Investigation Report Issued Under PFUTP Regulations Requires Full Disclosure To Whom Show-Cause Notice Is Issued - SC

|

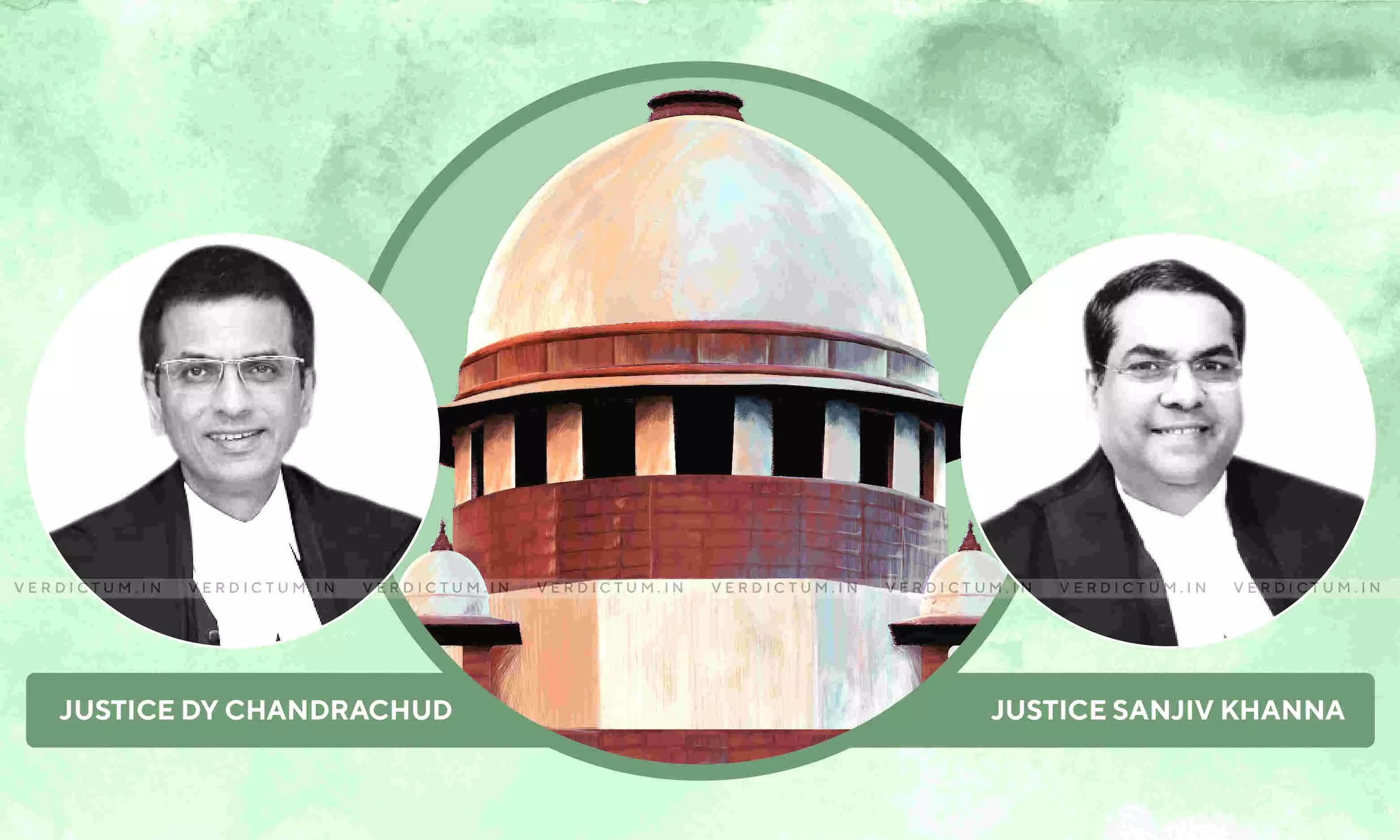

|A two-judge Bench of the Supreme Court comprising of Justice Dr. DY Chandrachud and Justice Sanjiv Khanna has held that as a default rule all relevant material must be disclosed. The Court noted that it would be 'fundamentally contrary to the principles of natural justice if the relevant part of the investigation report pertaining to the appellant is not disclosed'.

The Court noted that "the appellant has to be given a reasonable opportunity of hearing. The requirement of a reasonable opportunity would postulate that such material which has been and has to be taken into account under Regulation 10 must be disclosed to the noticee. If the report of the investigation authority under Regulation 9 has to be considered by the Board before satisfaction is arrived at on a possible violation of the regulations, the principles of natural justice require due disclosure of the report."

