Cancellation Of GST Registration On The Pretext Of Violation Of Rule 86B Of 'GST Rules' Is A Disproportionate Punishment: Himachal Pradesh HC

The Himachal Pradesh High Court held that the cancellation of GST registration on the pretext of violation of Rule 86B of of the Rules framed under GST Act is a disproportionate punishment.

The Court set aside the decision to cancel of petitioner’s GST Registration after noting the shocking and "extreme penalty" imposed on a business on the basis of a “prima facie” investigation conducted by the authorities.

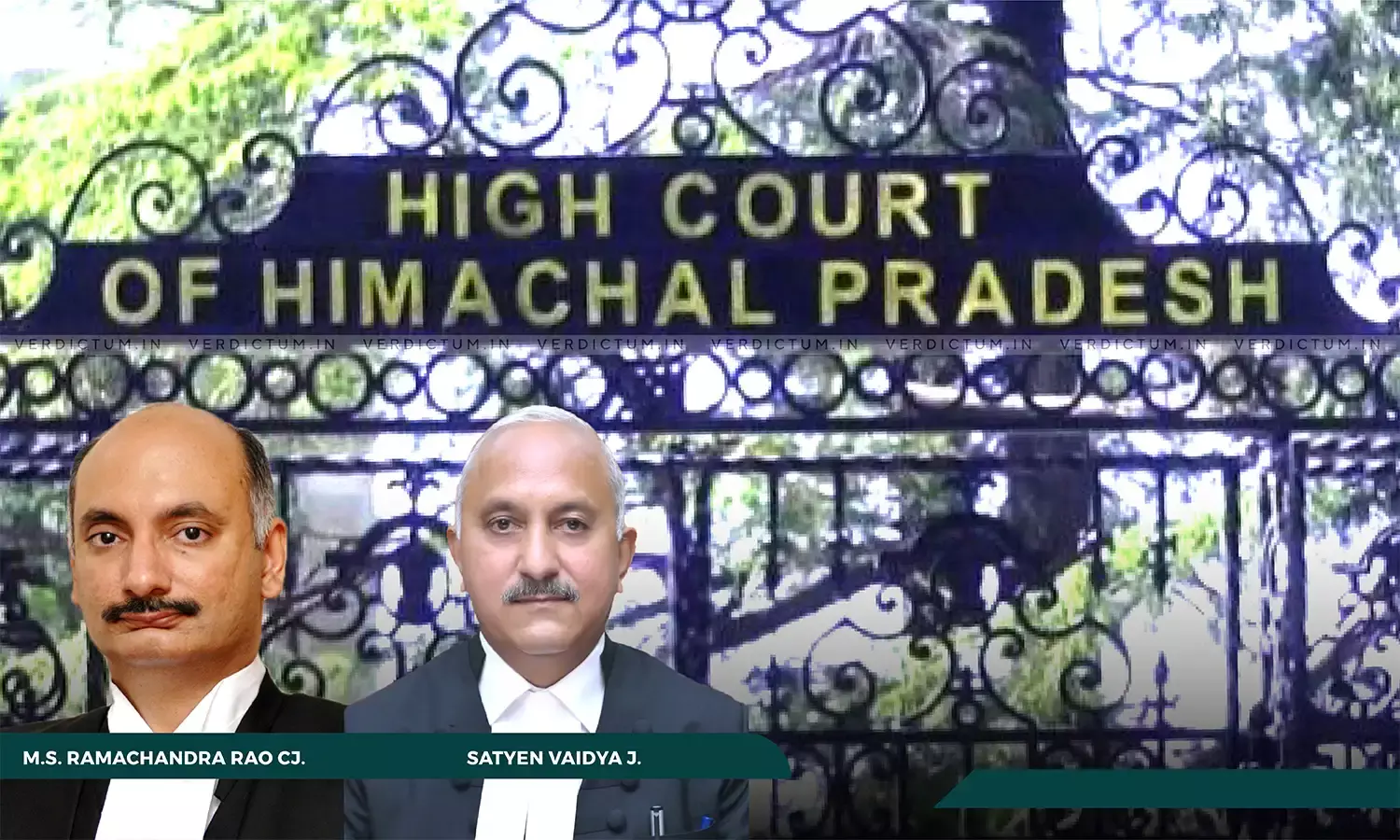

A Division Bench of Chief Justice M.S. Ramachandra Rao and Justice Satyen Vaidya held, "In our opinion, the cancellation of GST Registration on the pretext of violation of Rule 86B is a disproportionate punishment imposed on petitioner and is liable to be interfered in exercise of the power conferred on this Court under Article 226 of the Constitution of India."

Senior Advocate Vishal Mohan appeared for the petitioner, while Advocate General Anup Rattan represented the respondents.

The petitioner filed a petition to declare Section 16(2)(c) and Rule 86B of the Rules framed ultra vires the Central Goods and Services Tax Act, 2017 (the Act).

Rule 86B states that a registered person cannot use the amount available in the Electronic Credit Ledger to discharge his liability towards output tax in excess of 99% of such tax liability, in cases where the value of taxable supply other than exempt supply and zero-rated supply in a month exceeds Rs. fifty lakh.

Relying on the data presented before it, the Court stated that the petitioner had violated the said provision and had used the amount available in Electronic Credit Ledger to discharge his liability towards output tax in excess of 99%.

Noting that the amount available in Electronic Credit Ledger of the petitioner is the petitioner’s own money and it has been used to discharge the petitioner’s tax liability, though in excess of 99% of such tax liability, the Court urged the authorities to take extreme actions only in cases of serious violations.

"No doubt, Rule 21(g) enables cancellation of GST Registration if there is a violation by registered person of Rule 86B, but one has to see whether the violation is serious enough to warrant cancellation of the GST Registration, which would practically mean death of the business of the petitioner," the Court said.

The Court also pointed out that when there is a challenge to certain Rules framed under the GST Act in the Writ petition, appeal cannot be appropriate remedy, because a creature of the statute, it is settled law cannot decide on the vires/constitutionality of the provisions of the statute or the rules made thereunder.

Noting that there are no conditions or restrictions other than the one provided in Sections 49A & 49B of the Act, the Court noted that respondents had not answered in their reply to the petitioner’s contention that Rule 86B of the Act itself was not backed by any statutory provision.

"Rule 164 enables the Rule making authority to frame the Rule 86B or other Rules, but the Rules must have backing in the main body of the statute. Otherwise the Rule would be ultra vires," it said.

"Since the tax liability of the petitioner towards output tax stood discharged, no prejudice has been caused to the respondents. It was unnecessary for the respondents to cancel the GST Registration and they could have considered any other penalty which is more proportionate to the violation of law," the Court observed.

"The said action of the respondents is thus clearly arbitrary, unreasonable and violates Article 14 of the Constitution of India," the Court held.

Accordingly, the High Court allowed the appeal.

Cause Title: M/s A.M. Enterprises v. State of Himachal Pradesh & Ors. (Neutral Citation: 2024:HHC:8914)

Appearance:

Appellant: Senior Advocate Vishal Mohan; Advocates Goverdhan Lal Sharma and Praveen Sharma

Respondent: Advocate General Anup Rattan; Additional Advocate Generals Rakesh Dhaulta, Sushant Kaprate and Gobind Korla; Deputy Advocate Generals Arsh Rattan, Priyanka Chauhan and Sidharth Jalta

Click here to read/download Judgement: