TOLA Will Continue To Apply To Income Tax Act After April 1, 2021 If Any Action Or Proceeding Falls For Completion Between March 20, 2020 & March 31, 2021: SC

|

|The Supreme Court held that the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 (TOLA) will continue to apply to the Income Tax Act, 1961 (ITA) after April 1, 2021 if any action or proceeding falls for competition between March 20, 2020 and March 31, 2021.

The Court held thus in a batch of civil appeals involving the interplay of three Parliamentary statutes: the ITA, the TOLA, and the Finance Act, 2021.

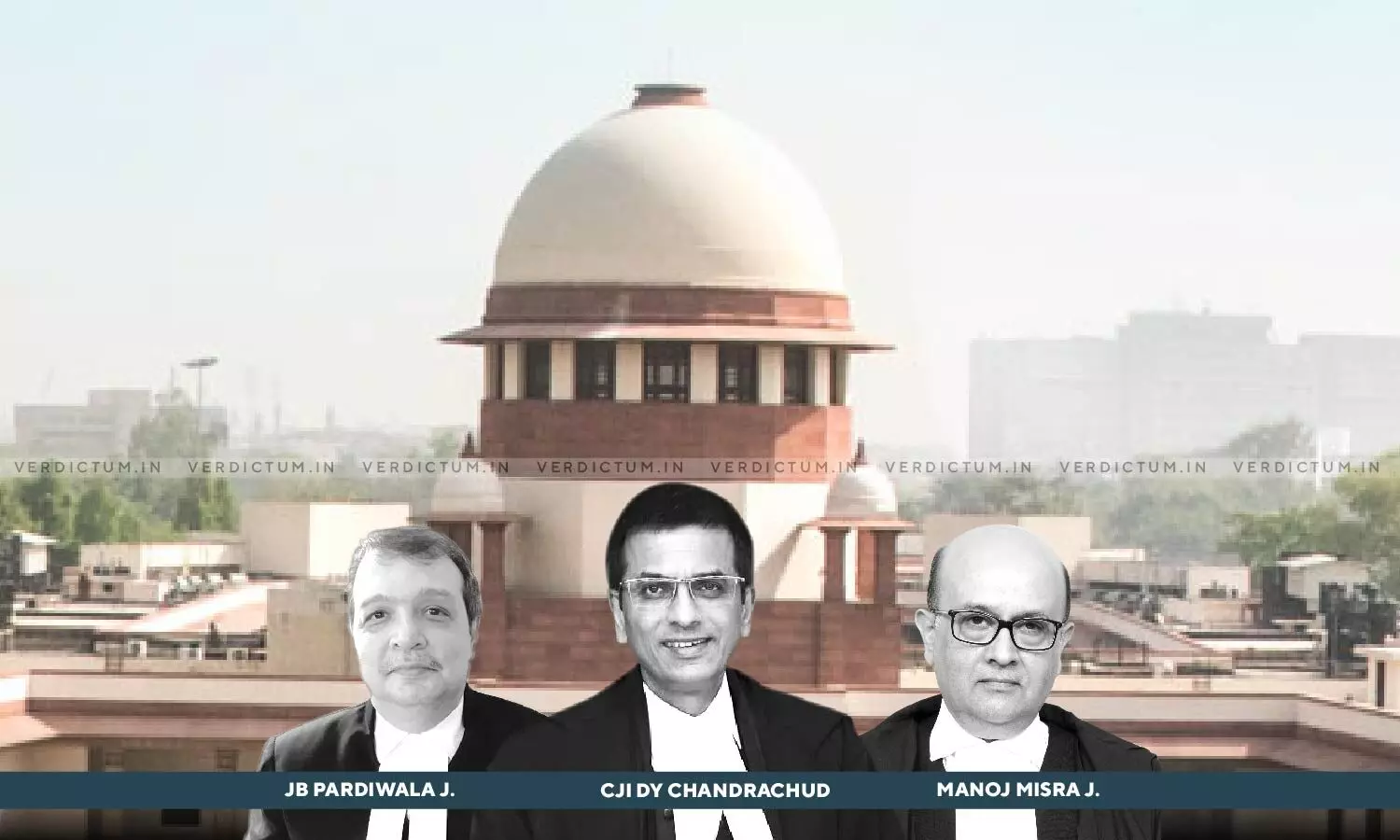

The three-Judge Bench of CJI D.Y. Chandrachud, Justice J.B. Pardiwala, and Justice Manoj Misra observed, “After 1 April 2021, the Income Tax Act has to be read along with the substituted provisions … TOLA will continue to apply to the Income Tax Act after 1 April 2021 if any action or proceeding specified under the substituted provisions of the Income Tax Act falls for completion between 20 March 2020 and 31 March 2021 … Section 3(1) of TOLA overrides Section 149 of the Income Tax Act only to the extent of relaxing the time limit for issuance of a reassessment notice under Section 148.”

The Bench further held that the TOLA will extend the time limit for the grant of sanction by the authority specified under Section 151 and the test to determine whether TOLA will apply to Section 151 of the new regime is this: if the time limit of three years from the end of an assessment year falls between March 20, 2020 and March 31, 2021, then the specified authority under Section 151(i) has extended time till June 30, 2021 to grant approval.

Additional Solicitor General of India (ASGI) N. Venkataraman represented the appellants while Senior Advocates Percy Pardiwalla, V Sridharan, Tushar Hemani, Saurabh Soparkar, K Shivram, Advocates Manish Shah, Darshan Patel, Suhrith Parthasarthy, Dharan Gandhi, and Ved Jain represented the respondents.

Background -

The TOLA was enacted in the backdrop of the COVID-19 pandemic to provide relaxation of time limits specified under the provisions of the Income Tax Act and certain other legislations as defined under Section 2(1)(b) of TOLA. The Finance Act 2021 amended the provisions dealing with the reassessment procedure under the ITA with effect from April 1, 2021. The issued by the Central Government under Section 3(1) of TOLA contained an explanation declaring that the provisions under the old regime shall apply to the reassessment proceedings initiated under them. Thus, the notifications directed the assessing officers to apply the provisions of the old regime for reassessment notices issued after April 1, 2021. The assessing officers accordingly issued reassessment notices between April 1, 2021 and June 30, 2021 by relying on the provisions under Section 148 of the old regime. These reassessment notices were challenged by the assesses before various High Courts.

The High Courts allowed the writ petitions and quashed all the reassessment notices issued between April 1, 2021 and June 30, 2021 under the old regime on the ground that: (i) Sections 147 to 151 stood substituted by Finance Act 2021 from 1 April 2021; (ii) In the absence of any saving clause, the Revenue could initiate reassessment proceedings after April 1, 2021 only in accordance with the provisions of the new regime since they were remedial, beneficial, and meant to protect the rights and interests of the assesses; and (iii) the Central Government could not exercise its delegated authority to “re-activate the pre-existing law”. In Union of India v. Ashish Agarwal, (2023) the Apex Court held that it was “in complete agreement with the view taken by various High Courts in holding” that “the benefit of the new provisions shall be made available even in respect of the proceedings relating to past assessment years, provided Section 148 notice has been issued on or after 1-4-2021.”

The assessing officers accordingly considered the replies furnished by the assesses and passed orders under Section 148A(d). Subsequently, notices under Section 148 of the new regime were issued to the assesses by the assessing officers between July and September 2022 for the assessment years 2013-2014, 2014-2015, 2015-2016, 2016-2017, and 2017-2018. These notices were challenged before several High Courts. The High Courts declared the notices to be invalid on the ground that they were: (i) time-barred; and (ii) issued without the appropriate sanction of the specified authority. Therefore, the following issues arose before the Apex Court –

a. Whether TOLA and notifications issued under it will also apply to reassessment notices issued after April 1, 2021?

b. Whether the reassessment notices issued under Section 148 of the new regime between July and September 2022 are valid?

The Supreme Court in view of the above issues, noted, “If this Court had not created the legal fiction and the original reassessment notices were validly issued according to the provisions of the new regime, the notices under Section 148 of the new regime would have to be issued within the time limits extended by TOLA. As a corollary, the reassessment notices to be issued in pursuance of the deemed notices must also be within the time limit surviving under the Income Tax Act read with TOLA. This construction gives full effect to the legal fiction created in Ashish Agarwal (supra) and enables both the assesses and the Revenue to obtain the benefit of all consequences flowing from the fiction.”

The Court reiterated that the period from the date of the issuance of the deemed notices till the supply of relevant information and material by the assessing officers to the assesses in terms of the directions issued in Ashish Agarwal case has to be excluded from the computation of the period of limitation and moreover, the period of two weeks granted to the assesses to reply to the show cause notices must also be excluded in terms of the third proviso to Section 149.

“The clock started ticking for the Revenue only after it received the response of the assesses to the show causes notices. … Once the clock started ticking, the assessing officer was required to complete these procedures within the surviving time limit. The surviving time limit, as prescribed under the Income Tax Act read with TOLA, was available to the assessing officers to issue the reassessment notices under Section 148 of the new regime”, it remarked.

The Court elucidated that, to assume jurisdiction to issue notices under Section 148 with respect to the relevant assessment years, an assessing officer has to: (i) issue the notices within the period prescribed under Section 149(1) of the new regime read with TOLA; and (ii) obtain the previous approval of the authority specified under Section 151.

“A notice issued without complying with the preconditions is invalid as it affects the jurisdiction of the assessing officer. Therefore, the reassessment notices issued under Section 148 of the new regime, which are in pursuance of the deemed notices, ought to be issued within the time limit surviving under the Income Tax Act read with TOLA. A reassessment notice issued beyond the surviving time limit will be time-barred”, it added.

The Court emphasised that in the case of Section 151 of the old regime, the test is: if the time limit of four years from the end of an assessment year falls between March 20, 2020 and March 31, 2021, then the specified authority under Section 151(2) has extended time till March 31, 2021 to grant approval.

“The directions in Ashish Agarwal (supra) will extend to all the ninety thousand reassessment notices issued under the old regime during the period 1 April 2021 and 30 June 2021 … The time during which the show cause notices were deemed to be stayed is from the date of issuance of the deemed notice between 1 April 2021 and 30 June 2021 till the supply of relevant information and material by the assessing officers to the assesses in terms of the directions issued by this Court in Ashish Agarwal (supra), and the period of two weeks allowed to the assesses to respond to the show cause notices”, it also said.

The Court concluded that the assessing officers were required to issue the reassessment notice under Section 148 of the new regime within the time limit surviving under the Income Tax Act read with TOLA.

Accordingly, the Apex Court allowed the appeals and set aside the judgments of High Courts to an extent.

Cause Title- Union of India & Ors. v. Rajeev Bansal (Neutral Citation: 2024 INSC 754)