Mr. Ashim Sood, Advocate appeared for the Appellant while Mr. CU Singh, Senior Advocate made submissions on behalf of the Respondents.

A Division Bench of the Bombay High court had dismissed a petition filed by the appellant under Article 226 of the Constitution for challenging a show-cause notice issued by SEBI alleging a violation of the SEBI (Prohibition of Fraudulent and Unfair Trade Practices) Regulations 2003. Review petitioner was disposed of. An SLP was moved against the judgment in writ and review.

The Court noted that the question for its consideration was the following:

Whether an investigation report under Regulation 9 of the PFUTP Regulations must be disclosed to the person to whom a notice to show cause is issued.

The appellant was serving as the MD and CEO in Ricoh India Limited for FY 2012-13 to 2014-15. In 2016, BSR & Co. were appointed as statutory auditors. They raised a suspicion qua the veracity of the financial statements of the Company for quarters ending on June 30, 2015, and September 30, 2015. The audit company appointed PwC to carry out a forensic audit.

A preliminary audit report was submitted by PwC. A letter was addressed to SEBI requesting to carry out an independent investigation on possible violations of the Regulations.

An investigation was initiated and summons were issued to the then MD & CEO for FY 15-16 and other officers in charge of the Company. SEBI in its ex parte interim order–cum–show cause notice prima facie found two others, including the appellant, responsible for facilitating the misstatements of the financial position. These directions were confirmed later.

The confirmatory order was challenged before SAT. Appeals were allowed and the order was quashed. Liberty was given to issue a fresh show-cause if the evidence is made available through a forensic report or through SEBI's investigation.

Fresh show cause was issued. Appellant stated that he had not received the report of the investigation conducted by SEBI. SEBI stated that the investigation report was an internal document that cannot be shared. A writ was filed before the Bombay High Court challenging the SCN. The Court noted that the investigation report prepared under Regulation 9 is solely for internal purposes. The Court held that the report does not form the basis of SCN and hence needn't be disclosed. The review was also rejected.

The Court noted that the Regulations were notified by SEBI in the exercise of powers conferred by Section 30 of the SEBI Act. The regulation in issue, i.e., Regulation 9 reads as follows.

"9. The Investigating Authority shall, on completion of investigation, after taking into account all relevant facts, submit a report to the appointing authority."

On Regulation 10, the Court made the following crucial observations:

"The language in which Regulation 10 is couched indicates that consideration of the report of the investigating authority which is submitted under Regulation 9 is one of the components guiding the Board's satisfaction on the violation of the regulations. The words of Regulation 10 indicate that the Board "after consideration of the report referred to in regulation 9, if satisfied that there is a violation of these regulations and after giving a reasonable opportunity of hearing to the persons concerned", takes action under Regulations 11 and 12. As a result of the mandate of Regulation 10, the Board has to consider the investigation report as an intrinsic element in arriving at its satisfaction on whether there has been a violation of the regulations."

The Court noted that the three key purposes that disclosure of information serves are reliability, fair trial, and transparency and accountability.

After discussing various authorities on the subject, the Court noted as follows:

"The following principles emerge from the above discussion:

(i) A quasi-judicial authority has a duty to disclose the material that has been relied upon at the stage of adjudication; and

(ii) An ipse dixit of the authority that it has not relied on certain material would not exempt it of its liability to disclose such material if it is relevant to and has a nexus to the action that is taken by the authority. In all reasonable probability, such material would have influenced the decision reached by the authority."

On the exceptions to the duty of disclosure, the Court noted that the appellant has been unable to prove that the disclosure of the entire report is necessary for him to defend the case. The Court noted that "the appellant did not sufficiently discharge his burden by proving that the non-disclosure of the above information would affect his ability to defend himself."

The Court noted that the SEBI should determine the parts of report under Regulation 9 which have a bearing on the action which is proposed to be taken against the person to whom the notice to show cause is issued and disclose the same.

The Court noted that "while directing that there should be a disclosure of the investigation report to the appellant, it needs to be clarified that this would not permit the appellant to demand roving inspection of the investigation report which may contain sensitive information as regards unrelated entities and transactions."

The appeal was allowed and SEBI was directed to provide copies of such parts of the report which concern the specific allegations which have been levelled against the appellant in the notice to show cause with the caveat entered above. The judgment of the Division Bench of the High Court was set aside.

Click here to read/download the Judgment