You Searched For "Maharashtra Value Added Tax"

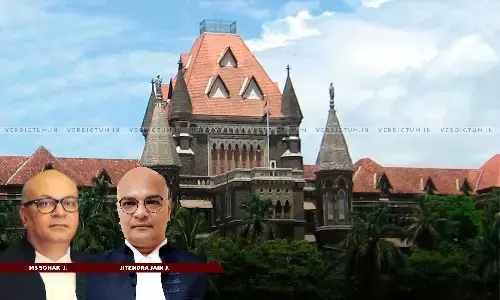

Authorities Under Settlement Act Cannot Pass Review Orders In Absence Of Order U/S. 50 Of MVAT Act:...

The Bombay High Court held that the authorities under the Maharashtra Settlement of Arrears of Taxes, Interest, Penalties or Late Fees Act, 2022...

MVAT Act | Intellectual Property Becomes 'Goods' Only When It Is Put On A Medium For Sale: Bombay HC

The Bombay High Court has clarified that intellectual property can be classified as a 'good' under the Maharashtra Value Added Tax Act only if it is...