Creation Of Simple Mortgage Via Title Deeds Would Remain Beyond Clutches Of Stamp Act Unless There’s Written Agreement Between Parties: Allahabad HC

The Allahabad High Court held that the creation of a simple mortgage through deposit of title deeds, though valid in law, would remain beyond the clutches of the Stamp Act, 1899 unless there is a written agreement executed between the parties.

The Court held thus in a reference that arose on a doubt expressed by the Single Judge to the correctness of the ratio contained in a Division Bench’s decision in HDFC Ltd. v. Assistant Commissioner Stamps, Ghaziabad, 2015:AHC:125281-DB; (2015) 129 RD 208; (2015) 113 ALR 483; (2016) 2 ALJ 87; 2015 SCC Online All 8079.

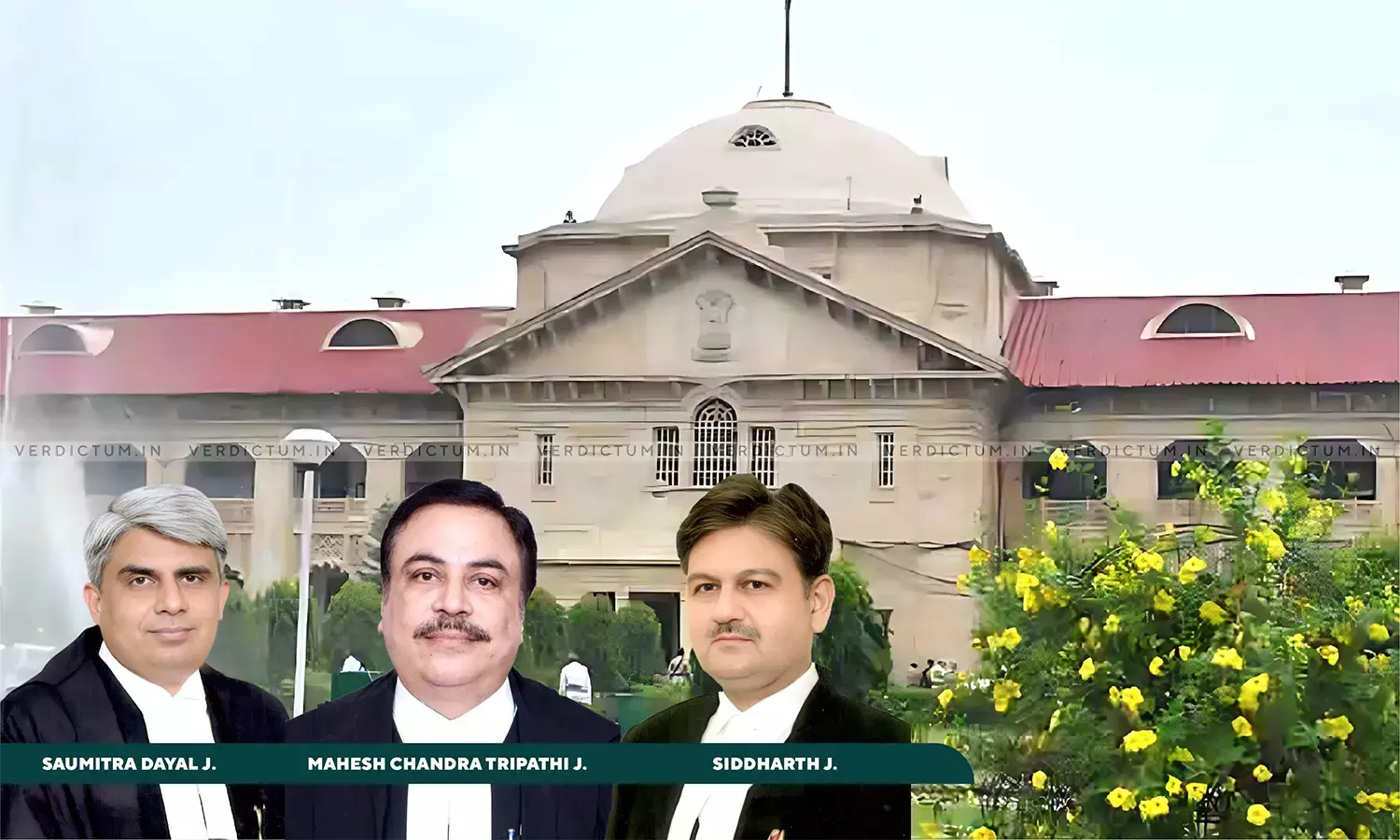

A Full Bench comprising Justice Mahesh Chandra Tripathi, Justice Saumitra Dayal Singh, and Justice Siddharth observed, “… creation of a simple mortgage (through deposit of title deeds), though valid in law and fully enforceable as such, would remain beyond the clutches of the Stamp Act, so long as there is no written agreement executed between the parties or any document that is made part of thereof that evidences the bargain reached between the parties – to deposit the title deed (with the lender) to secure the loan availed by the borrower.”

