There Is No Provision For Condonation Of Delay In Filing Appeals Under CGST Act: Rules Madhya Pradesh HC

While clarifying over the time limit for filing appeals under the Central Goods and Services Tax Act, 2017 (CGST Act), the Madhya Pradesh High Court held that the Appellate Authority cannot entertain an appeal filed beyond the original three-month period, with an additional one-month extension, as there is no provision for condonation of delay in the statute.

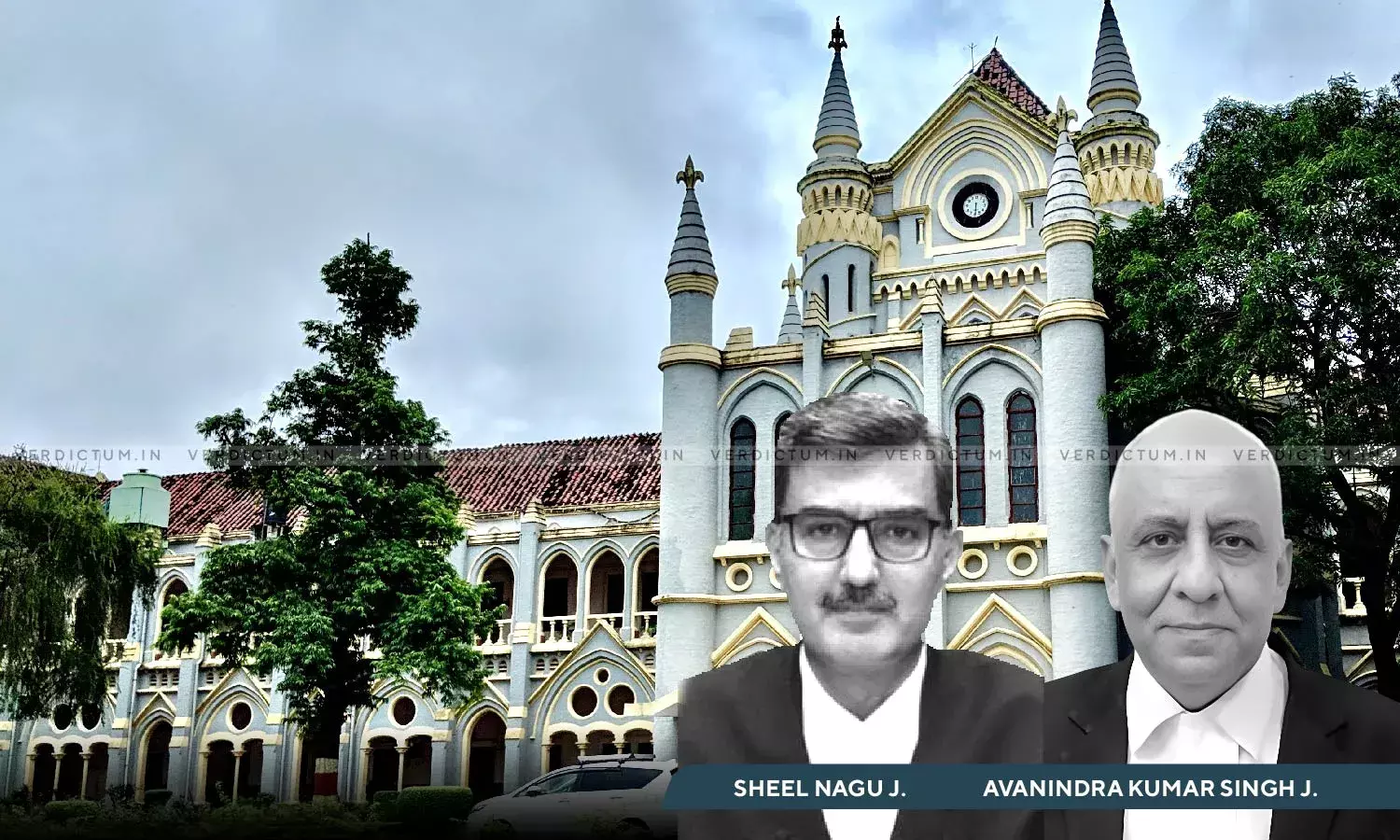

The Division Bench of Justice Sheel Nagu and Justice Avanindra Kumar Singh emphasized that nearly six years had passed since the new regime of the CGST Act came into effect on July 01, 2017, and noted that teething issues are over, and the provisions of Section 169(1) of the Act must be strictly followed without implying or reading into it anything that is not expressly provided.

Advocate Nitin Agrawal appeared for the Petitioner, whereas Government Advocate Ritwik Parashar appeared for the Respondent.

Although Gyan Cement House (petitioner) did not dispute the availability of an alternative statutory remedy of appeal under Section 107 of the CGST Act. However, they argued that they recently became aware of the impugned order, and by that time, the prescribed period for filing the appeal had already expired. Therefore, the petitioner approached the High Court seeking redress.

Upon examining the statutory provisions under Section 107 of the Act, the Bench found that the Appellate Authority could not entertain an appeal filed beyond the original three-month period, plus the one-month extension.

In short, the timeframe for filing the appeal was to be calculated from the day the decision or order appealed against was communicated to the aggrieved person, added the Bench.

Since there was a factual dispute about the date of communication of the impugned order to the petitioner, the High Court declined to delve into the merits of the matter and directed the petitioner to file an appeal before the Competent Authority.

The High Court also directed the Authority to examine the date of communication of the impugned order to determine whether the appeal was filed within the prescribed limitation period or not.

Cause Title: Gyan Cement House v. The State of Madhya Pradesh and Ors.

Click here to read/download the Order