and, therefore, the demand for recovery made by them was justified. The Single Judge of the High Court dismissed the Petition on the same ground. The Division Bench of the High Court also upheld the order of the Single Judge.

The Supreme Court opined that it had been consistently held that if the excess amount was not paid on account of any misrepresentation or fraud of the employee or if such excess payment was made by the employer by applying a wrong principle for calculating the pay/allowance or on the basis of a particular interpretation of rule/order which is subsequently found to be erroneous, such excess payment of emoluments or allowances are not recoverable.

To that end, the Court said "A government servant, particularly one in the lower rungs of service would spend whatever emoluments he receives for the upkeep of his family. If he receives an excess payment for a long period, he would spend it, genuinely believing that he is entitled to it. As any subsequent action to recover the excess payment will cause undue hardship to him, relief is granted in that behalf. But where the employee had knowledge that the payment received was in excess of what was due or wrongly paid, or where the error is detected or corrected within a short time of wrong payment, courts will not grant relief against recovery. The matter being in the realm of judicial discretion, courts may on the facts and circumstances of any particular case refuse to grant such relief against recovery. On the same principle, pensioners can also seek a direction that wrong payments should not be recovered, as pensioners are in a more disadvantageous position when compared to inservice employees. Any attempt to recover excess wrong payment would cause undue hardship to them."

The Court found that a similar stance had been taken in Syed Abdul Qadir and Others v. State of Bihar and Others, where it had been held that the Appellants cannot be held responsible for a mistake made in interpreting the rules, and recovery of excess payment cannot be ordered especially when the employee has retired.

Therefore, the Supreme Court opined that since the excess amounts were not paid on account of misrepresentation or fraud by the Appellant but were due to a mistake in interpreting the Rules, and since the Appellant was retired, an attempt to recover the said increments after the passage of ten years of his retirement was unjustified.

Accordingly, the appeal was allowed, and the orders passed by the High Court were set aside.

Click here to read/download the Judgment