The Bench said that the levy of stamp duty under Article 6 of Schedule 1-B of the Stamp Act may arise only on an ‘instrument’ that must be a ‘document’ containing writing (as would never include an oral agreement), to establish the existence of an “agreement relating to deposit of title deeds”, to secure the loan availed by the borrower.

Additional Advocate General Manish Goel and Additional Chief Standing Counsel A.K. Goyal represented the petitioner while Senior Advocate Anurag Khanna and Advocate Gunjan Jadwani represented the respondents.

In this case, the reference was made at the admission stage of the writ petition and at that stage, the State did not file its Counter Affidavit. It had opposed the writ petition on the strength of instructions and even those were not on record. The Chief Justice constituted Full Bench to answer the reference and thereafter, a Counter Affidavit was filed. It did not bring the Loan Agreement on record.

The State craved leave to file a Supplementary Counter Affidavit and the indulgence was granted. The hearing was adjourned and accordingly, a Supplementary Counter Affidavit was filed. The counsel for the petitioner proposed not to file a Rejoinder Affidavit. Since, the reference arose at the instance of the State, the Court heard the counsels.

The High Court in view of the facts and circumstances of the case noted, “In the absence of that written agreement, no ‘instrument’ less so ‘chargeable to duty’ - in terms of Section 3 read with Article 6(1) to Schedule 1-B of the Stamp Act may ever exist. In that event, an actual deposit of the title deed with a creditor, to secure any loan availed by the debtor, would not attract any stamp duty liability, since the Stamp Act does not seek to levy stamp duty on oral agreements/transactions. On the contrary, the Stamp Act imposes duty liability only on an ‘instrument’14. Those it construes as every document/ written record etc. Unless written words executed by the parties exist to establish the nature of the transaction described under Article 6(1) of Schedule 1-B of the Stamp Act, no taxable event may ever arise or be witnessed under the Stamp Act.”

The Court further noted that there is no evidence or credible material with the revenue authorities, to establish the existence of any written bargain reached between the parties that may have obliged the borrower to deposit any title deed with the petitioner to secure the loan availed by the former.

“Similarly, in the absence of any other document produced, the mere existence of Clauses 10(f), 10(h) of the Loan Agreement, Clauses 7, 10(a), 11, and 13 of the MITC, the terms and conditions of the Offer Letter, the Loan Application, and other documents (that may form part and parcel of the Loan Agreement), on their (own) force did not create any written stipulation or agreement or evidence of a bargain reached by the borrower to deposit any title deed etc., with the petitioner to secure the loan availed by him. Creation of security interest in immovable property, without documentary evidence of bargain, reached - to deposit the title deed in the immovable property (in which such security interest may have been created in terms of Act Number 54 of 2002), may also not be read as evidence of an ‘instrument’ drawn to deposit the title deed in that property, to secure the loan availed by the borrower”, it said.

The Court also observed that unless an ‘instrument’ evidencing an ‘agreement’ to deposit any title deed is executed by the borrower, in favour of the petitioner to secure a loan availed by the former, mere deposit of such title deed (against an oral agreement) and its return (against a written agreement) would not give rise to any taxing event under Section 3 read with Section 2(14) and Article 6(1) of Schedule 1-B to the Stamp Act.

“An oral ‘agreement’ not being a ‘document’ may never be described as an ‘instrument’. Hence, it may never suffer the impost of stamp duty. Forever, it would remain beyond the reach and clutches of the Stamp Act”, it added.

The Court said that an equitable mortgage may exist in favour of the petitioner, through a deposit of title deed, against an oral agreement and yet, Clauses 10.5(f), 10.5(h) of the Loan Agreement and Clause 13(iii)(b) of the MITC to the Loan Agreement do not constitute an ‘instrument’ or documentary evidence of a written ‘agreement’ or bargain reached between the parties, to thus secure the loan availed by the borrower.

“Levy of stamp duty under Article 6 of Schedule 1-B of the Stamp Act may arise only on an ‘instrument’ that must be a ‘document’ containing writing (as would never include an oral agreement), to establish the existence of an “agreement relating to deposit of title deeds”, to secure the loan availed by the borrower. Since that condition is not satisfied, no levy of stamp duty may arise, at present”, it held.

Accordingly, the High Court listed the matter before the appropriate Bench.

Cause Title- Housing Development Finance Corporation Ltd. v. State of U.P. and 2 Others